New Jersey Contract with Independent Contractor to Work as a Consultant

Description

How to fill out Contract With Independent Contractor To Work As A Consultant?

Are you presently in a scenario where you often require documents for either organizational or personal tasks.

There are numerous legitimate document templates accessible online, but finding reliable ones can be challenging.

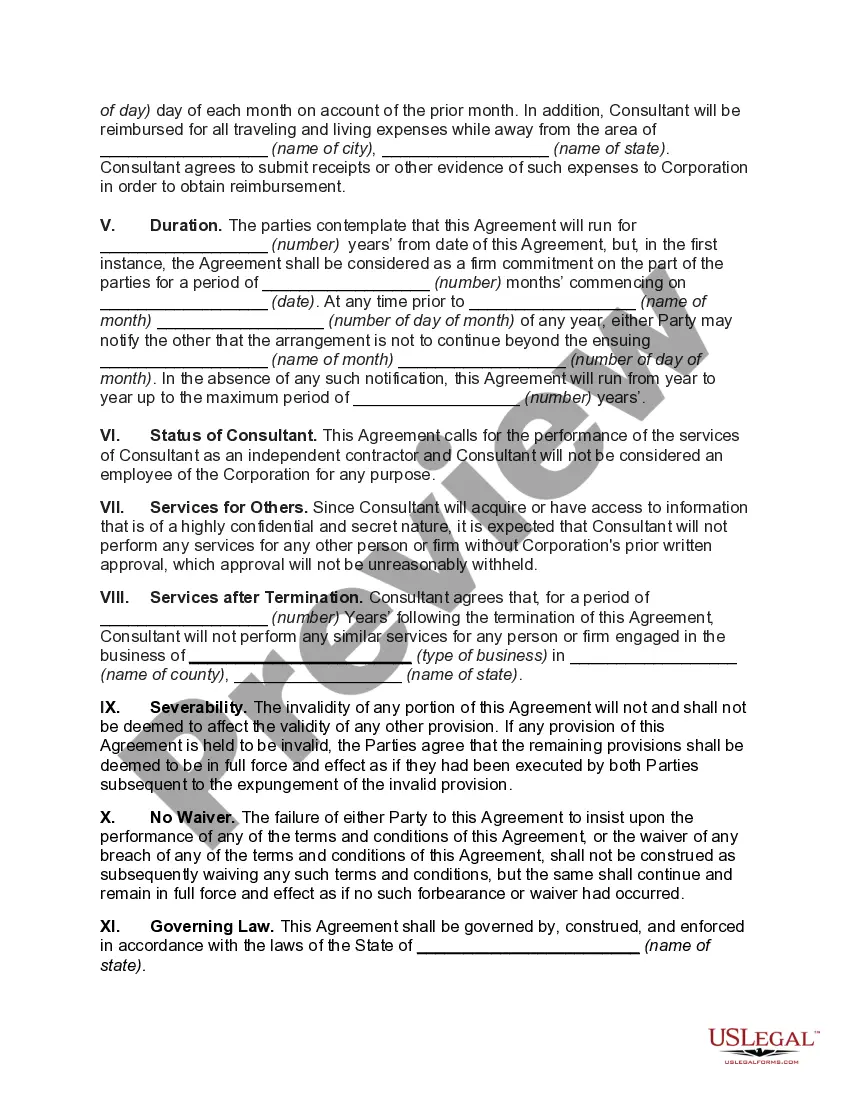

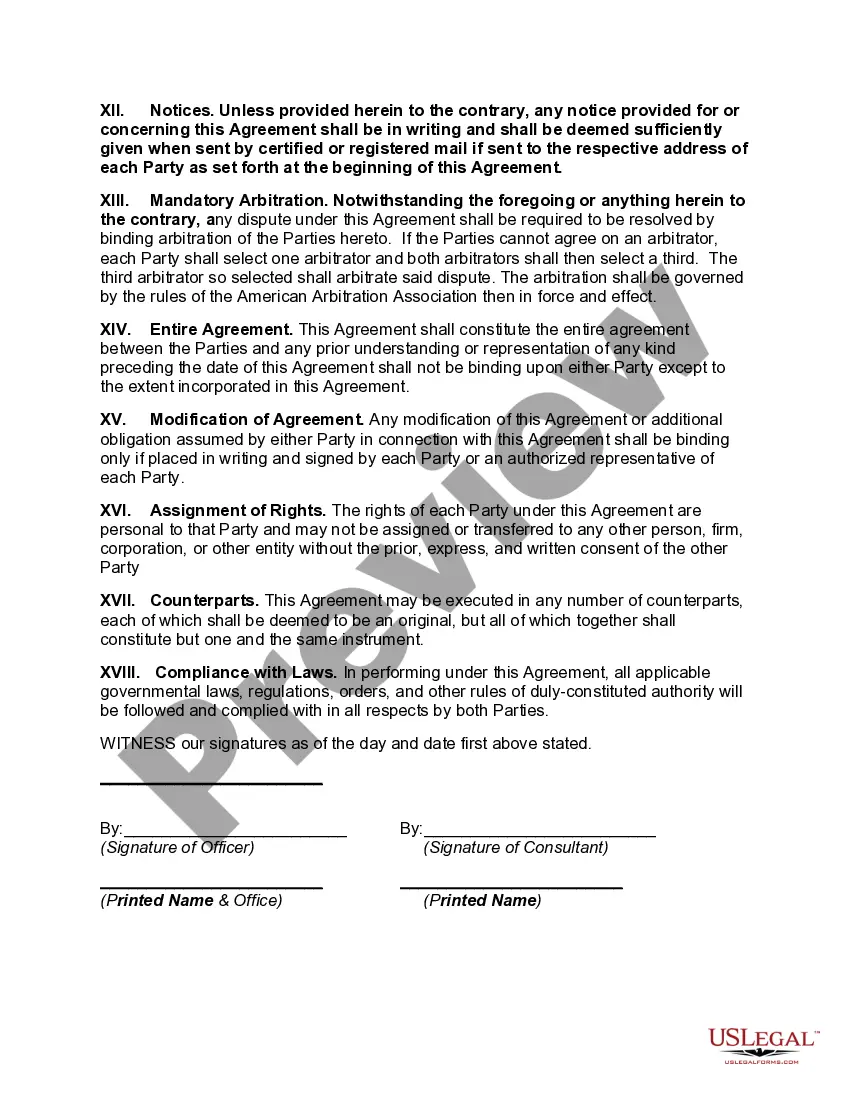

US Legal Forms provides a vast selection of form templates, such as the New Jersey Contract with Independent Contractor to Work as a Consultant, which are designed to comply with both federal and state regulations.

Once you locate the correct form, click Purchase now.

Select a convenient file format and download your copy.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Afterward, you can download the New Jersey Contract with Independent Contractor to Work as a Consultant template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/state.

- Utilize the Preview button to look over the document.

- Read the description to confirm that you have selected the correct form.

- If the form is not what you are seeking, use the Search section to find the form that meets your needs and criteria.

Form popularity

FAQ

The individual is customarily engaged in an independently established trade, occupation, profession or business.

