New Jersey Performance Evaluation for Exempt Employees

Description

How to fill out Performance Evaluation For Exempt Employees?

It is feasible to spend hours online looking for the legal document template that meets the state and federal requirements you need.

US Legal Forms offers a multitude of legal forms that have been reviewed by professionals.

You can easily download or create the New Jersey Performance Evaluation for Exempt Employees from my service.

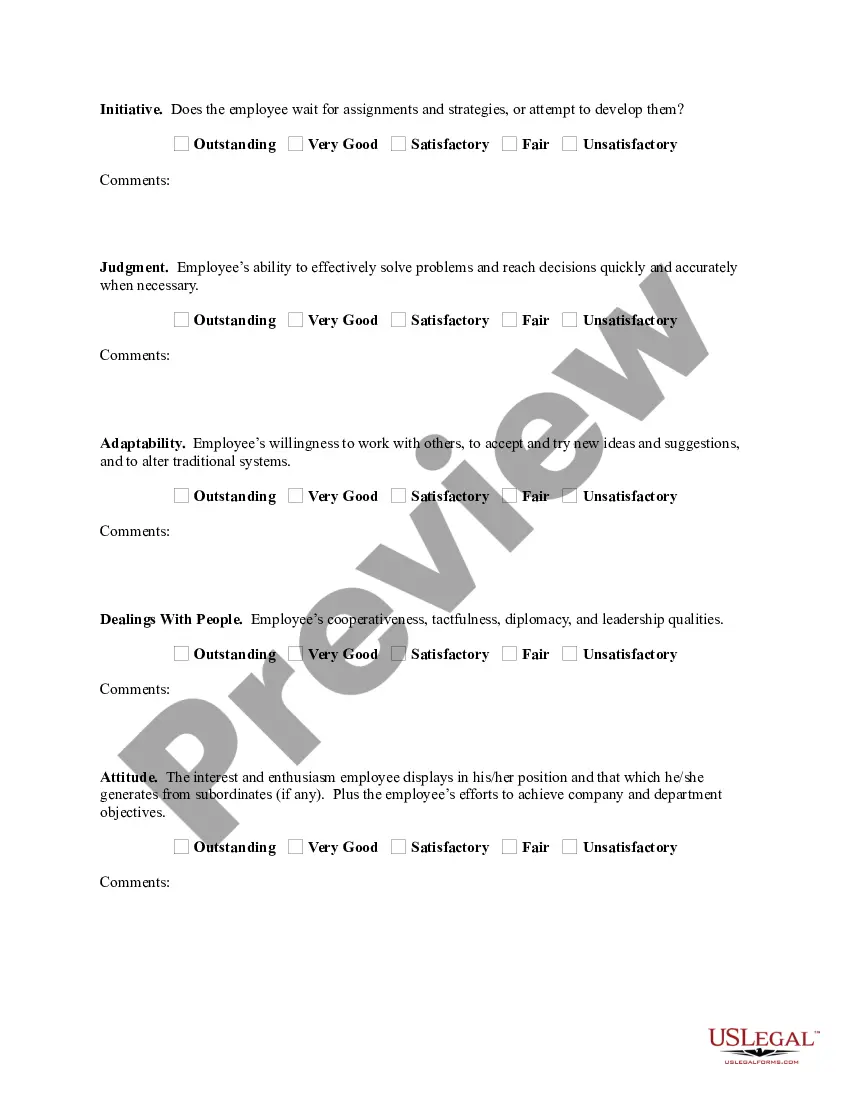

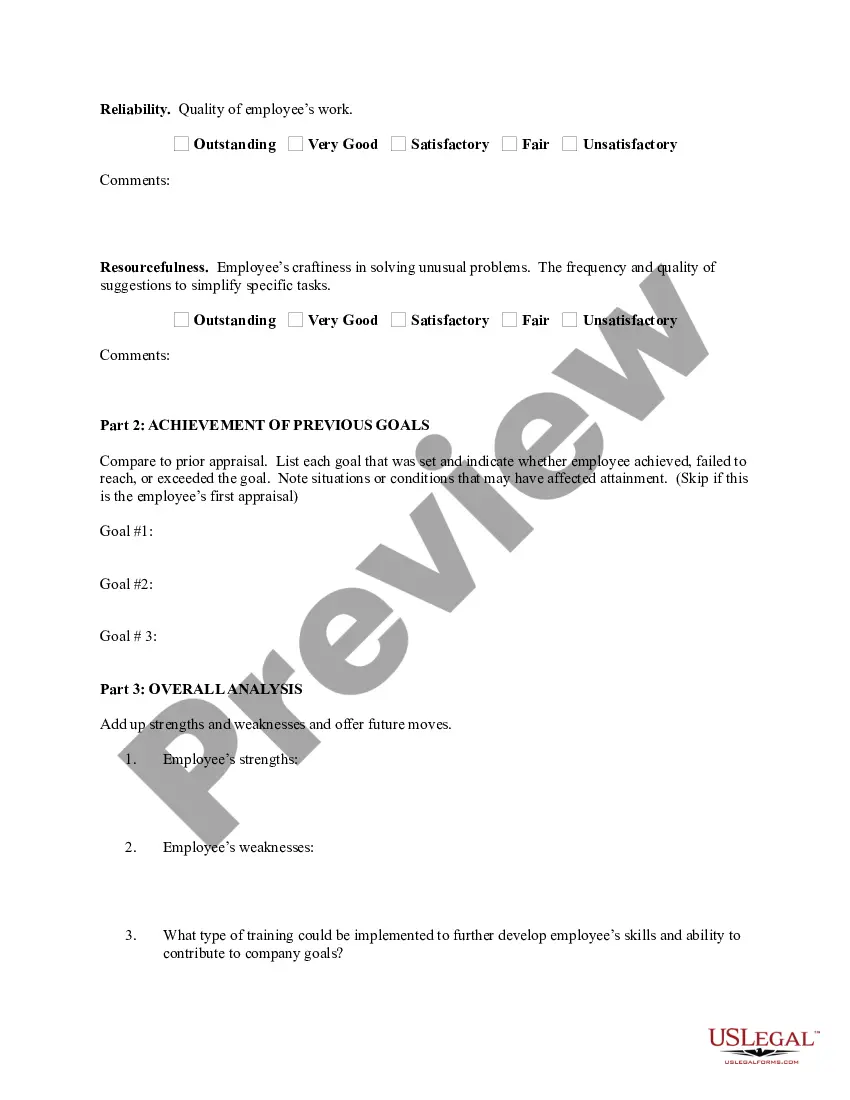

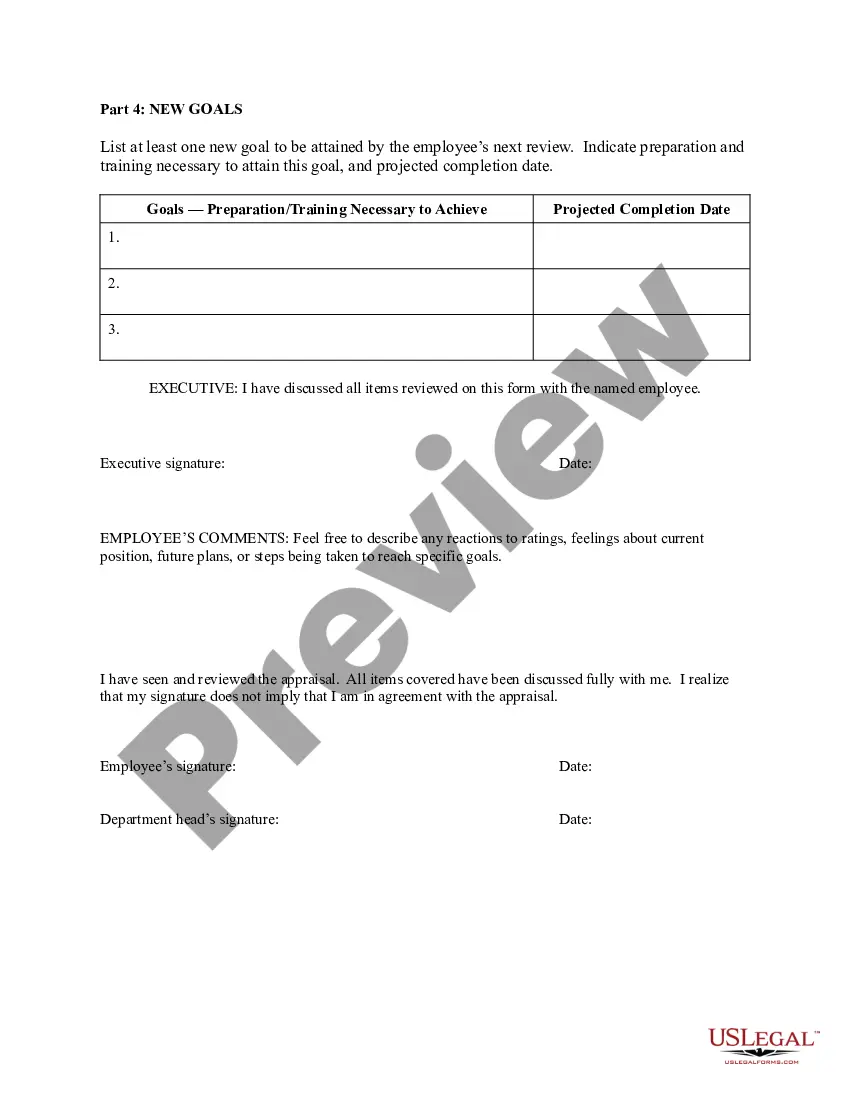

If available, utilize the Review option to examine the document template as well.

- If you already have a US Legal Forms account, you may Log In and click the Acquire button.

- After that, you can complete, modify, print, or sign the New Jersey Performance Evaluation for Exempt Employees.

- Each legal document template you purchase is yours forever.

- To obtain another copy of the purchased form, visit the My documents tab and click the corresponding option.

- If this is your first time using the US Legal Forms website, follow the simple instructions listed below.

- First, ensure that you have selected the correct document template for the region/town of your choosing.

- Review the template description to confirm you have chosen the right form.

