New Jersey Offer to Purchase a Vehicle

Description

How to fill out Offer To Purchase A Vehicle?

Are you presently in a situation where you require documents for either business or personal purposes almost every day.

There are numerous legitimate document templates accessible online, but finding reliable ones can be difficult.

US Legal Forms offers thousands of template forms, such as the New Jersey Offer to Purchase a Vehicle, which are crafted to comply with both federal and state requirements.

Once you find the appropriate template, click Get now.

Choose the pricing plan you prefer, provide the required details to create your account, and complete the transaction using your PayPal or credit card.

- If you're already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you'll be able to download the New Jersey Offer to Purchase a Vehicle template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/region.

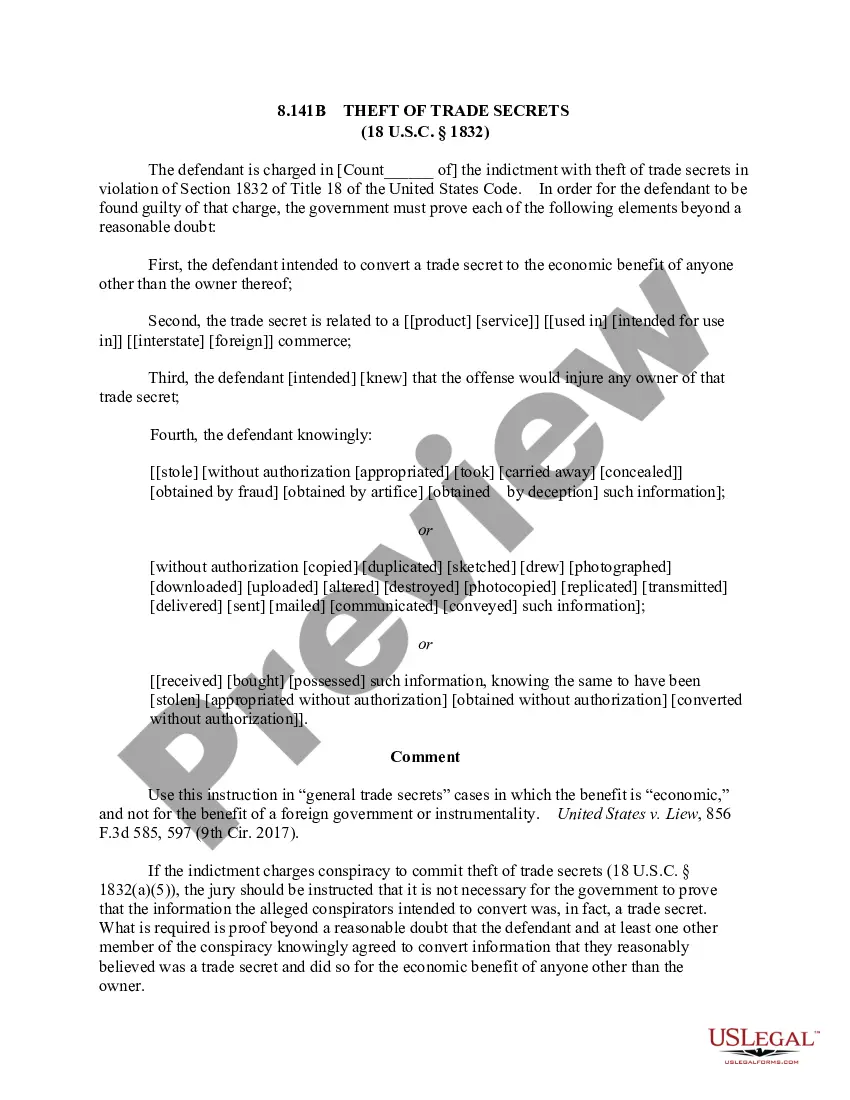

- Use the Review button to examine the form.

- Check the summary to confirm you have chosen the correct template.

- If the form does not meet your needs, utilize the Search field to find a template that fits your requirements.

Form popularity

FAQ

Giving a car as a gift is beyond generous, but in order to officially transfer ownership of a vehicle in New Jersey, you must complete a vehicle title transfer and pay a $60 title transfer fee. Gifting a carand receiving a car as a giftis so exciting!

Here's what you need to know. Whether you sell the vehicle for $1 or gift the vehicle, it is still a gift. It would be cleaner to simply gift the car and not try to disguise it as a sale, said Michael Karu, a certified public accountant with Levine, Jacobs & Co. in Livingston.

Giving a car as a gift is beyond generous, but in order to officially transfer ownership of a vehicle in New Jersey, you must complete a vehicle title transfer and pay a $60 title transfer fee.

New Jersey does not charge sales tax on vehicles that are gifted, he said. The sales price must indicate gift, he said. The New Jersey Motor Vehicle Commission may request documentation of the gift, Karu said.

Gift: If the vehicle is a gift, the sales price must be noted as GIFT. If the information appears to be changed or altered, additional documentation may be required by the Motor Vehicle Commission.

Visit a motor vehicle agency to transfer the title, complete the Vehicle Registration Application (Form BA-49) if applicable, and receive the license plates. To avoid a $25 penalty, New Jersey or dealer reassigned titles must be transferred within 10 working days from the date of sale.

Here's what you need to know. Whether you sell the vehicle for $1 or gift the vehicle, it is still a gift. It would be cleaner to simply gift the car and not try to disguise it as a sale, said Michael Karu, a certified public accountant with Levine, Jacobs & Co. in Livingston.

New Jersey law provides that sales that are performed and completed on a door-to-door basis are cancelable within three days.

In New Jersey, cars and trucks must be titled, registered, and insured before a licensed driver takes it on the road. Most dealers will issue temporary tags to new customers. If you happen to purchase the car from a private dealer, you can visit an MVC agency and request a temporary vehicle registration.

You might wonder about the value of gifting a car vs selling for $1. The theory is that a $1-dollar sale will have taxes calculated on that purchase price, not the car's value. But the DMV isn't going to be fleeced that easily the DMV gift car process is the better way.