New Jersey Insurance Agent Agreement - Self-Employed Independent Contractor

Description

How to fill out Insurance Agent Agreement - Self-Employed Independent Contractor?

If you need to thorough, obtain, or create legal document templates, utilize US Legal Forms, the largest collection of legal documents, which can be located online.

Employ the site's straightforward and convenient search to find the paperwork you need. A range of templates for business and individual purposes are organized by categories and states, or keywords.

Use US Legal Forms to locate the New Jersey Insurance Agent Agreement - Self-Employed Independent Contractor within a few clicks.

Every legal document template you acquire is yours permanently. You will have access to each form you downloaded in your account. Go to the My documents section and select a form to print or download again.

Complete and obtain, and print the New Jersey Insurance Agent Agreement - Self-Employed Independent Contractor with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or individual needs.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to find the New Jersey Insurance Agent Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

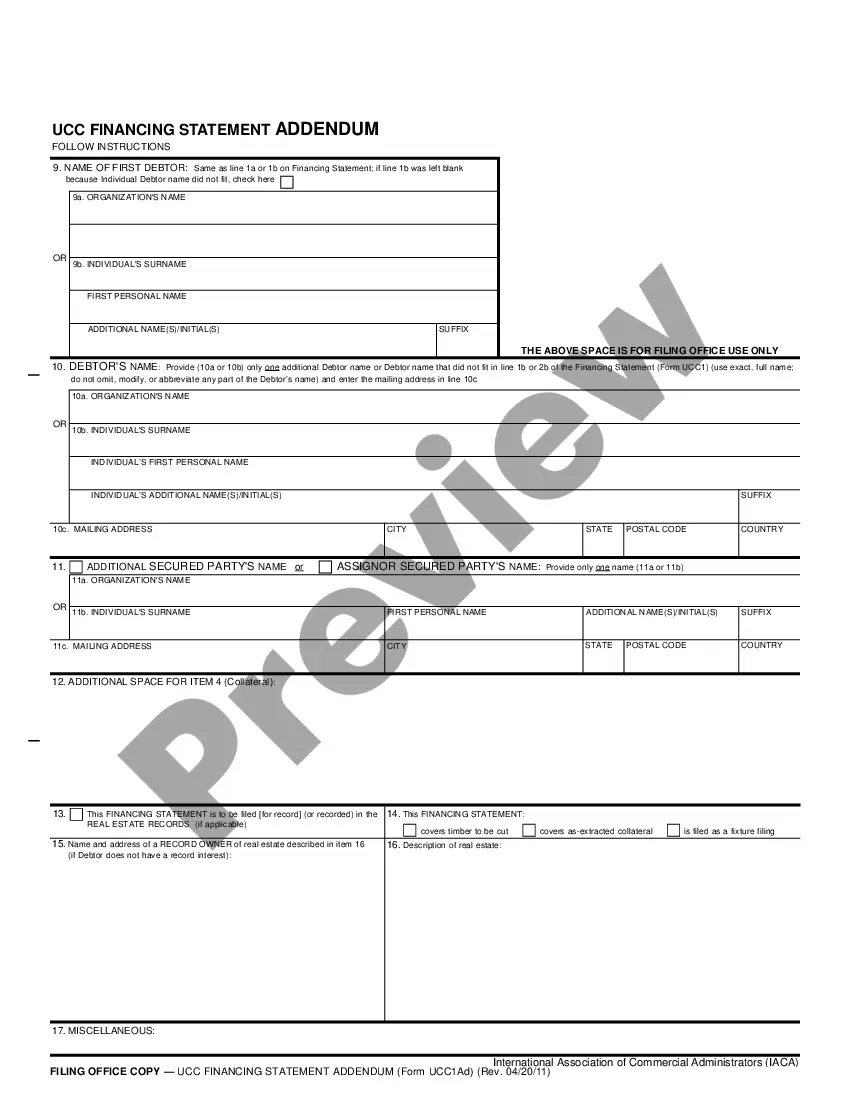

- Step 2. Use the Review feature to browse the form’s content. Don’t forget to check the description.

- Step 3. If you are not satisfied with the form, utilize the Search section at the top of the screen to find other versions of the legal document template.

- Step 4. Once you have found the form you need, select the Buy now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the New Jersey Insurance Agent Agreement - Self-Employed Independent Contractor.

Form popularity

FAQ

As a self-employed independent contractor operating under the New Jersey Insurance Agent Agreement, you need to complete several important forms. Start by filing a W-9 form to provide your taxpayer identification information. You may also need to submit a New Jersey Division of Revenue Business Registration form if you plan to operate as a business entity. Additionally, familiarize yourself with any specific agreements or documents required by the insurance agency you partner with.

Typically, the hiring party, or employer, drafts the independent contractor agreement. However, it is good practice for both parties to review and negotiate the terms before finalization. This collaboration ensures that both sides understand their obligations and rights under the agreement. For clarity and legal compliance, consider utilizing a New Jersey Insurance Agent Agreement - Self-Employed Independent Contractor from uslegalforms, which simplifies the process.

Writing an independent contractor agreement requires you to outline the roles and responsibilities of both parties clearly. Start with a title and include sections such as scope of work, payment terms, and confidentiality clauses. Additionally, it’s beneficial to establish the duration of the agreement and termination provisions. You can streamline your writing process by utilizing a reliable New Jersey Insurance Agent Agreement - Self-Employed Independent Contractor template.

Filling out an independent contractor form involves providing key details about both the contractor and the hiring entity. You should include your contact information, a description of the work to be performed, and payment terms. Make sure to review the form carefully for accuracy before submission, as this helps safeguard against future disputes. Using a well-designed New Jersey Insurance Agent Agreement - Self-Employed Independent Contractor form can simplify this process.

Yes, independent contractors typically file as self-employed individuals. This means they report their income and expenses on their tax returns using a Schedule C. It's crucial to keep track of all income and deductible business expenses to ensure accurate reporting. Understanding your tax obligations is essential when operating under a New Jersey Insurance Agent Agreement - Self-Employed Independent Contractor.

To fill out an independent contractor agreement, start by gathering basic information such as your name, the contractor's name, and the details of the services provided. It's important to specify payment terms and deadlines clearly to avoid misunderstandings. Additionally, include relevant clauses that define the scope of work and termination conditions. For a tailored option, consider using a New Jersey Insurance Agent Agreement - Self-Employed Independent Contractor template.

Indeed, an independent contractor does count as self-employed. They operate their own businesses, invoice clients, and manage their earnings. This classification allows them the freedom and flexibility to choose their projects. A New Jersey Insurance Agent Agreement - Self-Employed Independent Contractor reinforces this self-employment status while outlining the terms of their engagement.

Yes, independent contractors typically need to carry their own insurance to protect against risks related to their services. This insurance serves as a safeguard against potential liabilities. Depending on their field, specific coverage may be required. A New Jersey Insurance Agent Agreement - Self-Employed Independent Contractor often highlights the importance of securing the appropriate insurance.

To classify yourself as an independent contractor, you simply need to operate under a contract that defines your role. You should ensure that you have control over how you complete your work and that you service multiple clients. This independence is a hallmark of contracting. Utilizing a New Jersey Insurance Agent Agreement - Self-Employed Independent Contractor ensures proper classification and compliance.

An insurance agent can be self-employed, especially if they operate as an independent contractor. This means they manage their own schedules, seek out clients, and are responsible for their own finances. However, some agents may work under an employer, which changes their employment status. A New Jersey Insurance Agent Agreement - Self-Employed Independent Contractor supports those who choose the self-employed route.