New Jersey Letter of Transmittal

Description

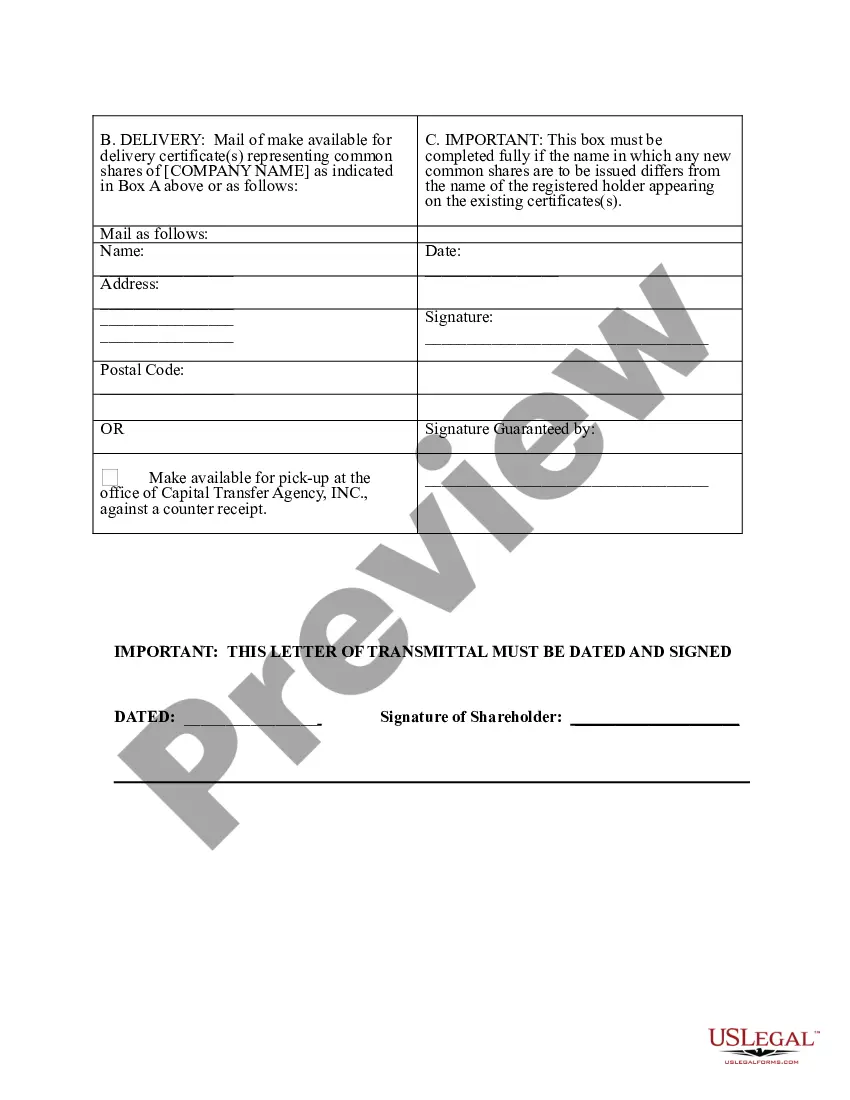

How to fill out Letter Of Transmittal?

Choosing the right lawful record template can be a struggle. Needless to say, there are a lot of themes available online, but how would you discover the lawful kind you require? Use the US Legal Forms internet site. The support delivers 1000s of themes, such as the New Jersey Letter of Transmittal, which you can use for business and personal requires. All of the forms are examined by specialists and meet federal and state demands.

If you are presently listed, log in for your accounts and click the Download option to obtain the New Jersey Letter of Transmittal. Make use of accounts to search from the lawful forms you possess acquired earlier. Proceed to the My Forms tab of the accounts and acquire an additional backup of your record you require.

If you are a brand new customer of US Legal Forms, here are easy guidelines so that you can stick to:

- First, ensure you have chosen the appropriate kind for your area/state. You may look through the form making use of the Preview option and look at the form outline to ensure it is the best for you.

- In the event the kind does not meet your expectations, utilize the Seach field to find the correct kind.

- When you are positive that the form is suitable, select the Acquire now option to obtain the kind.

- Select the prices plan you would like and enter in the necessary information. Create your accounts and pay for an order utilizing your PayPal accounts or bank card.

- Opt for the data file structure and down load the lawful record template for your system.

- Complete, modify and print and sign the attained New Jersey Letter of Transmittal.

US Legal Forms will be the biggest local library of lawful forms for which you will find various record themes. Use the service to down load skillfully-manufactured files that stick to express demands.

Form popularity

FAQ

How to complete Form 1096 Step 1: Fill in your business information. ... Step 2: Fill in your personal details. ... Step 3: Enter your EIN in Box 1. ... Step 4: Enter the number of forms in Box 3. ... Step 5: Calculate your withheld federal income tax in Box 4. ... Step 6: Indicate which return you're submitting in Box 6.

Use Form 1096 To Send Paper Forms to the IRS You must send Copies A of all paper Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G to the IRS with Form 1096, Annual Summary and Transmittal of U.S. Information Returns.

Form 1099 information returns with a letter of transmittal should be sent to: State of New Jersey-Division of Taxation, Revenue Processing Center, Gross Income Tax, PO Box 248, Trenton, NJ 08646-0248.

And, you must send it with its corresponding returns to the IRS. Unlike Form 1099-NEC or 1099-MISC, do not send Form 1096 to independent contractors or applicable state tax agencies. Only send Form 1096 to the IRS.

Yes, it is permissible to submit handwritten forms. Not clear on your question about it being scannable. Are you asking if you can scan one and reprint however many you need? The answer on the 1096 is NO.

Every Form 1099, 1097, 1098, 3921, 3922, 5498, 8935, and W-2G that you mail to the IRS must come with its own Form 1096 cover sheet. Since each form needs its own 1096, there should be only one ?X? mark in box 6 on every 1096 you submit.