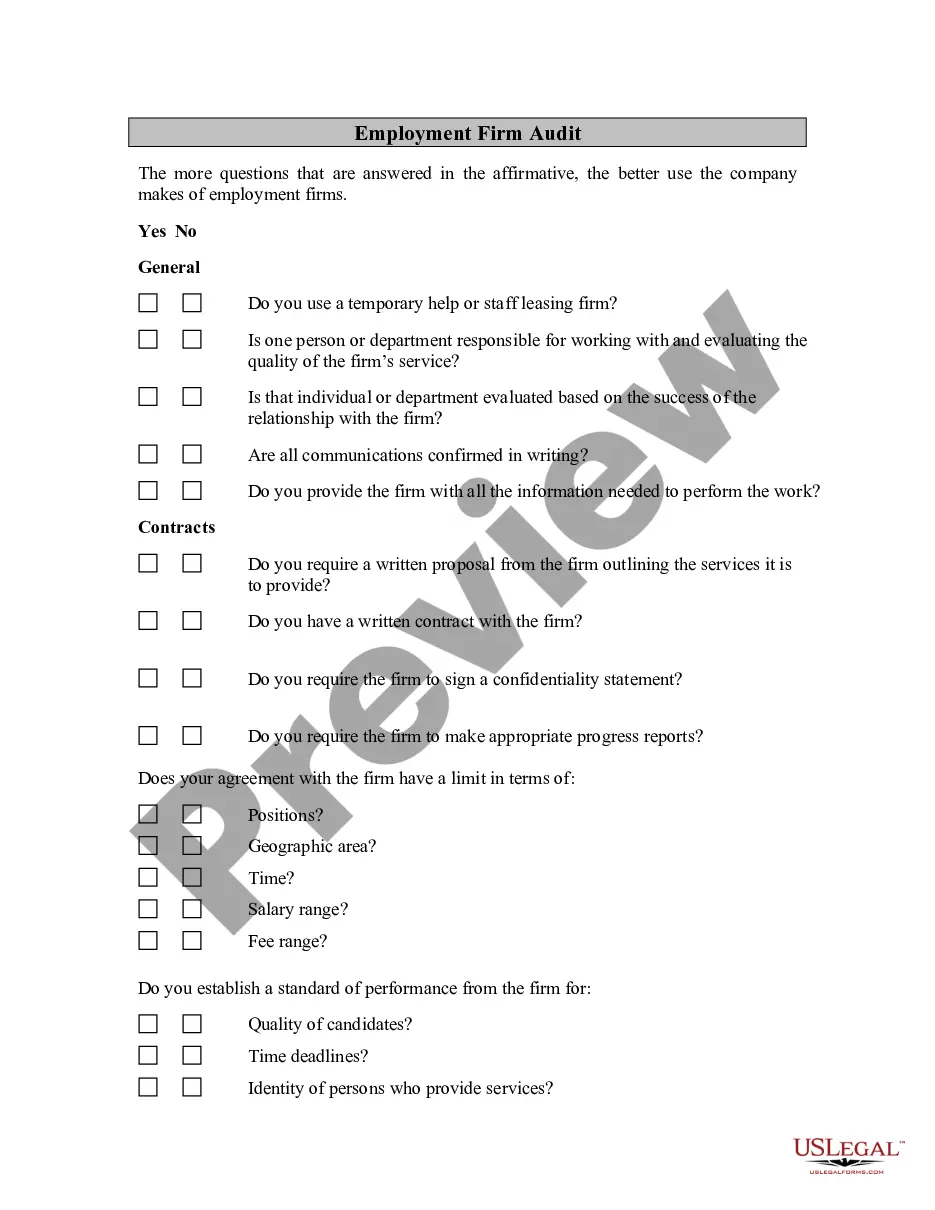

New Jersey Employment Firm Audit

Description

How to fill out Employment Firm Audit?

If you intend to compile, obtain, or print official document templates, utilize US Legal Forms, the most extensive assortment of official forms, which is accessible online.

Take advantage of the site’s user-friendly and convenient search to find the documents you require.

A range of templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you acquire is yours permanently. You will have access to every form you downloaded in your account. Click on the My documents section and select a form to print or download again.

Stay competitive and obtain, and print the New Jersey Employment Agency Audit with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal purposes.

