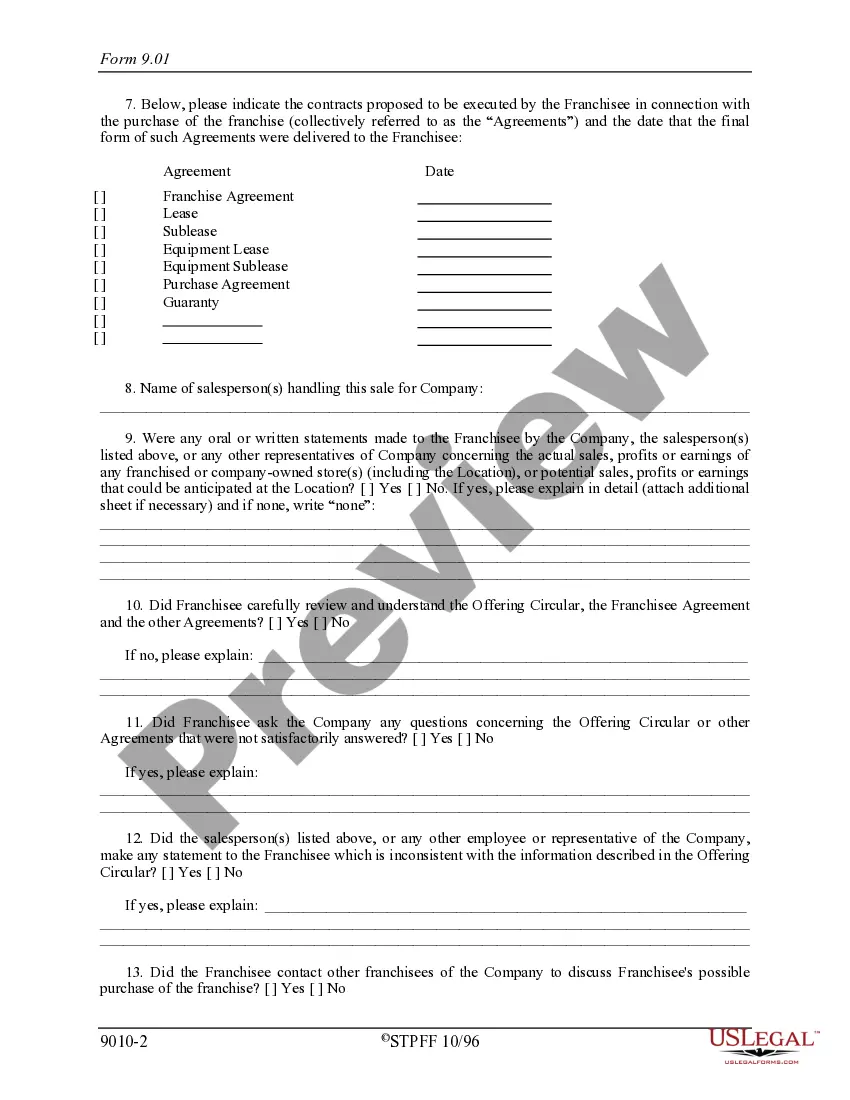

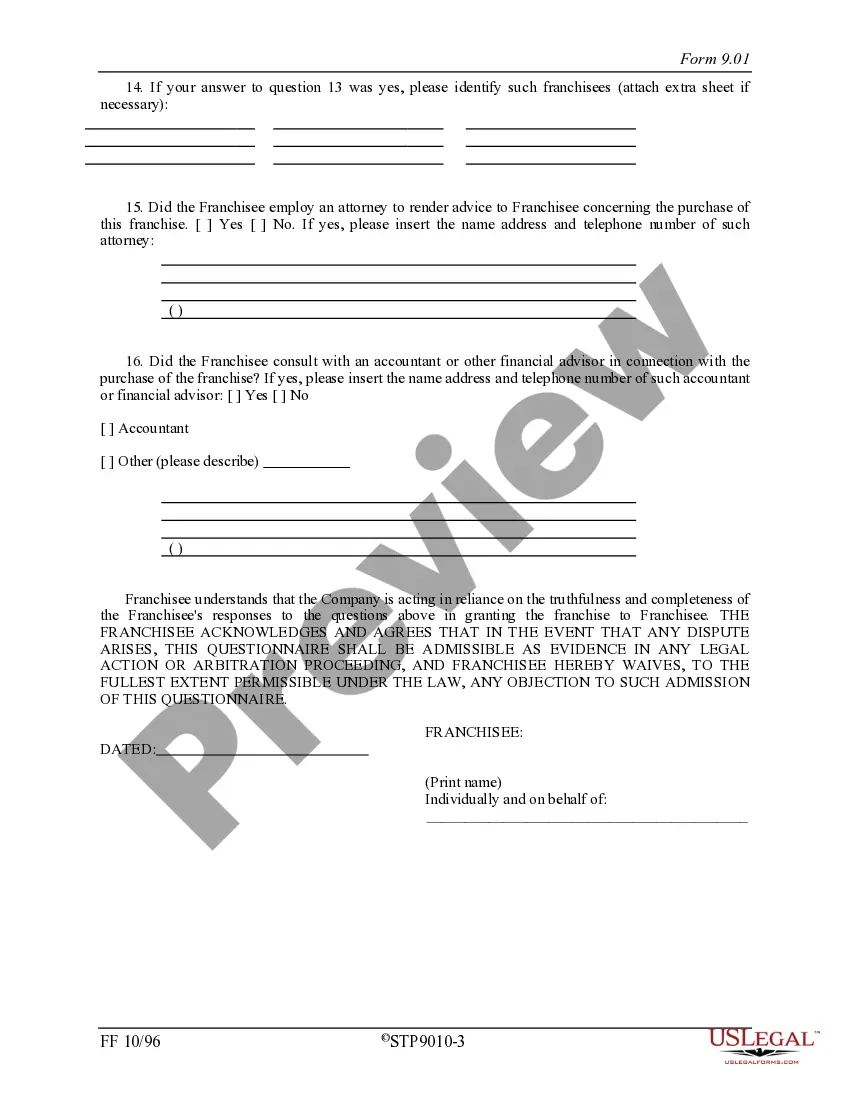

New Jersey Franchisee Closing Questionnaire

Description

How to fill out Franchisee Closing Questionnaire?

Are you in the placement in which you need to have files for both organization or specific functions almost every day time? There are tons of legal file web templates accessible on the Internet, but getting kinds you can depend on isn`t effortless. US Legal Forms provides thousands of develop web templates, such as the New Jersey Franchisee Closing Questionnaire, which can be written to fulfill state and federal specifications.

In case you are presently familiar with US Legal Forms web site and also have your account, merely log in. Afterward, you can down load the New Jersey Franchisee Closing Questionnaire design.

If you do not come with an accounts and need to start using US Legal Forms, abide by these steps:

- Find the develop you will need and make sure it is to the correct metropolis/area.

- Use the Review button to check the shape.

- Read the description to ensure that you have chosen the appropriate develop.

- In the event the develop isn`t what you are searching for, utilize the Search discipline to obtain the develop that fits your needs and specifications.

- When you discover the correct develop, just click Buy now.

- Select the prices plan you desire, complete the necessary information to generate your account, and pay for your order utilizing your PayPal or charge card.

- Choose a convenient file file format and down load your duplicate.

Discover each of the file web templates you might have bought in the My Forms menu. You can obtain a further duplicate of New Jersey Franchisee Closing Questionnaire any time, if necessary. Just click on the essential develop to down load or produce the file design.

Use US Legal Forms, one of the most extensive collection of legal varieties, in order to save some time and prevent mistakes. The service provides appropriately created legal file web templates which you can use for a range of functions. Create your account on US Legal Forms and initiate creating your way of life easier.

