New Jersey Stockholders Agreement between Unilab Corp., Kelso Investment Associates VI, LLP, KEP VI, LLC, EOS Partners, LP, Pequot Scout Fund, LP, and Rollover Investors

Description

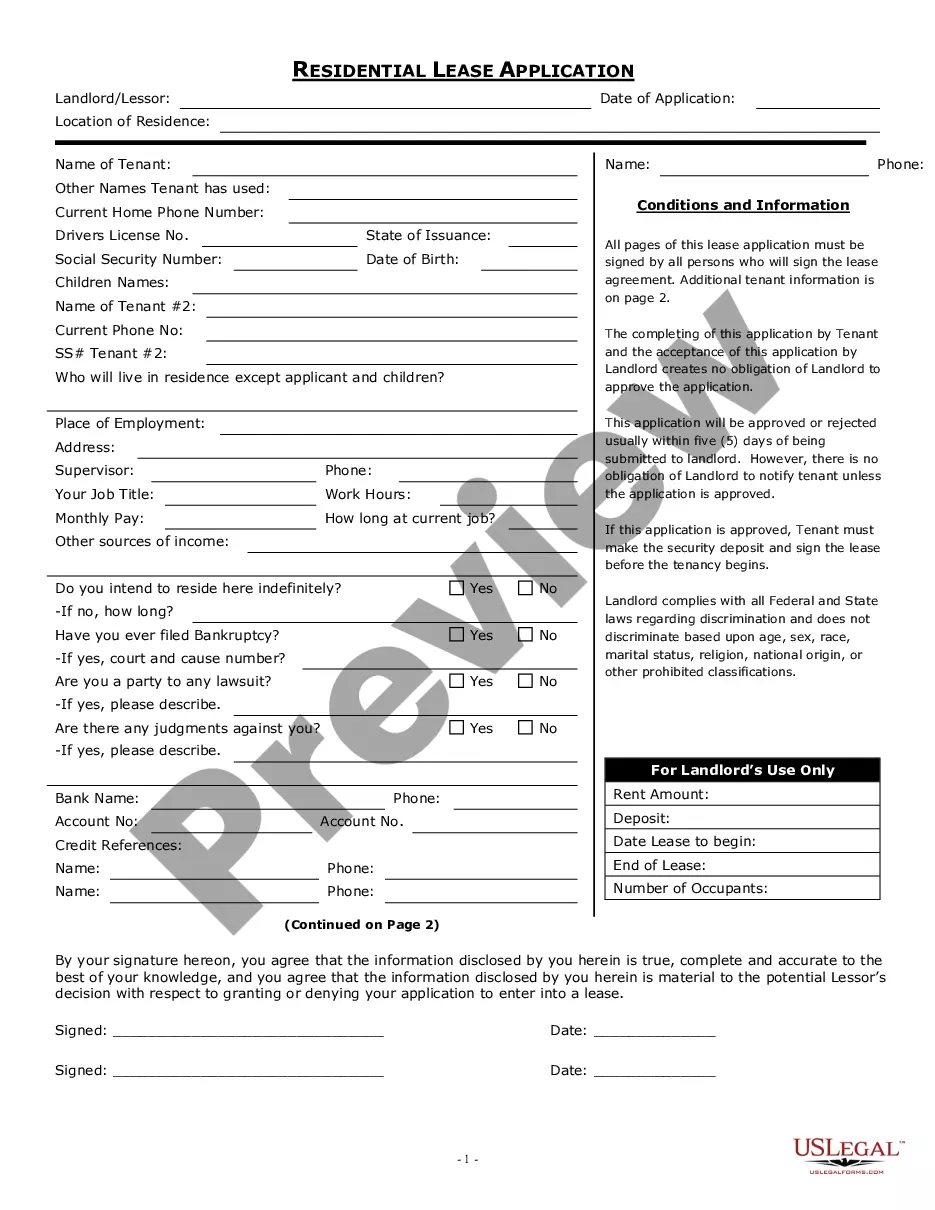

How to fill out Stockholders Agreement Between Unilab Corp., Kelso Investment Associates VI, LLP, KEP VI, LLC, EOS Partners, LP, Pequot Scout Fund, LP, And Rollover Investors?

Finding the right legitimate document design can be a battle. Of course, there are a variety of layouts available on the Internet, but how do you get the legitimate develop you will need? Utilize the US Legal Forms internet site. The services provides thousands of layouts, like the New Jersey Stockholders Agreement between Unilab Corp., Kelso Investment Associates VI, LLP, KEP VI, LLC, EOS Partners, LP, Pequot Scout Fund, LP, and Rollover Investors, that can be used for company and private requires. Each of the forms are checked out by pros and satisfy federal and state specifications.

In case you are previously listed, log in to the account and click on the Obtain option to obtain the New Jersey Stockholders Agreement between Unilab Corp., Kelso Investment Associates VI, LLP, KEP VI, LLC, EOS Partners, LP, Pequot Scout Fund, LP, and Rollover Investors. Use your account to look with the legitimate forms you might have acquired in the past. Check out the My Forms tab of the account and obtain one more copy of your document you will need.

In case you are a new customer of US Legal Forms, here are straightforward instructions for you to adhere to:

- Initially, make sure you have selected the right develop for your personal town/county. You are able to look over the shape utilizing the Preview option and read the shape explanation to make sure it is the best for you.

- When the develop fails to satisfy your needs, take advantage of the Seach industry to obtain the proper develop.

- When you are positive that the shape is acceptable, go through the Acquire now option to obtain the develop.

- Select the costs program you need and type in the needed info. Create your account and pay for the transaction utilizing your PayPal account or charge card.

- Opt for the document formatting and down load the legitimate document design to the gadget.

- Total, modify and produce and indication the attained New Jersey Stockholders Agreement between Unilab Corp., Kelso Investment Associates VI, LLP, KEP VI, LLC, EOS Partners, LP, Pequot Scout Fund, LP, and Rollover Investors.

US Legal Forms will be the most significant library of legitimate forms where you can see numerous document layouts. Utilize the company to down load professionally-manufactured papers that adhere to state specifications.