New Jersey Loan Term Sheet

Description

How to fill out Loan Term Sheet?

Finding the right legitimate record format can be a struggle. Obviously, there are tons of layouts available on the net, but how would you obtain the legitimate type you will need? Utilize the US Legal Forms site. The support gives thousands of layouts, including the New Jersey Loan Term Sheet, that you can use for organization and private demands. All the kinds are checked out by professionals and satisfy federal and state needs.

If you are presently listed, log in to the account and then click the Download option to find the New Jersey Loan Term Sheet. Make use of your account to check through the legitimate kinds you might have purchased earlier. Check out the My Forms tab of your account and get another version in the record you will need.

If you are a whole new end user of US Legal Forms, listed here are easy recommendations for you to stick to:

- First, make certain you have chosen the right type for your town/region. It is possible to look through the shape making use of the Review option and browse the shape information to ensure it will be the best for you.

- When the type is not going to satisfy your needs, take advantage of the Seach discipline to get the appropriate type.

- Once you are sure that the shape is suitable, click the Buy now option to find the type.

- Pick the costs program you desire and enter the essential info. Build your account and pay for an order using your PayPal account or bank card.

- Pick the data file file format and down load the legitimate record format to the system.

- Full, modify and produce and sign the received New Jersey Loan Term Sheet.

US Legal Forms will be the greatest catalogue of legitimate kinds in which you can discover various record layouts. Utilize the company to down load expertly-produced paperwork that stick to express needs.

Form popularity

FAQ

NJHMFA (DPA) Program provides qualified homebuyers with $10,000 toward down payment and/or closing costs. The DPA it is a $10,000 forgivable loan with no payments and no interest rate the loan is forgiven.

NJHMFA First-Time Homebuyer Mortgage You're a first-time homebuyer or haven't owned a home in the past three years. The home must be your primary residence and located in New Jersey. You must meet credit score and debt-to-income ratio requirements. You must meet NJHMFA income and purchase price limits.

You may be required to provide an alternate source of income and/or an impressive credit score or be able to provide significant collateral. They may also require that you have a business plan if you are a new business, they will want projected cash flows and other financial documents.

Income Limits Household SizeIncome Limit1 Person$66,3002 persons$75,7503 persons$85,2004 persons$94,6504 more rows

9 Steps to Buying a House in NJ with Low-Income Calculate What You Can Afford. ... Research Low-Income Housing Programs in NJ. ... Consider Down Payment Assistance Programs. ... Gather Necessary Documents. ... Get Preapproved for a Mortgage with New American Funding. ... Find a Local Real Estate Agent in NJ. ... Look for an Affordable Home.

To qualify for the ERMA program, homeowners must meet the following requirements: Be a New Jersey homeowner with a demonstrated COVID-19 related financial hardship occurring after January 20, 2020; Own and occupy an eligible primary residence; Have an income at or below 150% of their county's Area Median Income (AMI).

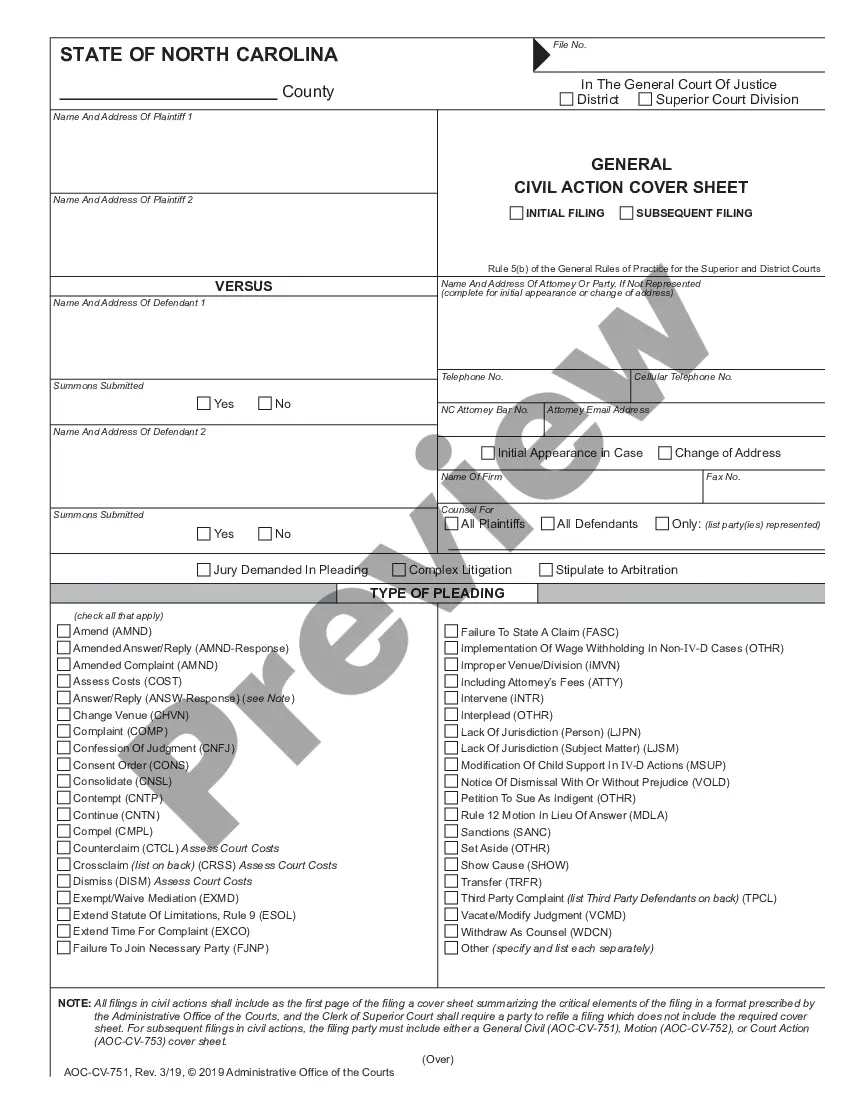

A term sheet is a nonbinding agreement that shows the basic terms and conditions of an investment. The term sheet serves as a template and basis for more detailed, legally binding documents.

You're considered a first-time homebuyer if you have not owned a home within the previous three years. Are you planning to purchase a home in New Jersey? This program applies to homes to be used as a primary residence in any New Jersey county. ask for an NJHMFA First-Time Homebuyer Mortgage Program loan today!