Form popularity

FAQ

In order to close your sales tax permit in New Jersey, you will need to complete the New Jersey Change Tax/Employer Registration Records Form REG-C-L.

To close your business in New Jersey and avoid potential fines and fees there are several steps you need to take: File the closure of your business. ... File your future annual reports until your business is formally closed. ... Cancel tax registration. ... File final tax returns.

To revive a New Jersey LLC, you'll need to file a reinstatement application with the New Jersey Division of Revenue and Enterprise Services. You'll also have to fix the issues that led to your New Jersey LLC's dissolution.

The report is due every year on the last day of the month, in the month in which you completed your business formation (LLC, Corporation, etc). The responsibility to file falls on the business, even if you fail to receive any notification from the State. Failure to file can result in the revocation of your business.

Every business in NJ must file an annual report. This includes simply ensuring that your registered agent and address are up to date, and submitting a $75 filing fee. The report is due every year on the last day of the month, in the month in which you completed your business formation (LLC, Corporation, etc).

There is a $100 filing fee to cancel a New Jersey LLC. Paying with a credit card? There's an additional $3 processing fee. If you file in person, you must pay an additional $25 fee to have documents expedited.

New Jersey State Income Tax LLCs with S-corp status must pay a state Corporate Business Tax based on gross receipts: starting at 7.5% for a minimum of $375 for less than $100,000 in receipts, up to $1,500 at for receipts of $1,000,000 or more.

Corporations ending business in New Jersey can dissolve, cancel, or withdraw online. Go to njportal.com/dor/annualreports and select ?Close a Business.? Businesses that choose to complete a paper application must submit all of the following: Appropriate dissolution/withdrawal/cancellation form.