- Utilize US Legal Forms to find the New Jersey Employment Agency Audit within a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Download button to access the New Jersey Employment Agency Audit.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

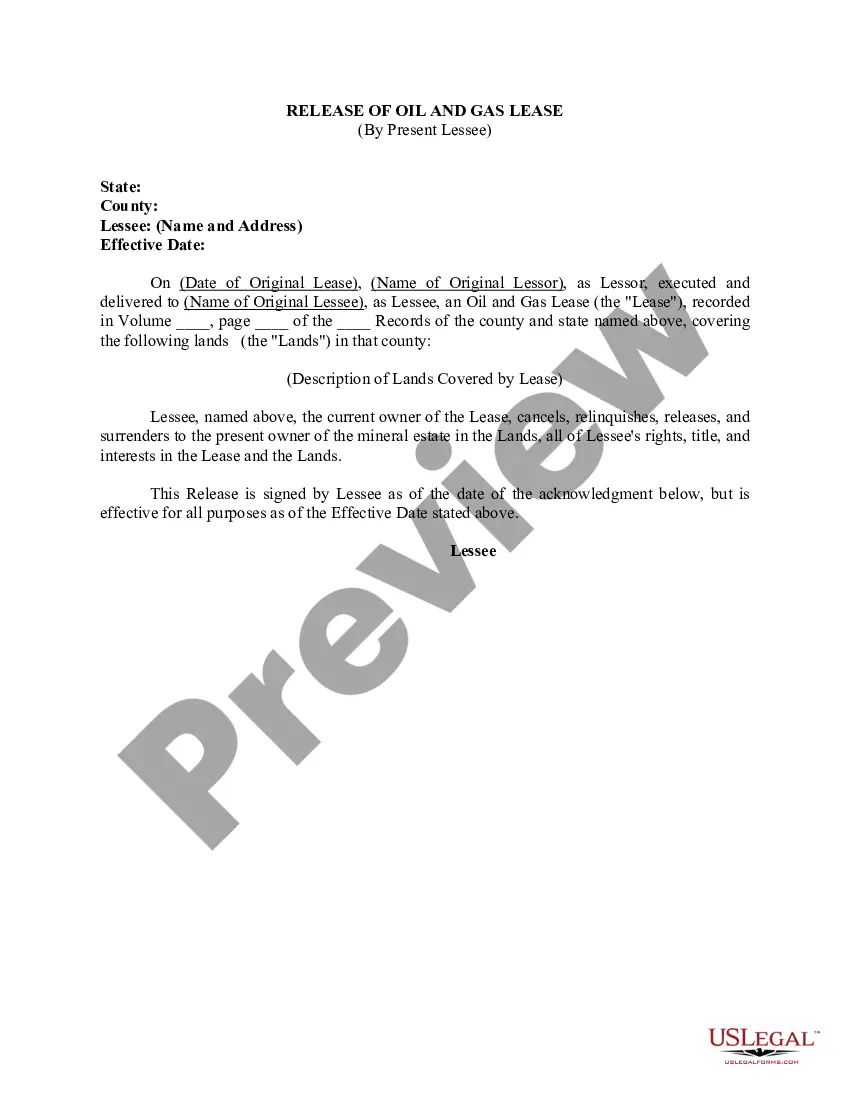

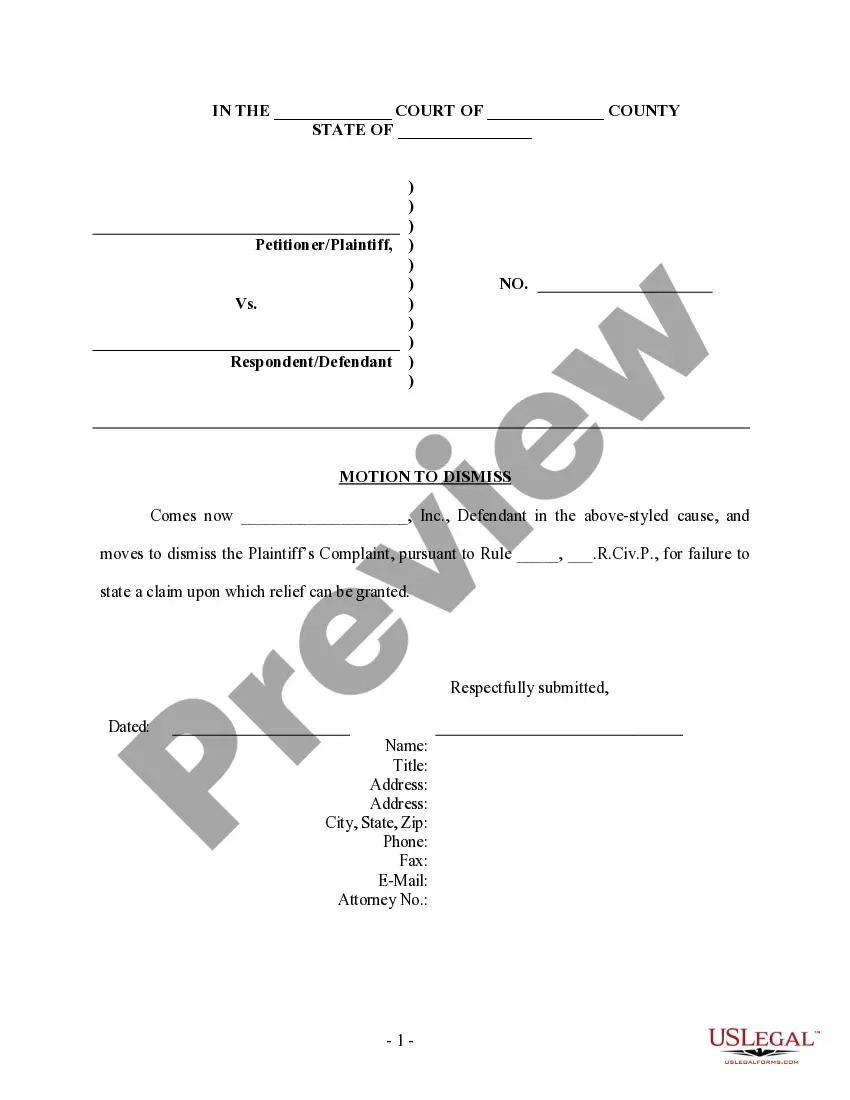

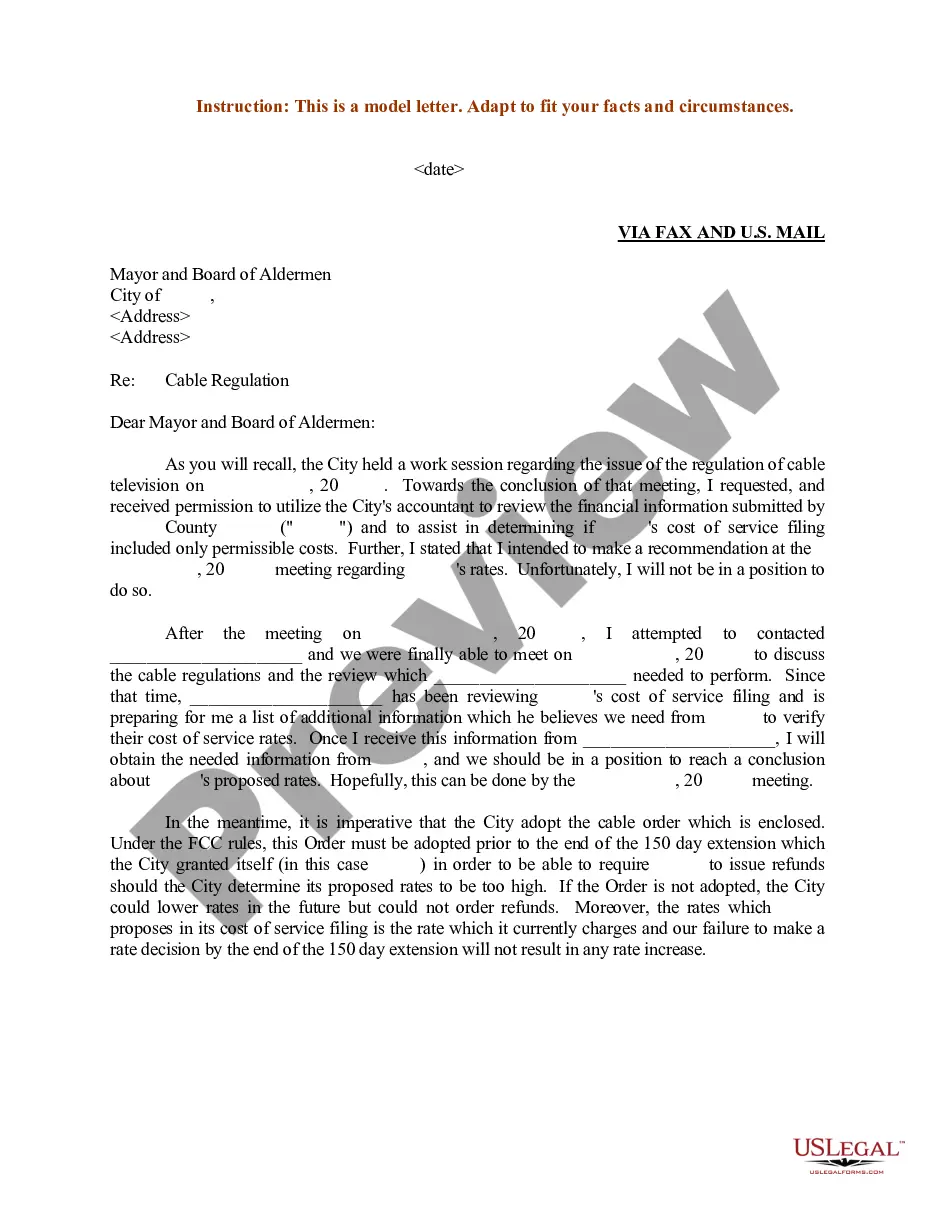

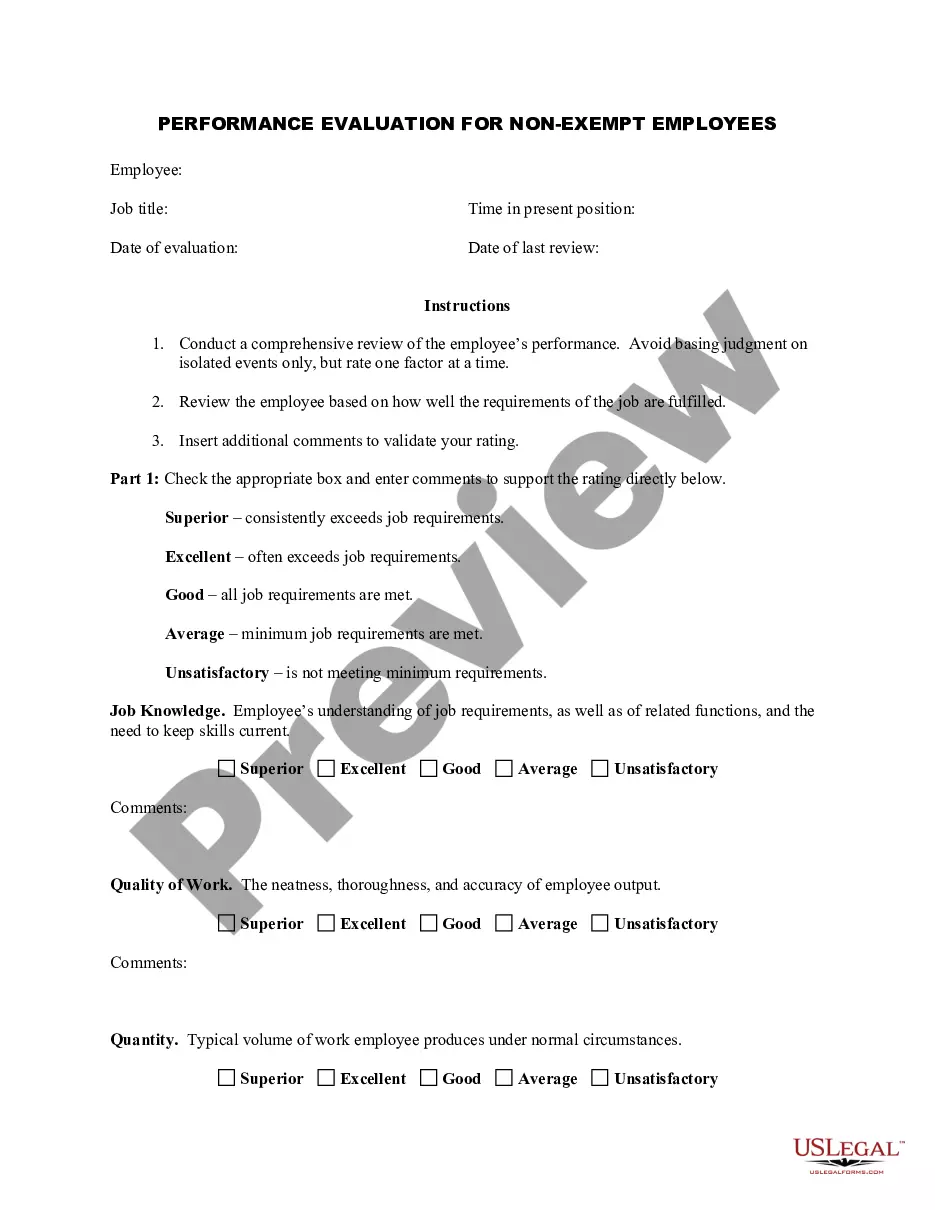

- Step 2. Use the Review option to view the form’s content. