New Jersey Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor in Two Person Partnership with Each Partner Owning 50% of Partnership

Description

How to fill out Partnership Buy-Sell Agreement Fixing Value And Requiring Sale By Estate Of Deceased Partner To Survivor In Two Person Partnership With Each Partner Owning 50% Of Partnership?

Locating the appropriate legal document template may prove to be a challenge. Clearly, there are numerous designs available online, but how can you secure the legal form you require? Visit the US Legal Forms website.

The service offers thousands of templates, including the New Jersey Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor in a Two-Person Partnership where Each Partner Holds 50% of the Partnership, which you can utilize for business and personal purposes.

All documents are reviewed by professionals and meet federal and state requirements.

Once you are confident that the form is appropriate, click the Buy now button to acquire the document. Choose the pricing plan you wish and enter the required information. Create your account and complete the purchase using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, edit, print, and sign the received New Jersey Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor in a Two-Person Partnership where Each Partner Holds 50% of the Partnership. US Legal Forms is the largest collection of legal documents where you can find various document designs. Use the service to acquire professionally crafted paperwork that adheres to state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the New Jersey Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor in a Two-Person Partnership where Each Partner Holds 50% of the Partnership.

- Use your account to browse the legal forms you have previously ordered.

- Navigate to the My documents section of your account and retrieve another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple instructions you can follow.