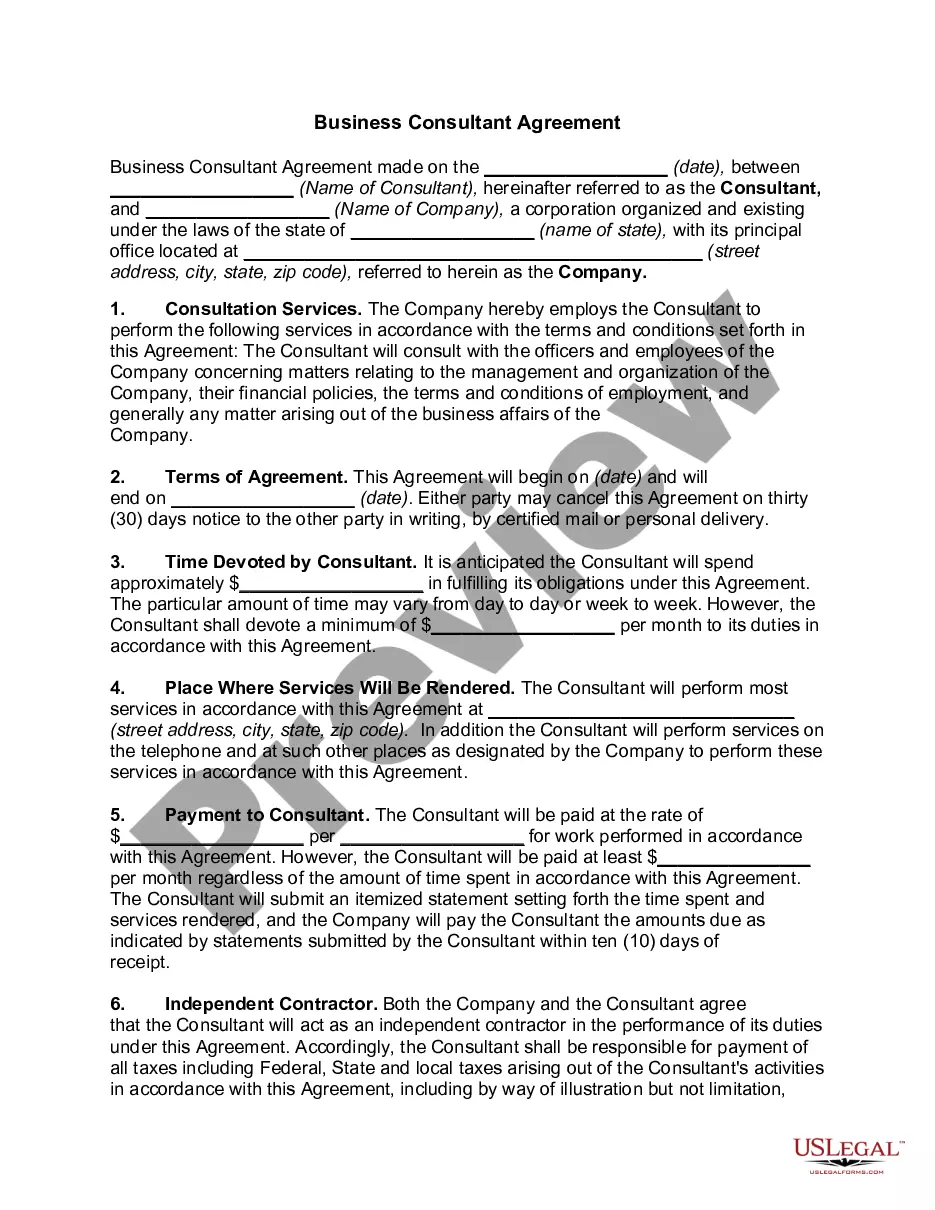

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

If you are classified as an "independent contractor," you may be paid with a 1099 with no deductions made for taxes, unemployment, or other contributions that an employee pays.

In general, the difference is that the consultant's role is to evaluate a client's needs and provide expert advice and opinions on what needs to be done, while the contractors role is generally to evaluate the client's needs and actually perform the work.

What is the difference between a Consultant and a Contractor? The short answer is that the Consultants role is evaluate a client's needs and provide expert advice and opinion on what needs to be done while the Contractors role is generally to evaluate the client's needs and actually perform the work.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

Cons of Independent Contracting Employers like contractors because they can avoid paying for taxes and benefits, and that means those costs fall entirely on independent contractors. Contractors must withhold their own federal, state, and local taxes. They may also have to submit quarterly estimated taxes to the IRS.

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.