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and provide your information to sign up for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the New Jersey Employment Agency Audit.

Form popularity

FAQ

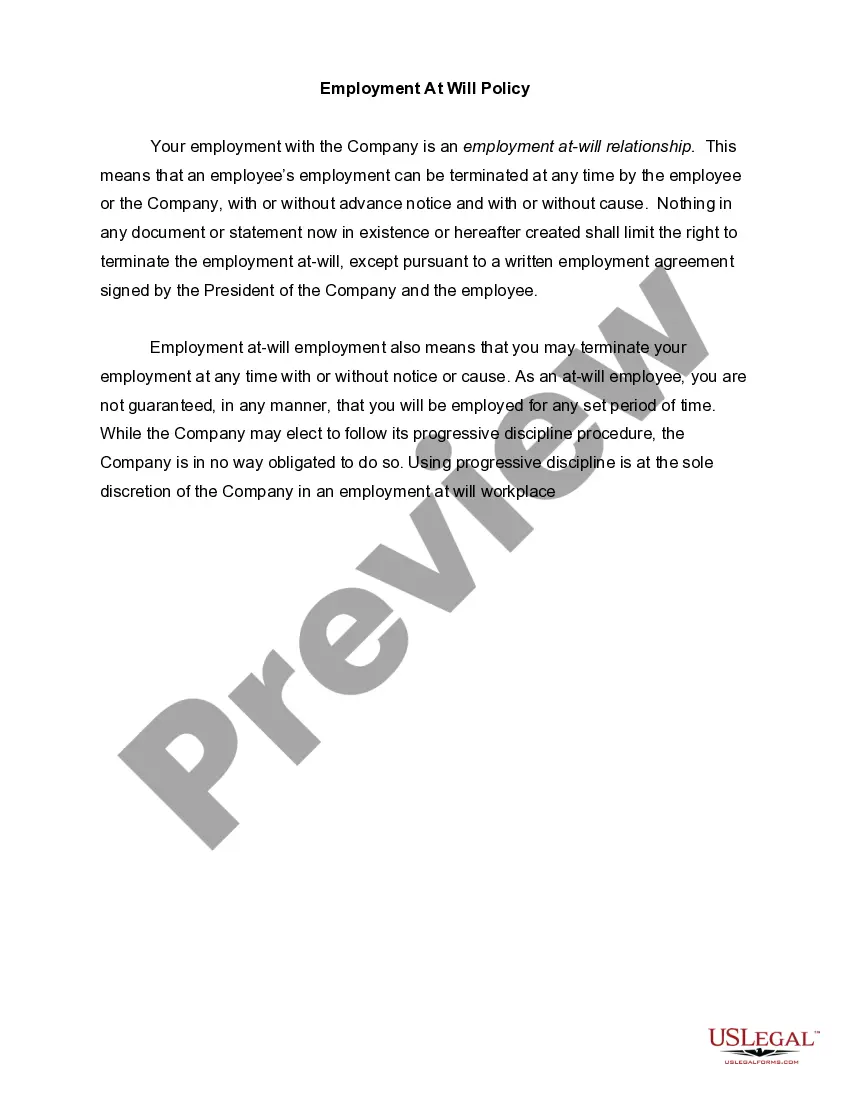

Employers should keep in mind that the U.S. Department of Labor (DOL) can audit employers at any time, although the most common reason for an audit is a complaint from an employee.