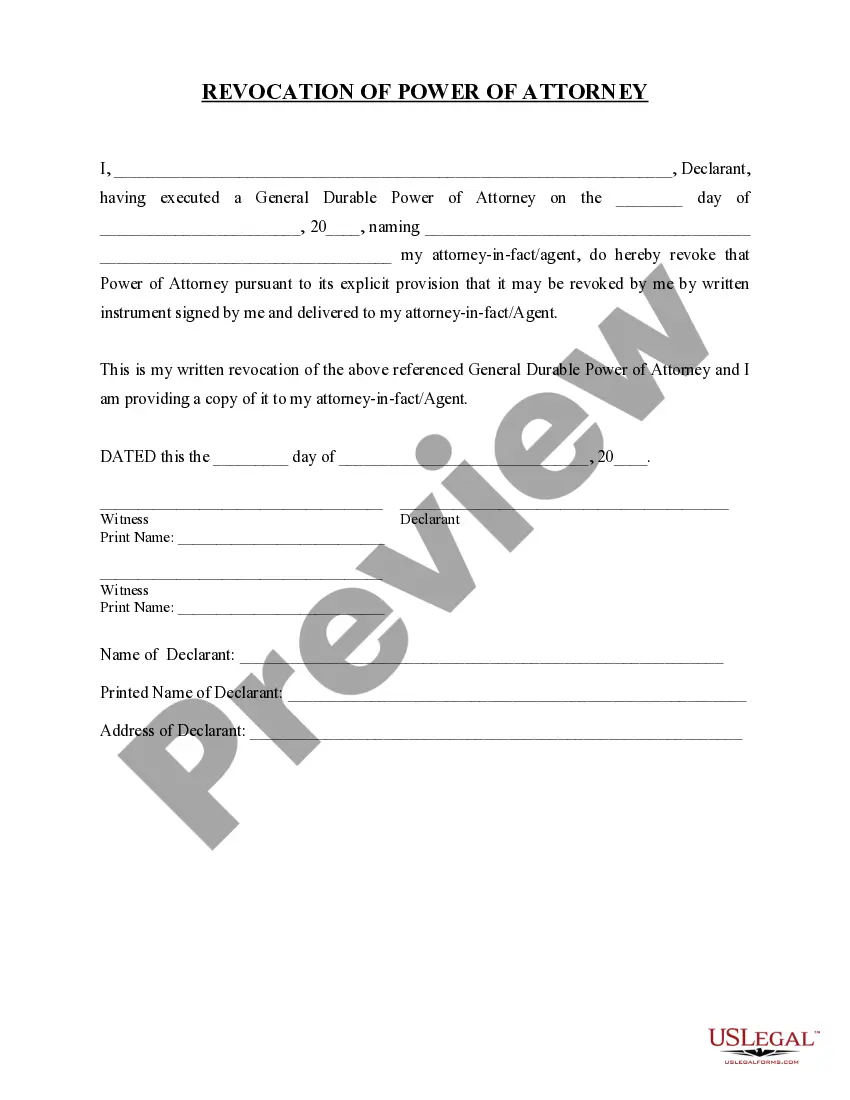

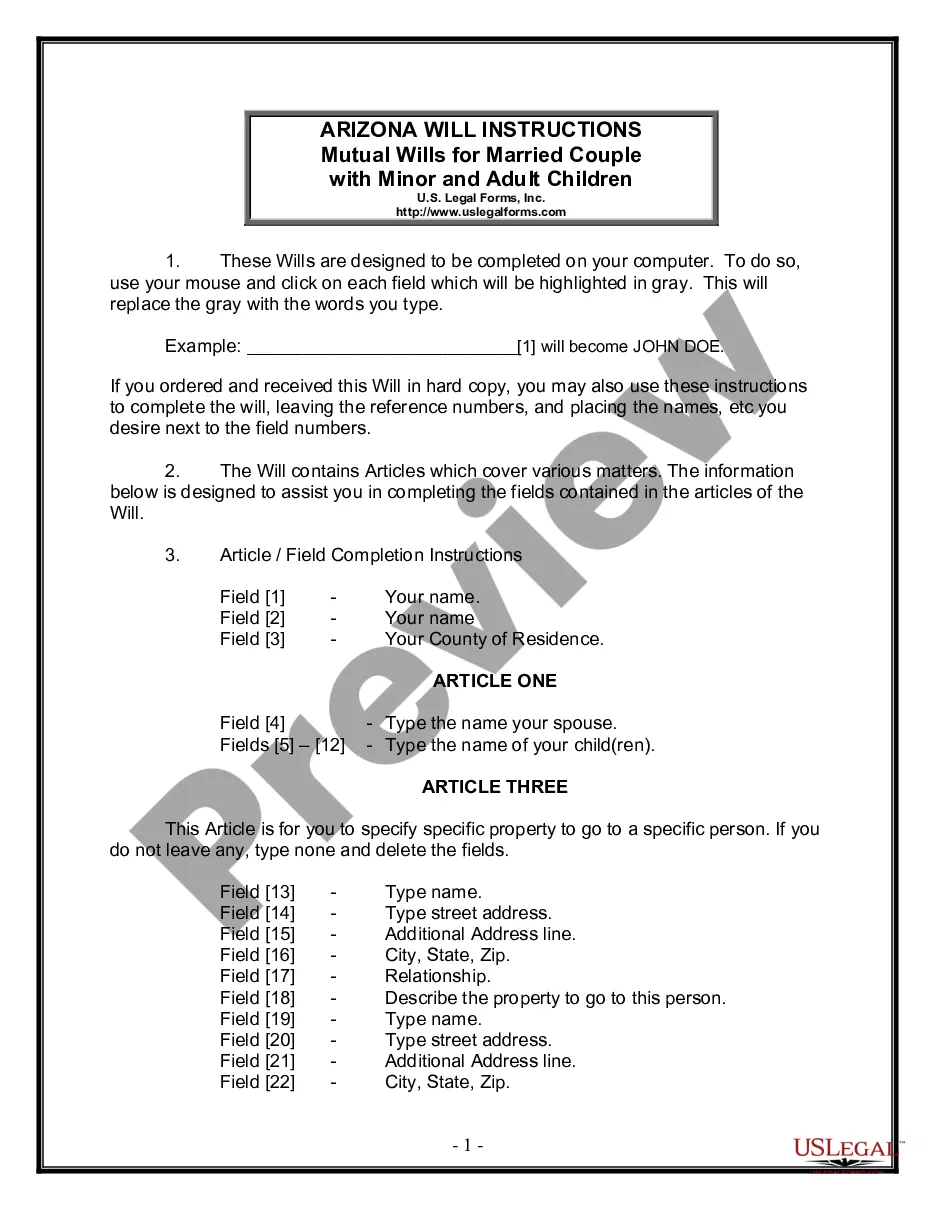

- First, ensure you have selected the correct form for your region/area. You can preview the document using the Preview feature and read the form description to confirm this is suitable for you.

- If the form does not meet your needs, utilize the Search area to find the appropriate document.

Form popularity

FAQ

Non-resident partners in New Jersey are subject to a tax rate on income earned from sources in the state. Generally, this income is taxed at the same rates applied to residents, but specific considerations apply depending on your individual situation. If you own part of a partnership under a New Jersey Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor in Two Person Partnership with Each Partner Owning 50%, it is wise to consult a tax professional to ensure compliance and optimize your tax obligations.

Your agreement should include detailed information about your business' worth. It is important for these numbers to be as accurate as possible. Because your company's value may not remain the same, you should consider having it professionally appraised or using a clearly defined formula to value the business.

Here is how buy-sell agreements work:Determine which events invoke a triggered buyout.Establish who has rights and purchase obligations.Identify the names and address of the purchasers.Set a purchase price or valuation with applicable discounts.Establish payment terms as well as their intervals.More items...

Buy and sell agreements are commonly used by sole proprietorships, partnerships, and closed corporations in an attempt to smooth transitions in ownership when each partner dies, retires, or decides to exit the business.

Keeping it successful is even harder, and coping with the death of a partner may be the hardest situation of all. When that happens, your deceased partner's share in the business usually passes to a surviving spouse, either by terms of a will or simply by default as the primary heir.

Business of a partnership firm may not come to an end due to the death of a partner. Other partners shall continue to run the business of the firm.

Death of the partner If there are only two partners, and one of the partner dies, the partnership firm will automatically dissolve. If there are more than two partners, other partners may continue to run the firm.

The Supreme Court held as under: Section 42(c) of the Partnership Act can appropriately be applied to a' partnership where there are more than two partners. If one of them dies, the firm is dissolved; but if there is a contract to the contrary, the surviving partners will continue the firm.

Business partnership agreement. A properly arranged and funded agreement is a legally binding contract that spells out exactly what is to happen if one of the business's owners dies. It generally calls for the survivors to buy the deceased owner's share in the business from his or her heirs.

After the Death of a Business PartnerThe deceased's estate takes over their share of the partnership. A transfer happens of the other partner's share to you on a payment to the estate. You buy the share of the partnership using a financial formula.