New Jersey Proposal to increase common stock regarding to pursue acquisitions - transactions providing profit and growth

Description

How to fill out Proposal To Increase Common Stock Regarding To Pursue Acquisitions - Transactions Providing Profit And Growth?

Are you presently within a situation that you need to have paperwork for sometimes business or person uses just about every day? There are a lot of lawful record themes available online, but locating types you can trust is not straightforward. US Legal Forms gives thousands of form themes, such as the New Jersey Proposal to increase common stock regarding to pursue acquisitions - transactions providing profit and growth, which are created in order to meet federal and state requirements.

If you are already acquainted with US Legal Forms site and have an account, basically log in. After that, you may down load the New Jersey Proposal to increase common stock regarding to pursue acquisitions - transactions providing profit and growth design.

Unless you provide an profile and wish to begin using US Legal Forms, adopt these measures:

- Get the form you want and ensure it is for the appropriate area/area.

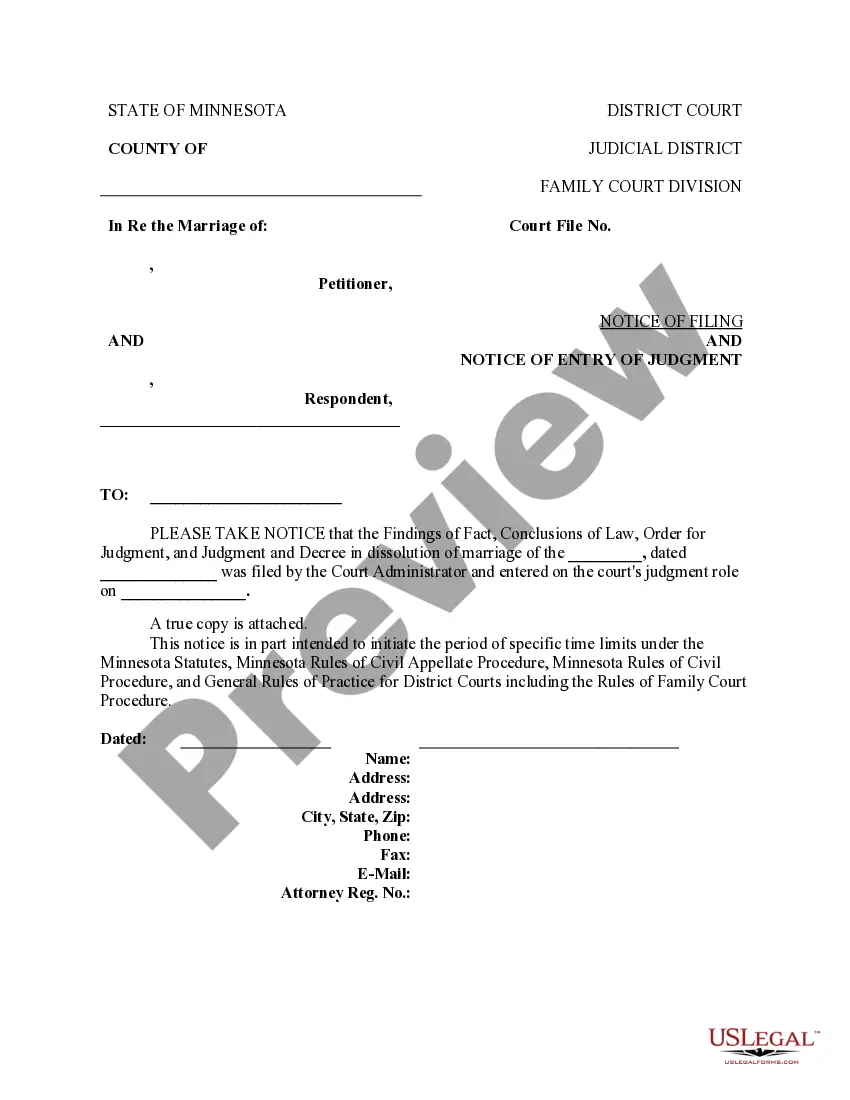