At worst, the ATO will order an audit on your tax affairs not just for the current year, but up to five years.

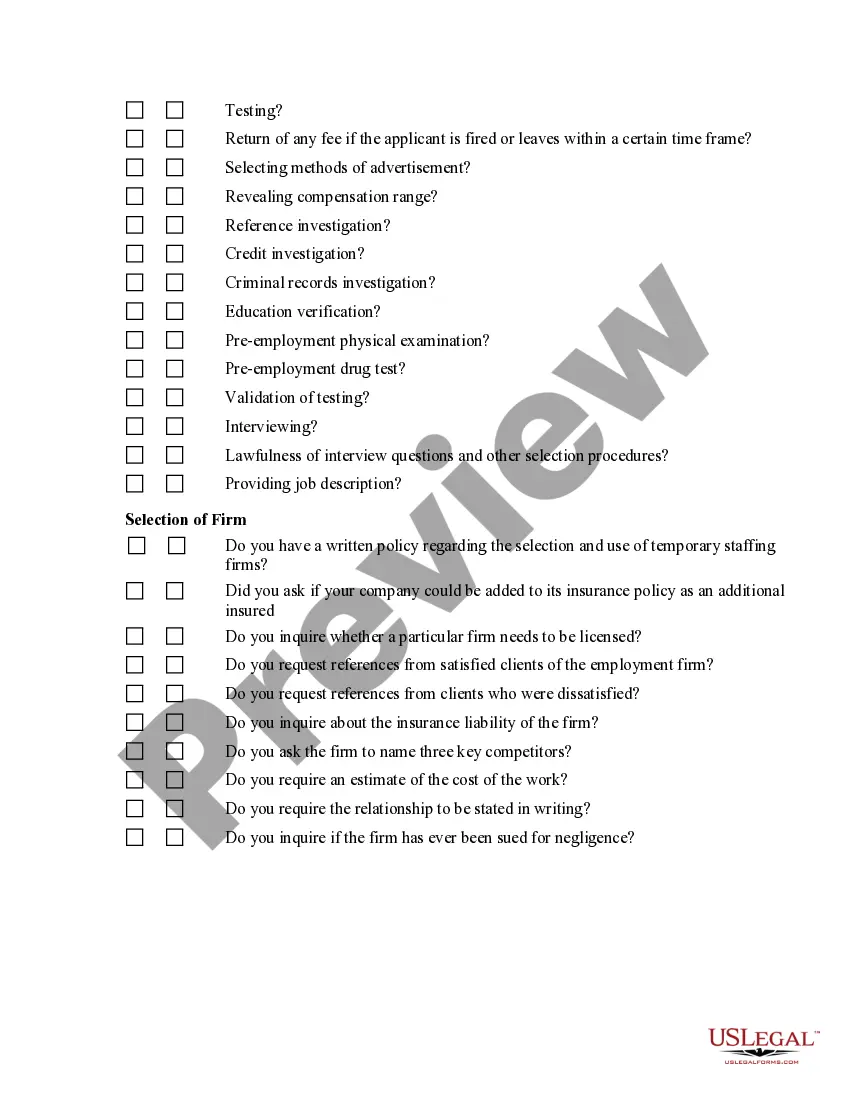

A job audit is a formal review of the current duties and responsibilities assigned to a position to ensure appropriate classification within the classified pay program. An audit should be requested if the duties and responsibilities of a position have significantly changed.

In New Jersey, the Division has six years from the date of the first assessment to file a COD with the New Jersey Superior Court against the taxpayer for the delinquent tax due.

Under California Revenue and Taxation Code Section 19255, the statute of limitations to collect unpaid state tax debts is 20 years from the assessment date, but there are situations that may extend the period or allow debts to remain due and payable.

That means Revenue will always have four years from the end of the year in which the return is filed in which to carry out enquiries into a return. Under section 959AA(1) TCA a similar time frame applies to the amending of assessments.

3 tips to survive a DOL audit of your FMLA process#1: Read the letter, find an attorney and employ the 'Jedi mind trick'#2: Gather exactly what DOL wants.#3: If the agency shows up, prep interviewees.

