New Jersey Hourly Employee Evaluation

Description

How to fill out Hourly Employee Evaluation?

Are you in a situation where you require documents for either business or personal purposes frequently.

There is a wide array of legitimate document templates available online, but finding reliable versions can be challenging.

US Legal Forms offers a vast selection of form templates, such as the New Jersey Hourly Employee Evaluation, which can be tailored to meet both state and federal standards.

Once you find the correct form, click on Buy now.

Select the pricing plan you prefer, fill out the necessary information to create your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Once logged in, you can download the New Jersey Hourly Employee Evaluation template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct area/county.

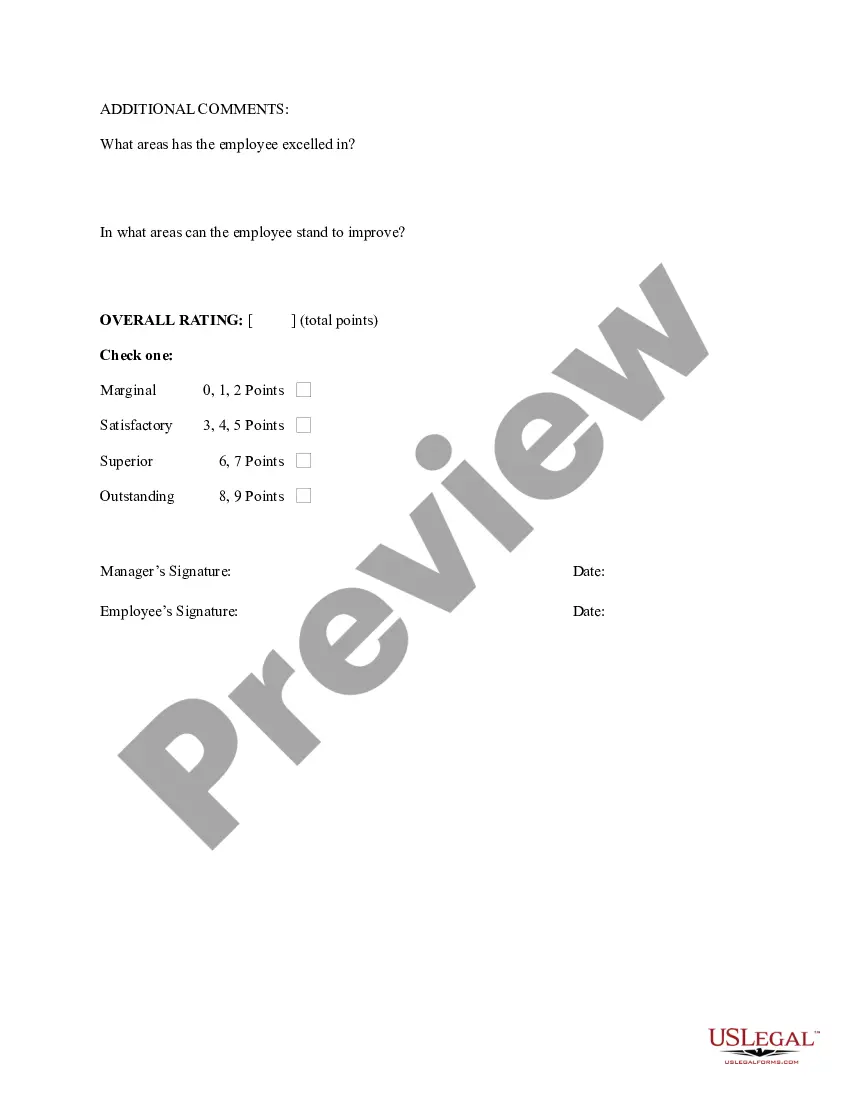

- Use the Preview button to review the form.

- Read the description to confirm that you have selected the right form.

- If the form is not what you are looking for, utilize the Search field to find the form that meets your needs and requirements.

Form popularity

FAQ

The 7-minute rule in New Jersey pertains to how employers should account for work time and breaks, specifically regarding minute increments. Under this guideline, if an employee works or is required to stay for a period of more than 7 minutes beyond their scheduled time, it must be documented and compensated accordingly. This rule is vital for ensuring compliance during a New Jersey Hourly Employee Evaluation. By using US Legal Forms, employers can find templates that assist in tracking employee work time accurately.

For purposes of determining which employees are eligible for insurance under a Small Employer plan and whether the Small Employer meets the participation requirement, full-time is defined as 25 hours per week.

Overtime pay is the amount of overtime paid to each employee in a pay period. Overtime pay is calculated: Hourly pay rate x 1.5 x overtime hours worked. Here is an example of total pay for an employee who worked 42 hours in a workweek: Regular pay rate x 40 hours = Regular pay, plus.

In New Jersey, the minimum wage increases $1 to $13 an hour for most employees on Jan. 1, 2022, and $15 by 2024. The increase is part of legislation that was signed by Governor Phil Murphy in February 2019.

New Jersey law requires nonexempt employees to be paid 1.5 times their regular pay rate for hours worked over 40 in a workweek. New Jersey does not require overtime pay when you work more than eight hours in a day.

New Jersey labor laws require an employer to pay overtime to employees, unless otherwise exempt, at the rate of 1½ times the employee's regular rate of pay for all hours worked in excess of 40 hours in a workweek.

New Jersey employers should provide new employees with both the IRS Form W-4 and the Form NJ-W4. See Employee Withholding Forms. New Jersey employers just provide new employees with notice of employee rights under New Jersey wage and hour laws.

The most common types of employment forms to complete are:W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

And finally, to calculate the overtime pay rate for a normal work day, multiply the employee's hourly rate of pay by 1.5, and then multiply that figure with the number of overtime hours worked.

Under the FLSA, overtime pay is determined by multiplying the employee's straight time rate of pay by all overtime hours worked PLUS one-half of the employee's hourly regular rate of pay times all overtime hours worked.