New Jersey Guaranty without Pledged Collateral

Description

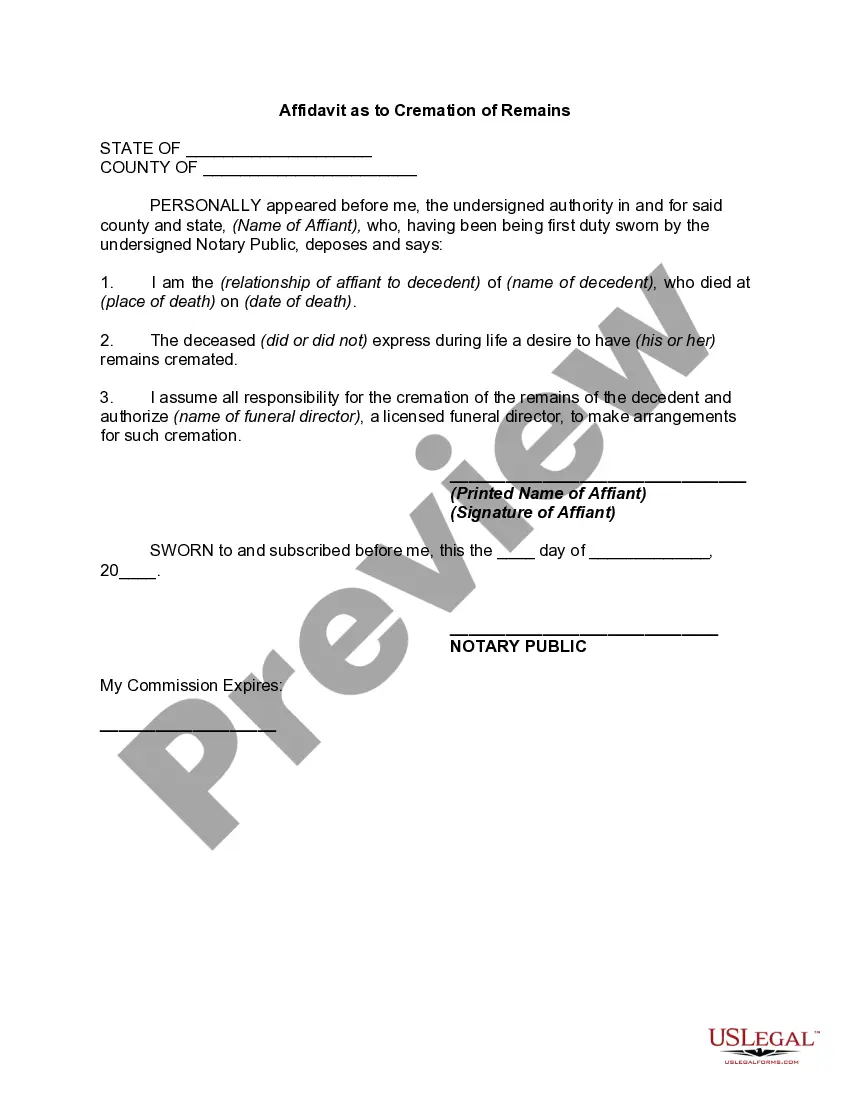

How to fill out Guaranty Without Pledged Collateral?

Are you presently in a situation where you require documents for either professional or personal purposes almost continuously.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers a vast array of form templates, including the New Jersey Guaranty without Pledged Collateral, designed to comply with federal and state regulations.

When you find the appropriate form, click Purchase now.

Select the pricing plan you desire, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you will be able to download the New Jersey Guaranty without Pledged Collateral template.

- If you do not have an account and want to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it is for the correct municipality/region.

- Utilize the Review button to examine the form.

- Check the details to confirm that you have selected the correct form.

- If the form isn’t what you are looking for, use the Lookup field to find the form that fits your needs and requirements.

Form popularity

FAQ

Types of CollateralReal estate.Cash secured loan.Inventory financing.Invoice collateral.Blanket liens.

A guarantee is a simple security document. It states the conditions where the guarantor must take over the borrower's repayment obligations upon default. As a lender, you want to be sure that the guarantor will be able to satisfy its obligations under the guarantee.

Types of Collateral When you take out a mortgage, your home becomes the collateral. If you take out a car loan, then the car is the collateral for the loan. The types of collateral that lenders commonly accept include carsonly if they are paid off in fullbank savings deposits, and investment accounts.

For example, if X agrees to buy goods from Y that will, accordingly, be manufactured by Z, and does so on the strength of Z's assurance as to the high quality of the goods, X and Z may be held to have made a collateral contract consisting of Z's promise of quality given in consideration of X's promise to enter into the

Collateral Guarantee means the irrevocable and unconditional limited liability guarantee of the Collateral Owner given or, as the case may be, to be in favour of the Bank, as security of part of the Outstanding Indebtedness and any and all other obligations of the Borrowers hereunder up to the Guaranteed Amount , in

How To Create a Collateral Contract YourselfNames, contact information, and addresses of all parties.Terms and conditions of the collateral contract.Indication of a promissory note.Duties and responsibilities assigned to each party.The effective date of the agreement.More items...

The main technical requirement for a guarantee to be valid is that it must be in writing and signed by the guarantor or a person authorised on the guarantor's behalf.

Collateral is when an asset is pledged to secure repayment. The five main types of collateral are consumer goods, equipment, farm products, inventory, and property on paper. All can be used as collateral when applying for loans, provided there is a recognizable value associated with the item.

Written or oral agreement associated as a second, or side contract made between the original parties, or between a third party and an original party. This typically occurs before or at the same time of the first or main contract is made. This collateral contract is independent and separate from the primary contract.

Understanding Financial Guarantees Guarantees may take on the form of a security deposit. Common in the banking and lending industries, this is a form of collateral provided by the debtor that can be liquidated if the debtor defaults.