New Jersey Approval of deferred compensation investment account plan

Description

How to fill out Approval Of Deferred Compensation Investment Account Plan?

US Legal Forms - one of many most significant libraries of lawful kinds in the USA - delivers a wide range of lawful document themes you can download or printing. Making use of the site, you can find thousands of kinds for organization and personal functions, sorted by groups, suggests, or keywords.You will find the newest models of kinds such as the New Jersey Approval of deferred compensation investment account plan in seconds.

If you already possess a monthly subscription, log in and download New Jersey Approval of deferred compensation investment account plan in the US Legal Forms library. The Acquire key can look on each and every type you look at. You gain access to all previously saved kinds from the My Forms tab of the profile.

If you wish to use US Legal Forms initially, listed here are basic directions to get you started:

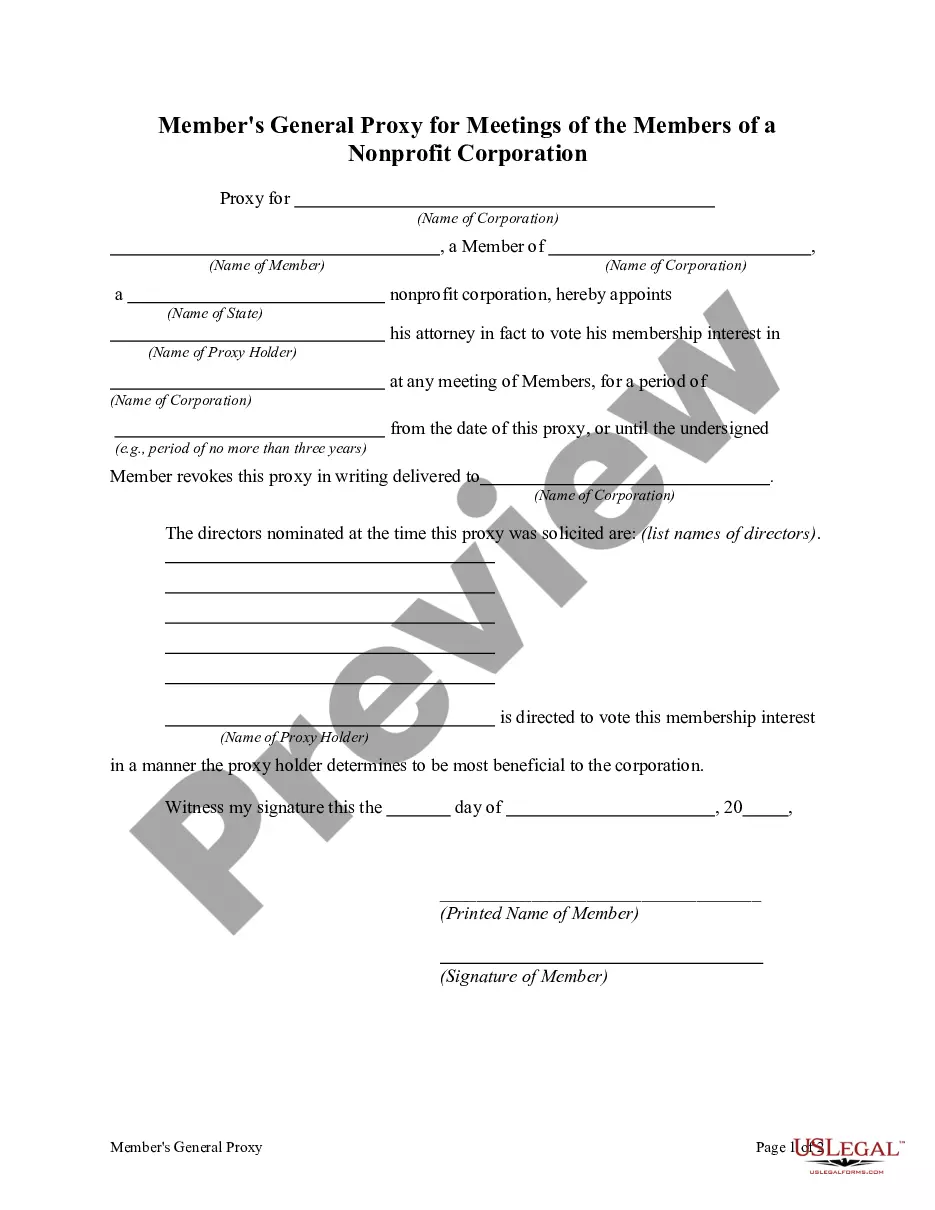

- Ensure you have chosen the correct type for the area/county. Click the Review key to examine the form`s information. Look at the type description to ensure that you have chosen the proper type.

- If the type doesn`t match your requirements, make use of the Look for area towards the top of the display screen to get the one which does.

- When you are pleased with the form, verify your selection by visiting the Purchase now key. Then, choose the rates strategy you like and give your accreditations to register on an profile.

- Procedure the purchase. Make use of your credit card or PayPal profile to finish the purchase.

- Select the file format and download the form on your product.

- Make changes. Complete, modify and printing and sign the saved New Jersey Approval of deferred compensation investment account plan.

Each template you added to your money lacks an expiry time which is yours for a long time. So, if you wish to download or printing another backup, just go to the My Forms area and click on in the type you need.

Obtain access to the New Jersey Approval of deferred compensation investment account plan with US Legal Forms, the most substantial library of lawful document themes. Use thousands of professional and state-particular themes that meet your company or personal needs and requirements.

Form popularity

FAQ

Deferred Retirement is available if you have at least 10 years of service credit upon terminating employ- ment, but do not yet meet the retirement age require- ment set forth by the State-administered retirement systems.

NJ Taxation Income earned in New Jersey is subject to Gross Income Tax, regardless of the residency of the taxpayer when the income is reported. This includes deferred income that is earned in one period, then reported and taxed in a later one.

The New Jersey State Employees Deferred Compen- sation Plan (NJSEDCP) provides you, as an eligible State employee, an opportunity to voluntarily shelter a portion of your wages from federal income taxes while saving for retirement to supplement your So- cial Security and pension benefits.

Investing your deferred compensation Your plan might offer you several options for the benchmark?often, major stock and bond indexes, the 10-year US Treasury note, the company's stock price, or the mutual fund choices in the company 401(k) plan.

At least 25 years of service required. Annual Benefit = Years of Service ÷ 55 X Final Average (3 yrs.) Salary. No minimum age; however, if under age of 55, the benefit is reduced 3 percent per year (1/4 of 1 percent per month) for each year under age 55.

The Defined Contribution Retirement Program (DCRP) provides eligible members with a tax-sheltered, defined contribution retirement benefit, along with life insurance and disability coverage.

The New Jersey State Employees Deferred Compen- sation Plan (NJSEDCP) provides you, as an eligible State employee, an opportunity to voluntarily shelter a portion of your wages from federal income taxes while saving for retirement to supplement your So- cial Security and pension benefits.