Form popularity

FAQ

Under federal and New Jersey law, an employee who is classified as exempt is not entitled to be paid overtime, at a rate of one and one-half times his or her normal rate of pay, for hours worked in excess of forty in a workweek.

Effective December 31, 2020, in Nassau, Suffolk and Westchester counties, the minimum salary threshold for an employee to qualify as exempt under such exemptions increased to $1,050.00 per week ($54,600.00 per year).

Because they're exempt, salaried employees, you would pay them their $1000/week salary for all four pay periods, regardless of the number of hours workedand no overtime pay is required. So, if your employee is both salaried and classified as exempt, they are not entitled to overtime pay.

Maximum hours an exempt employee can be required to work The law does not provide a maximum number of hours that an exempt worker can be required to work during a week. This means that an employer could require an exempt employee to work well beyond 40 hours a week without overtime compensation.

With few exceptions, to be exempt an employee must (a) be paid at least $23,600 per year ($455 per week), and (b) be paid on a salary basis, and also (c) perform exempt job duties. These requirements are outlined in the FLSA Regulations (promulgated by the U.S. Department of Labor).

If you are a non-exempt employee, you have the right to receive minimum hourly wages, overtime at a rate of one-and-one-half times your hourly rate and the right to be paid for all of the hours you work under federal and state law.

Answered by: Kenneth J. Katz. Many salaried employees in New Jersey must still receive overtime pay despite being compensated on a salary basis. Being paid a salary only partially determines whether you are eligible for overtime pay under the federal Fair Labor Standards Act (FLSA) and New Jersey state law.

New 2021 Minimum Salary Requirement for Exempt Employees The minimum federal salary requirement for exempt employees in 2021 is currently unchanged at $684 per week or $35,568 annually.

Overtime is payable at the rate of 1 1/2 times the employee's regular hourly rate for hours worked in excess of 40 in any week except exempted by wage order. New Jersey exempts all employees working for nonprofit, seasonal camps and retreats from overtime pay, as well as a variety of other occupations.

Salaried Employees Can Be Entitled to Overtime Pay Regardless of how you are paid, you are entitled to be paid time-and-a-half for your overtime hours each week in which you work more than 40 hours unless you fall into an exempt category.