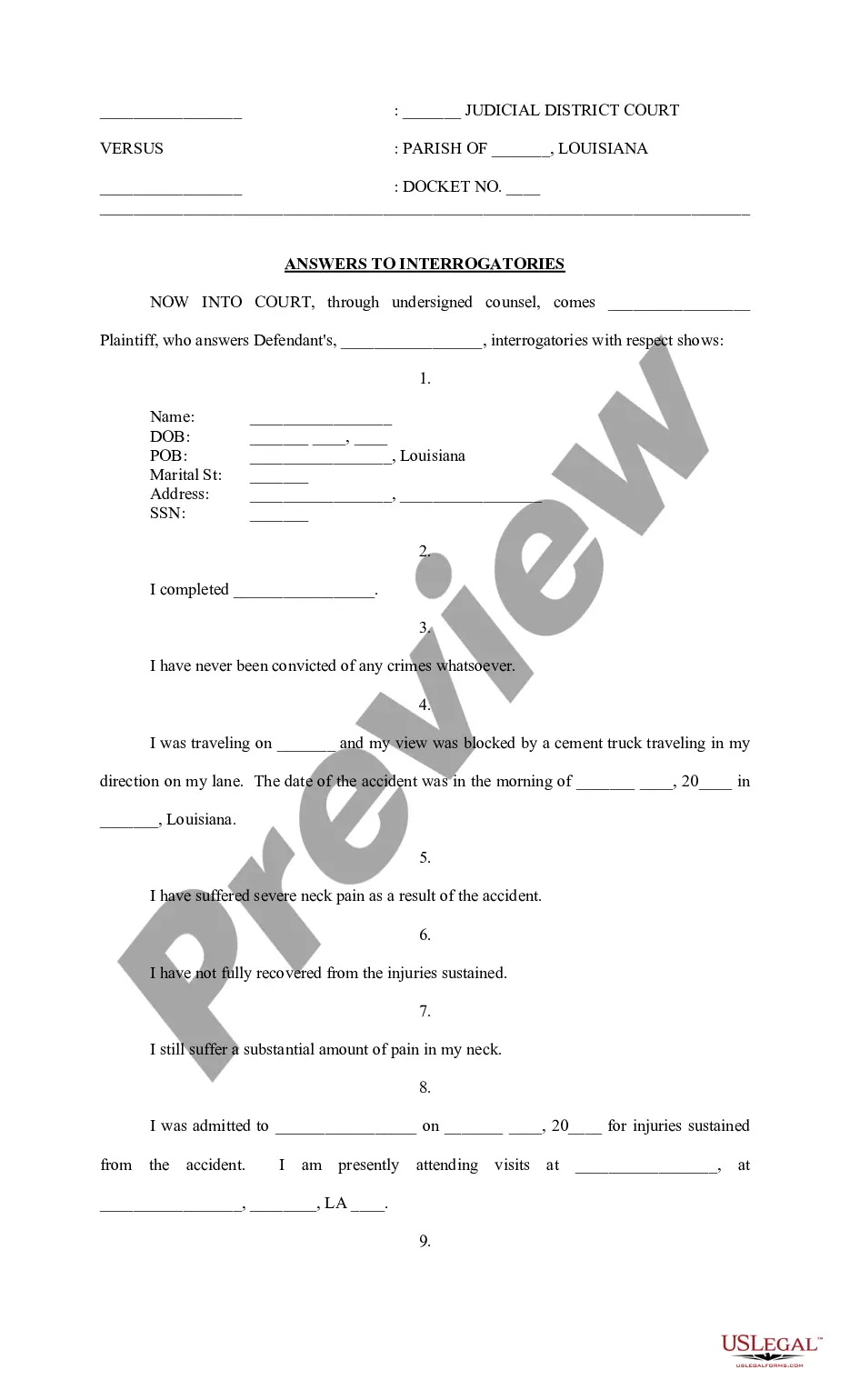

- Take advantage of the Review option to examine the form.

- Read the explanation to ensure that you have selected the appropriate form.

- In the event the form is not what you`re searching for, utilize the Search industry to discover the form that meets your requirements and requirements.

- If you get the appropriate form, click on Buy now.

- Choose the pricing prepare you need, complete the specified info to generate your bank account, and buy your order making use of your PayPal or Visa or Mastercard.

- Choose a handy file formatting and down load your backup.

Find all the record themes you have bought in the My Forms food selection. You may get a more backup of New Jersey Proposal to increase common stock regarding to pursue acquisitions - transactions providing profit and growth whenever, if needed. Just go through the necessary form to down load or print out the record design.

Use US Legal Forms, the most comprehensive assortment of lawful varieties, to conserve time as well as stay away from blunders. The services gives expertly created lawful record themes which can be used for a selection of uses. Make an account on US Legal Forms and commence making your life easier.