New Jersey FCRA Disclosure and Authorization Statement

Description

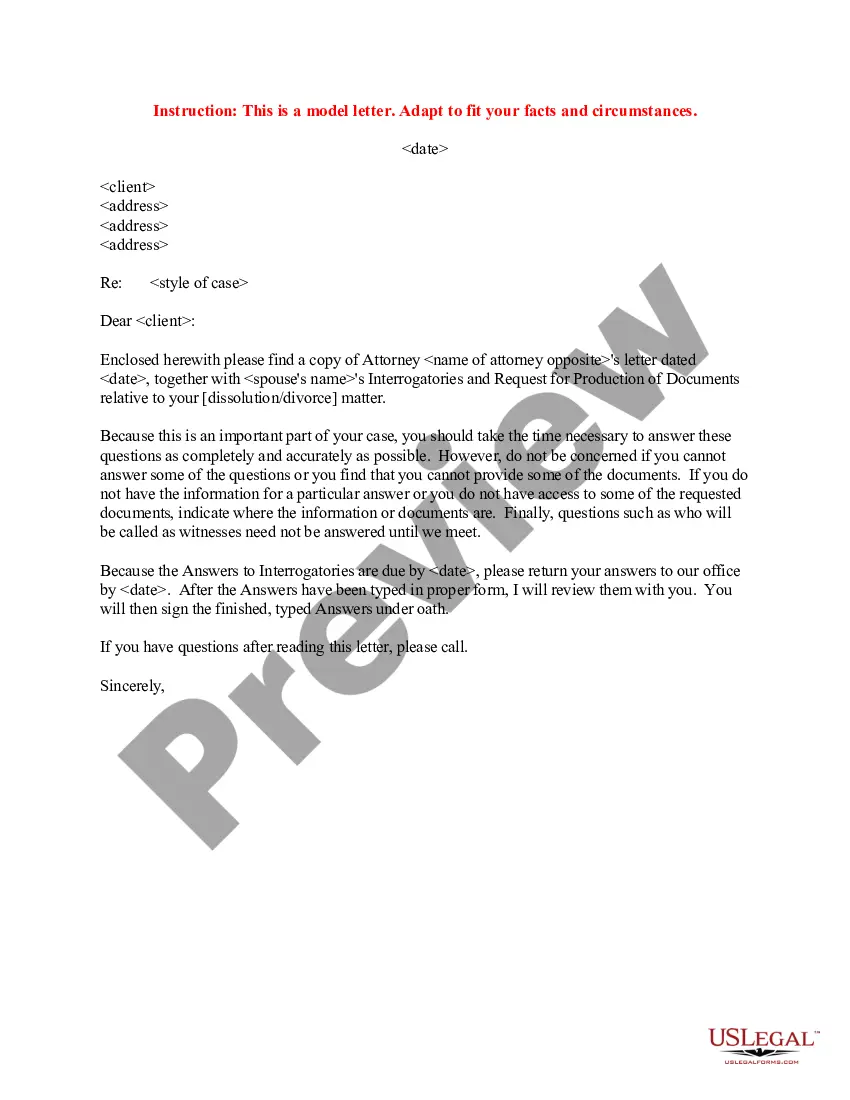

How to fill out FCRA Disclosure And Authorization Statement?

Have you ever found yourself in a circumstance where you require documents for either business or personal purposes almost all the time.

There are numerous legal document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms offers a vast array of template options, including the New Jersey FCRA Disclosure and Authorization Statement, which is designed to comply with state and federal regulations.

Once you find the appropriate template, simply click Acquire now.

Choose the pricing plan you prefer, complete the required information to create your account, and pay for the order using PayPal or your credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Next, you can download the New Jersey FCRA Disclosure and Authorization Statement template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the template you need and ensure it is for your specific region/state.

- Use the Preview button to review the form.

- Check the description to confirm that you have selected the correct template.

- If the template is not what you are looking for, use the Lookup field to find the form that meets your needs.

Form popularity

FAQ

Enforcing the FCRA begins with ensuring all consumer reports are obtained through proper channels, along with implementing the New Jersey FCRA Disclosure and Authorization Statement. Establish a clear policy for handling consumer information, which includes training your employees on their responsibilities. Regular audits of your practices can help identify areas for improvement. Consider using reliable platforms like USLegalForms to ensure that your disclosures and authorizations meet legal standards.

Under the FCRA, an employer may not run a background check on a prospective employee without first providing "a clear and conspicuous disclosure . . . in a document that consists solely of that disclosure, that a consumer report may be obtained for employment purposes." For efficiency, many employers include all

The FCRA requires that before an employer pulls a consumer report for employment purposes that the employer give the applicant a clear and conspicuous disclosure that the employer may obtain such a report. The disclosure must be in a document that consists solely of the disclosure. 15 U.S.C. 1681b(b)(2)(A)(i).

The Fair Credit Reporting Act (FCRA) is a federal law that requires you to make a disclosure to employees or applicants informing them that you will obtain a consumer report about them for employment consideration purposes. The form of the disclosure must meet very specific criteria set forth in the statute.

The Fair Credit Reporting Act (FCRA) is a federal law that requires you to make a disclosure to employees or applicants informing them that you will obtain a consumer report about them for employment consideration purposes.

On July 21, 2010, Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act). Section 1100F of the Dodd-Frank Act amended the FCRA to require disclosure of credit scores and information relating to credit scores for both risk-based pricing and FCRA adverse action notices.

The FCRA requires any prospective user of a consumer report, for example, a lender, insurer, landlord, or employer, among others, to have a legally permissible purpose to obtain a report. Legally Permissible Purposes.

What is FCRA Compliance? FCRA compliance is designed to protect consumers. The FCRA regulates employers that use background reports and the Consumer Reporting Agencies (CRAs) (aka background screening companies) that provide the information.

A Summary of Your Rights Under the Fair Credit Reporting Act. The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and privacy of. information in the files of consumer reporting agencies.

The Fair Credit Reporting Act describes the kind of data that the bureaus are allowed to collect. That includes the person's bill payment history, past loans, and current debts.