New Jersey Geologist Agreement - Self-Employed Independent Contractor

Description

How to fill out Geologist Agreement - Self-Employed Independent Contractor?

Finding the correct valid document template can be quite a challenge. Obviously, there are numerous templates available online, but how do you find the valid form you need.

Utilize the US Legal Forms website. The service offers thousands of templates, including the New Jersey Geologist Agreement - Self-Employed Independent Contractor, which you can utilize for business and personal purposes. All of the forms are verified by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Obtain button to acquire the New Jersey Geologist Agreement - Self-Employed Independent Contractor. Use your account to view the legal forms you have previously purchased. Proceed to the My documents section of your account and obtain another copy of the document you need.

Complete, modify, print, and sign the obtained New Jersey Geologist Agreement - Self-Employed Independent Contractor. US Legal Forms is the largest repository of legal forms from which you can find a variety of document templates. Use the service to download professionally crafted documents that comply with state requirements.

- If you are a new user of US Legal Forms, here are simple steps that you can follow.

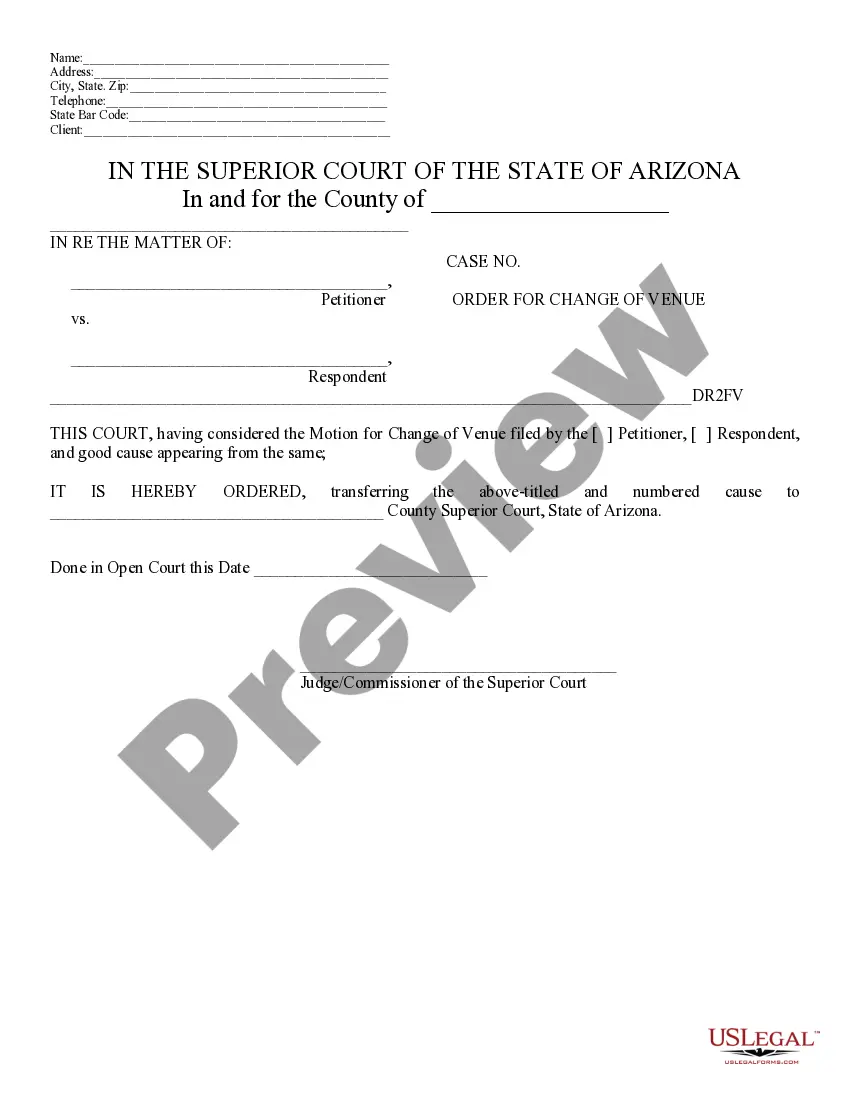

- First, ensure you have selected the correct form for the city/region. You can review the form using the Preview button and read the form summary to ensure it is suitable for you.

- If the form does not meet your needs, use the Search field to find the appropriate form.

- When you are certain that the form is appropriate, click the Acquire now button to obtain the form.

- Select the payment plan you want and enter the required information. Create your account and pay for the order using your PayPal account or Visa or Mastercard.

- Choose the file format and download the legal document template to your device.

