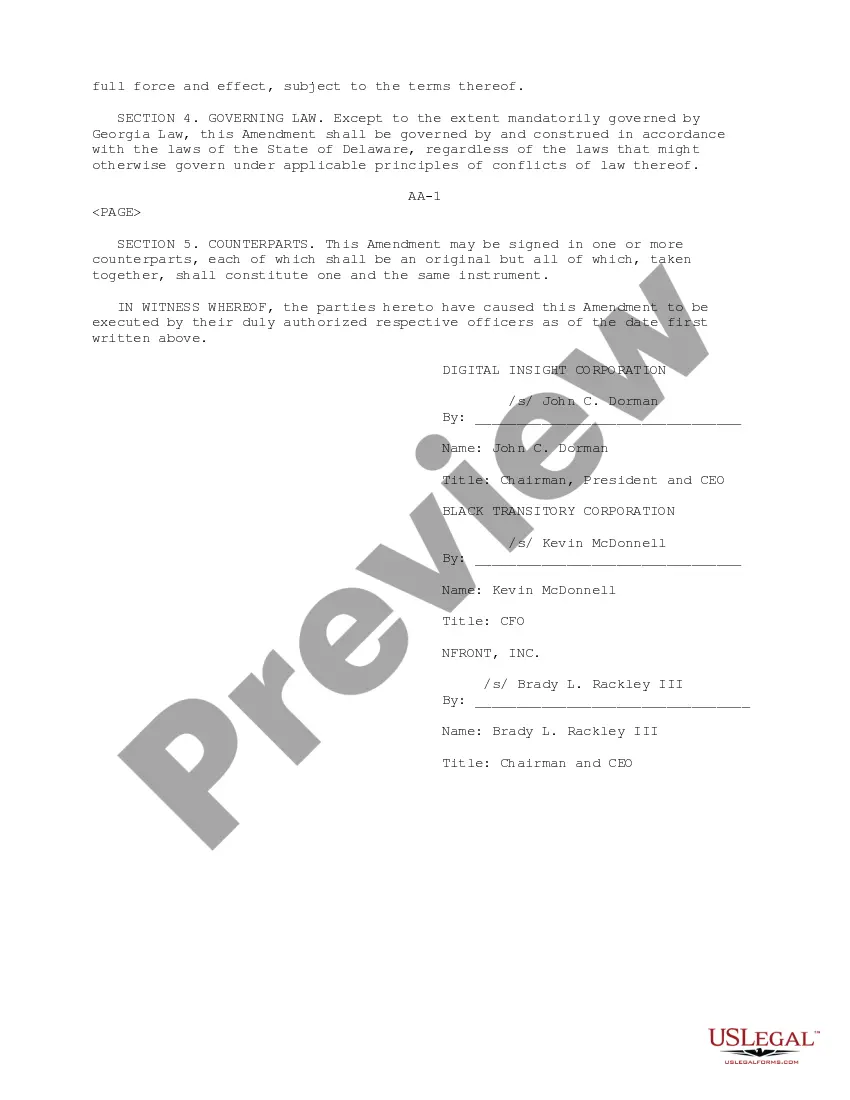

New Jersey Amendment No. 1 to Plan of Merger and Reorganization by and among Digital Insight Corp, Black Transitory Corp and nFront, Inc.

Description

How to fill out Amendment No. 1 To Plan Of Merger And Reorganization By And Among Digital Insight Corp, Black Transitory Corp And NFront, Inc.?

US Legal Forms - one of many most significant libraries of legal forms in America - gives a wide array of legal file layouts you can down load or print out. While using internet site, you will get a large number of forms for enterprise and specific reasons, categorized by categories, claims, or keywords.You can find the latest variations of forms like the New Jersey Amendment No. 1 to Plan of Merger and Reorganization by and among Digital Insight Corp, Black Transitory Corp and nFront, Inc. within minutes.

If you already have a registration, log in and down load New Jersey Amendment No. 1 to Plan of Merger and Reorganization by and among Digital Insight Corp, Black Transitory Corp and nFront, Inc. from the US Legal Forms local library. The Download button will appear on every kind you see. You get access to all formerly delivered electronically forms within the My Forms tab of the profile.

In order to use US Legal Forms the first time, listed here are simple recommendations to get you started out:

- Ensure you have selected the right kind for the area/county. Click the Review button to check the form`s content material. Read the kind description to actually have chosen the right kind.

- If the kind does not satisfy your requirements, take advantage of the Search area at the top of the display screen to get the the one that does.

- Should you be happy with the shape, validate your selection by simply clicking the Get now button. Then, pick the pricing strategy you favor and provide your references to sign up for the profile.

- Approach the financial transaction. Utilize your bank card or PayPal profile to finish the financial transaction.

- Choose the formatting and down load the shape on the device.

- Make changes. Complete, modify and print out and signal the delivered electronically New Jersey Amendment No. 1 to Plan of Merger and Reorganization by and among Digital Insight Corp, Black Transitory Corp and nFront, Inc..

Each web template you added to your money lacks an expiry particular date and is the one you have permanently. So, if you would like down load or print out an additional backup, just go to the My Forms segment and click on the kind you need.

Gain access to the New Jersey Amendment No. 1 to Plan of Merger and Reorganization by and among Digital Insight Corp, Black Transitory Corp and nFront, Inc. with US Legal Forms, probably the most substantial local library of legal file layouts. Use a large number of professional and status-distinct layouts that meet your organization or specific requires and requirements.