New Jersey Certificate of Accredited Investor Status

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Certificate Of Accredited Investor Status?

Have you been in the place in which you require documents for both company or individual functions virtually every time? There are plenty of legal papers templates accessible on the Internet, but discovering versions you can rely on is not simple. US Legal Forms offers a huge number of form templates, like the New Jersey Certificate of Accredited Investor Status, that are created to meet federal and state demands.

Should you be already informed about US Legal Forms site and get a merchant account, simply log in. Next, you can obtain the New Jersey Certificate of Accredited Investor Status design.

Should you not offer an profile and need to begin to use US Legal Forms, follow these steps:

- Find the form you want and ensure it is for that right city/state.

- Utilize the Preview button to examine the shape.

- Read the explanation to actually have chosen the appropriate form.

- When the form is not what you`re trying to find, use the Lookup area to discover the form that meets your requirements and demands.

- Whenever you get the right form, click Get now.

- Select the costs strategy you would like, complete the desired info to produce your money, and purchase your order with your PayPal or charge card.

- Pick a handy data file file format and obtain your duplicate.

Find all the papers templates you may have bought in the My Forms food list. You can obtain a extra duplicate of New Jersey Certificate of Accredited Investor Status anytime, if required. Just click the necessary form to obtain or printing the papers design.

Use US Legal Forms, by far the most comprehensive selection of legal kinds, in order to save time and avoid errors. The service offers expertly created legal papers templates which you can use for an array of functions. Make a merchant account on US Legal Forms and initiate making your way of life easier.

Form popularity

FAQ

How to Become an Accredited Investor Meet Specific Financial Requirements. The most direct way to become an accredited investor is to have a net worth that exceeds $1 million or earns at least $200,000 per year . ... Pass the Knowledge Test. ... Obtain Accredited Investor Documentation. ... Apply to Become an Accredited Investor.

If you are accredited based on income, you will need to provide documentation in the form of tax returns, W-2s, or other official documents that show you meet the required income threshold for the prior two years.

If that type of official documentation is not available, you may be able to provide evidence through earnings statements, pay stubs, a letter from your employer certifying your income, or perhaps bank statements that show that you receive that income.

The simplest way to attain ?accredited investor? status is to ask for a 3rd party verification letter from a registered broker dealer, an attorney or a certified public accountant.

For the net worth test, you (or you and a spouse or spousal equivalent) must show enough assets to evidence a net worth of at least $1,000,000 USD ignoring the value of your primary residence and after discounting all your other liabilities (including liabilities exceeding the value of your primary residence and ...

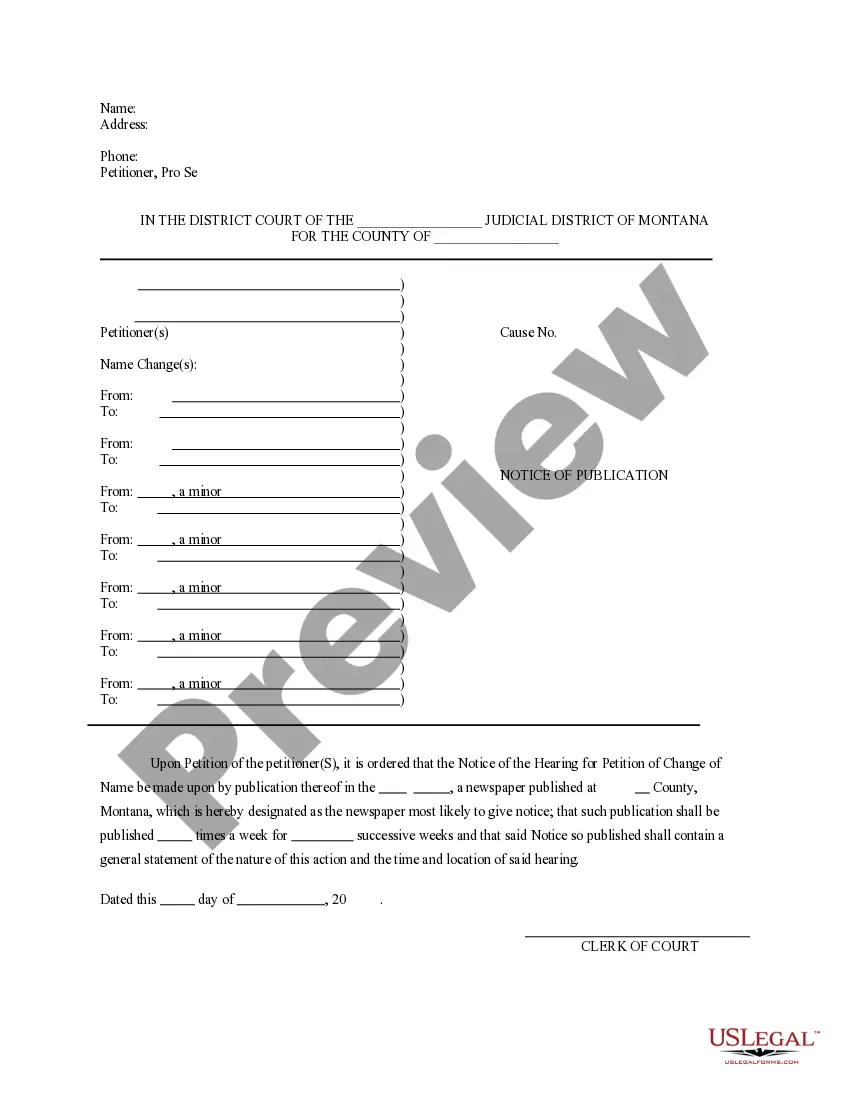

This certificate can be used in an issuer's private placement of securities to determine whether a potential investor is an accredited investor. This Standard Document has integrated notes with important explanations and drafting tips.

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

The SEC's Rule 506 allows self-certification of investors in order for them to become accredited.