Form popularity

FAQ

The new federal rule for independent contractors focuses on clarifying the criteria used to determine if a worker is an independent contractor or an employee. This rule aims to protect workers from misclassification and ensures that they receive the appropriate benefits and protections. Understanding these criteria is essential when drafting a New Jersey Geologist Agreement - Self-Employed Independent Contractor, as it helps ensure compliance with federal guidelines and secures your business practices.

Creating an independent contractor agreement is straightforward and essential for outlining the working relationship. Begin by clearly defining the scope of work, payment terms, and deadlines. Make sure to include clauses regarding confidentiality and termination. To simplify this process, consider using uslegalforms to access customizable templates for a New Jersey Geologist Agreement - Self-Employed Independent Contractor, ensuring that all legal aspects are covered consistently.

Yes, an independent contractor is considered self-employed. This means they operate independently and are not on the payroll of a single employer. Instead, independent contractors typically work with multiple clients, allowing them to manage their workload and financial responsibilities. If you're working under a New Jersey Geologist Agreement - Self-Employed Independent Contractor, you're defining your business relationship clearly and retaining control over your services.

Being self-employed means you work for yourself rather than an employer. Essentially, you are in business for yourself, taking on clients or customers directly. This structure allows for flexibility in how you operate, manage your finances, and handle your work schedule. If you’re considering a New Jersey Geologist Agreement - Self-Employed Independent Contractor, this status gives you the autonomy to set your terms.

To complete an independent contractor form, start by accurately providing your personal information along with your business details. Clearly outline the services you will offer, and specify the payment terms and how payments will be processed. Finally, review the form to ensure every section is filled out correctly. Templates available on platforms like US Legal Forms can assist in ensuring a comprehensive and legally sound form.

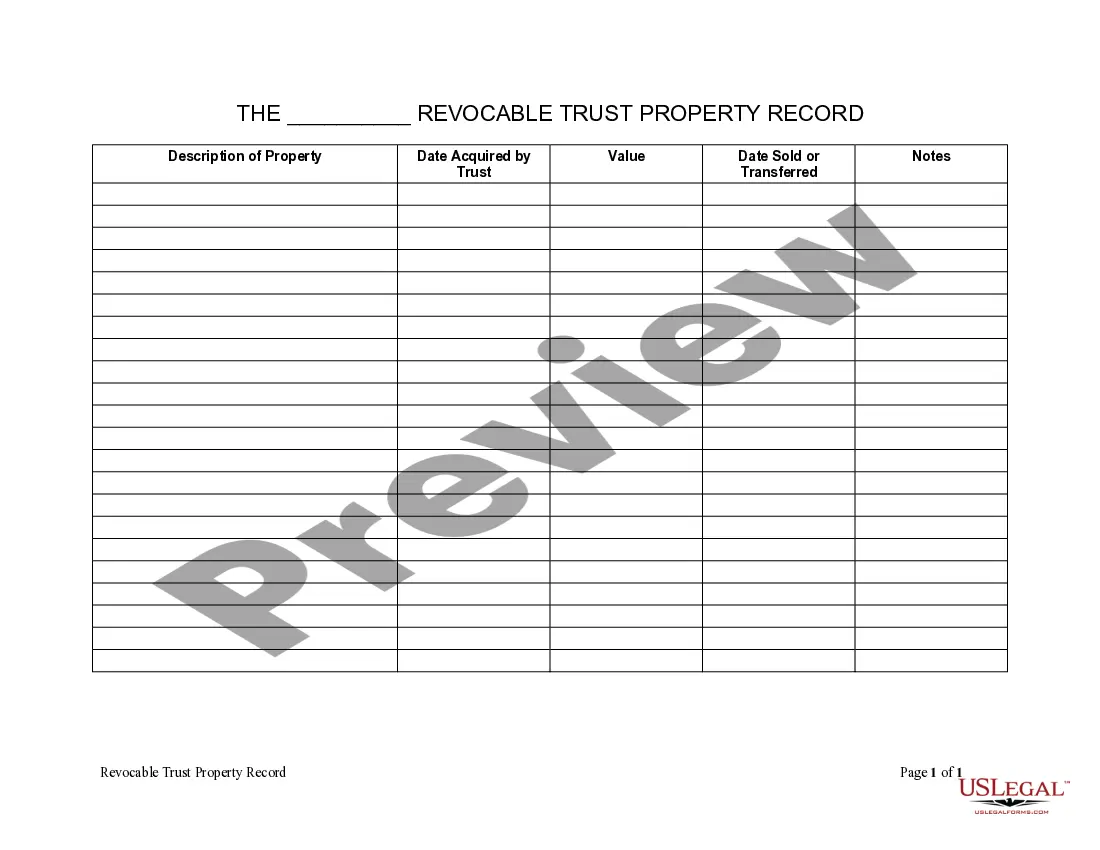

Filling out a New Jersey Geologist Agreement - Self-Employed Independent Contractor requires careful attention to detail. Begin by entering the names and addresses of both the contractor and the client, followed by a description of services. Next, include payment details and any specific conditions that relate to the contract. Utilizing templates from services like US Legal Forms can help streamline this process efficiently.