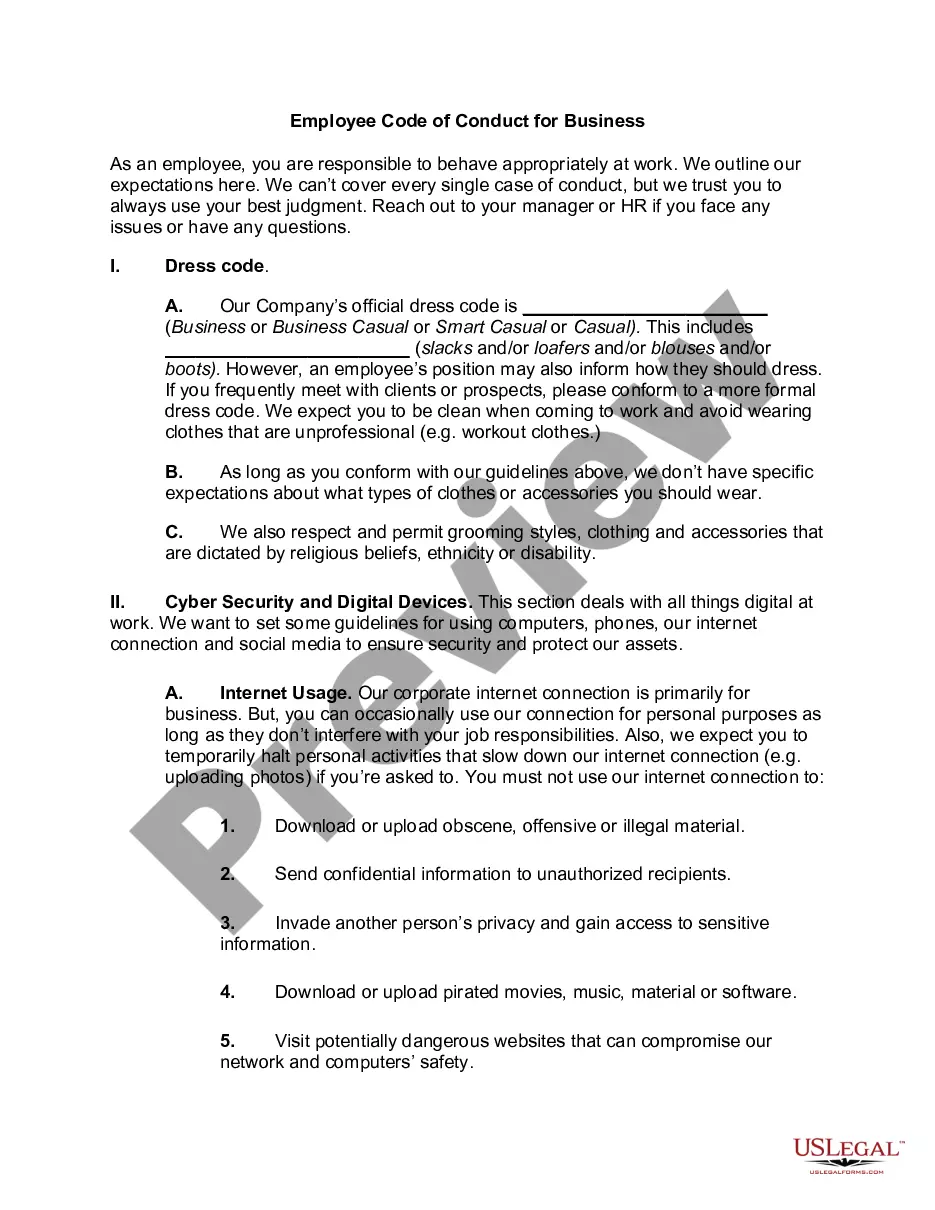

An audit can be as simple as reviewing employment files to ensure that they are in order or it can involve reviewing effectiveness of corporate HR policies, which may include interviewing supervisors, managers and employees. Audits can be broad, incorporating how a business operates and reviewing efficiencies.

New Jersey Tax Law generally places a four-year statute of limitations on tax audits, beyond which the Division may not audit without your written consent. The exception is the Gross Income Tax., which has a different statute of limitations.

The DOL can choose to audit an employer at any time, but most often audits are initiated when a complaint filed by a current or former employee, or as a result of the DOL's efforts to target specific low-wage, high-violation industries (agriculture, child care, food services, health care, landscaping, retail, etc.)