New Jersey Proposed amendment to articles eliminating certain preemptive rights

Description

How to fill out Proposed Amendment To Articles Eliminating Certain Preemptive Rights?

Are you in the placement where you need files for possibly organization or individual uses nearly every working day? There are plenty of lawful file templates available online, but finding ones you can rely on isn`t easy. US Legal Forms provides a huge number of develop templates, such as the New Jersey Proposed amendment to articles eliminating certain preemptive rights, which are created to meet state and federal requirements.

Should you be currently informed about US Legal Forms web site and possess an account, merely log in. After that, you can download the New Jersey Proposed amendment to articles eliminating certain preemptive rights design.

If you do not come with an profile and need to begin using US Legal Forms, adopt these measures:

- Get the develop you will need and ensure it is to the right town/county.

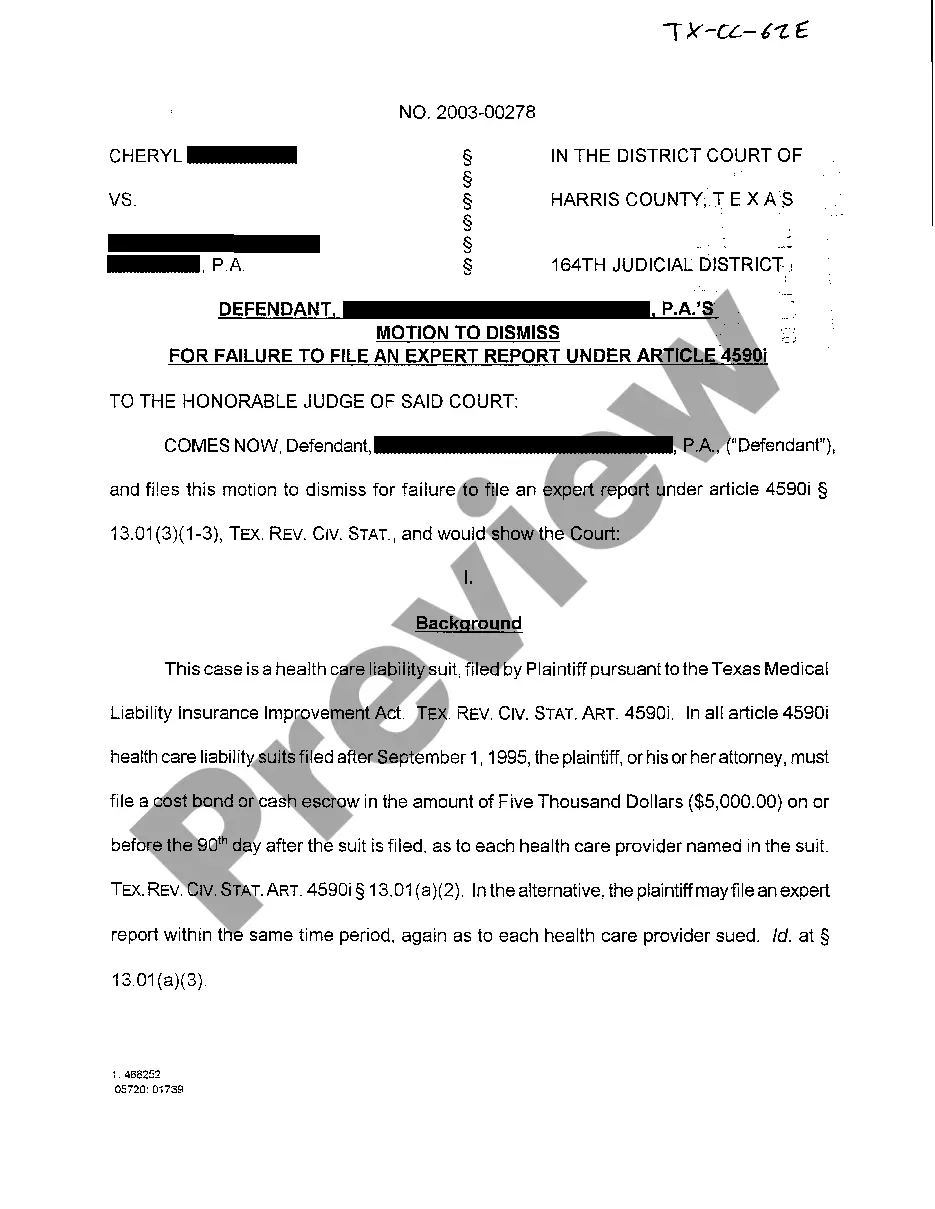

- Utilize the Review key to examine the form.

- See the information to actually have chosen the right develop.

- When the develop isn`t what you`re seeking, take advantage of the Search field to discover the develop that suits you and requirements.

- If you find the right develop, just click Purchase now.

- Opt for the prices strategy you need, submit the necessary info to make your account, and purchase your order with your PayPal or Visa or Mastercard.

- Decide on a practical document formatting and download your version.

Discover all the file templates you have purchased in the My Forms food selection. You may get a extra version of New Jersey Proposed amendment to articles eliminating certain preemptive rights any time, if possible. Just select the needed develop to download or produce the file design.

Use US Legal Forms, one of the most extensive selection of lawful varieties, to save time as well as stay away from mistakes. The support provides appropriately produced lawful file templates which can be used for a variety of uses. Create an account on US Legal Forms and commence producing your daily life a little easier.

Form popularity

FAQ

Section 163 outlines the rights of minority shareholders Section 163 of the Act sets out the rights of minority shareholders to bring actions for the protection of their interests, such as the right to bring an action if they feel that the majority shareholders are acting in an oppressive manner.

Section 14A:2-2.1 - Corporate alternate names (1) No domestic corporation, or foreign corporation which transacts business in this State within the meaning of section 14A:13-3, shall transact any business in this State using a name other than its actual name unless (a) It also uses its actual name in the transaction of ...

There are a number of ways a majority shareholder may remove a minority shareholder, and doing so is not necessarily wrong. For example, the majority shareholder may buy out the minority shareholder's shares, either by following the terms of the shareholder agreement or by negotiating with the shareholder.

Common shareholders are granted six rights: voting power, ownership, the right to transfer ownership, a claim to dividends, the right to inspect corporate documents, and the right to sue for wrongful acts. Investors should thoroughly research the corporate governance policies of the companies they invest in.

New Jersey Law The New Jersey Shareholders' Protection Act, N.J.S.A. 14A:10A-1, et seq. protects minority shareholders, who suffer oppression, which is defined as situations where the majority shareholders act in a way that is illegal, fraudulent, or oppressive to the minority shareholders.

New Jersey Oppressed Shareholders Act 14A:14-7) (the ?Act?) protects minority shareholders from unlawful and oppressive acts by the majority or controlling shareholders. The protections afforded by the Act apply to closely held corporations with 25 or fewer shareholders.

The New Jersey Professional Service Corporation Act sets laws and regulations for professional service corporations. A professional corporation is a unique business structure formed by licensed professionals who provide personal services for their clients.