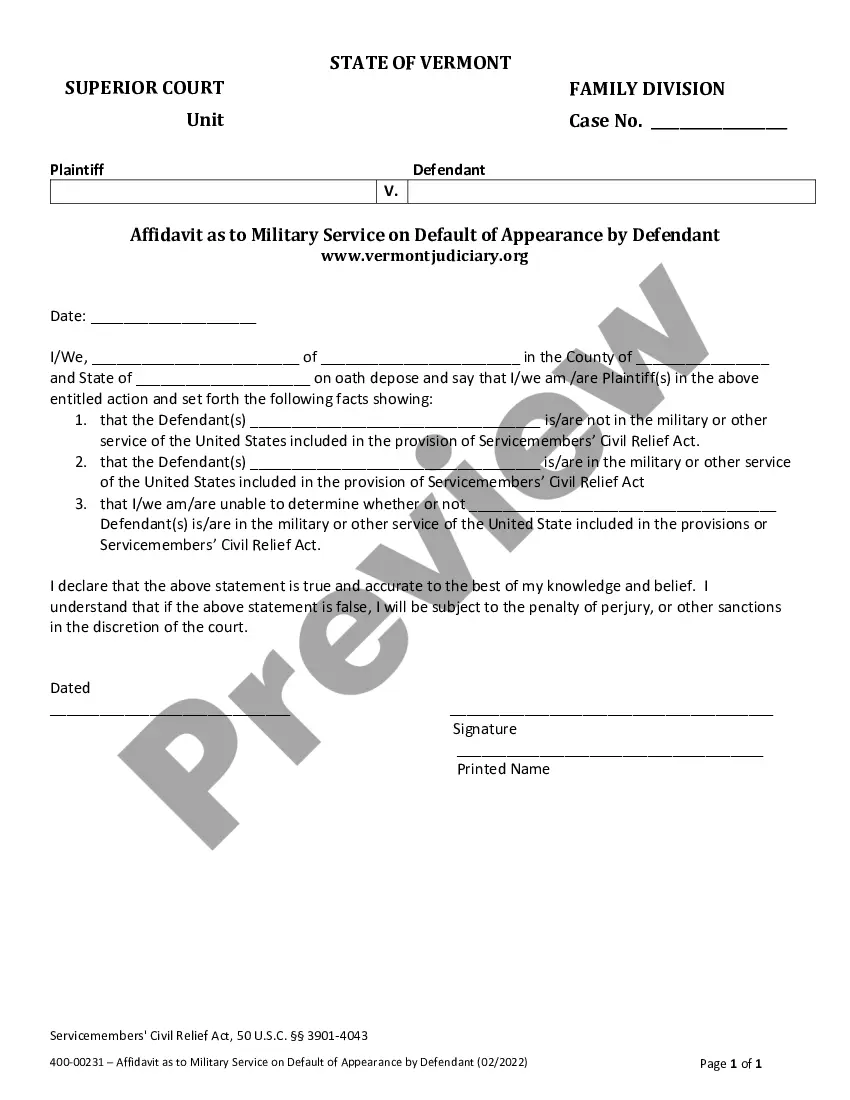

An independent contractor in New Jersey needs to complete several key documents, including a W-9 form and the New Jersey Geologist Agreement - Self-Employed Independent Contractor itself. Additionally, they should gather any necessary identification and business licenses if applicable. Having these documents ready helps establish a clear and professional arrangement with clients and protects both parties.

To write a New Jersey Geologist Agreement - Self-Employed Independent Contractor, start by clearly defining the services to be provided. Identify the parties involved, specify payment terms, and outline the duration of the agreement. Ensure you include any confidentiality clauses and terms regarding termination. You can use professional templates on platforms like US Legal Forms to simplify this process.

Yes, an independent contractor is indeed considered self-employed. This classification grants you the freedom to operate your business while bearing the responsibilities and perks of being your own boss. Understanding this distinction through the lens of the New Jersey Geologist Agreement - Self-Employed Independent Contractor can help clarify your role in the workforce.

To report income as an independent contractor, you will need to complete Schedule C, detailing your income and deductibles. It's vital to accurately record all income received, including any payments documented in the New Jersey Geologist Agreement - Self-Employed Independent Contractor. Utilize accounting software to streamline this process and ensure precision.