New Jersey Record of Separation from Employment

Description

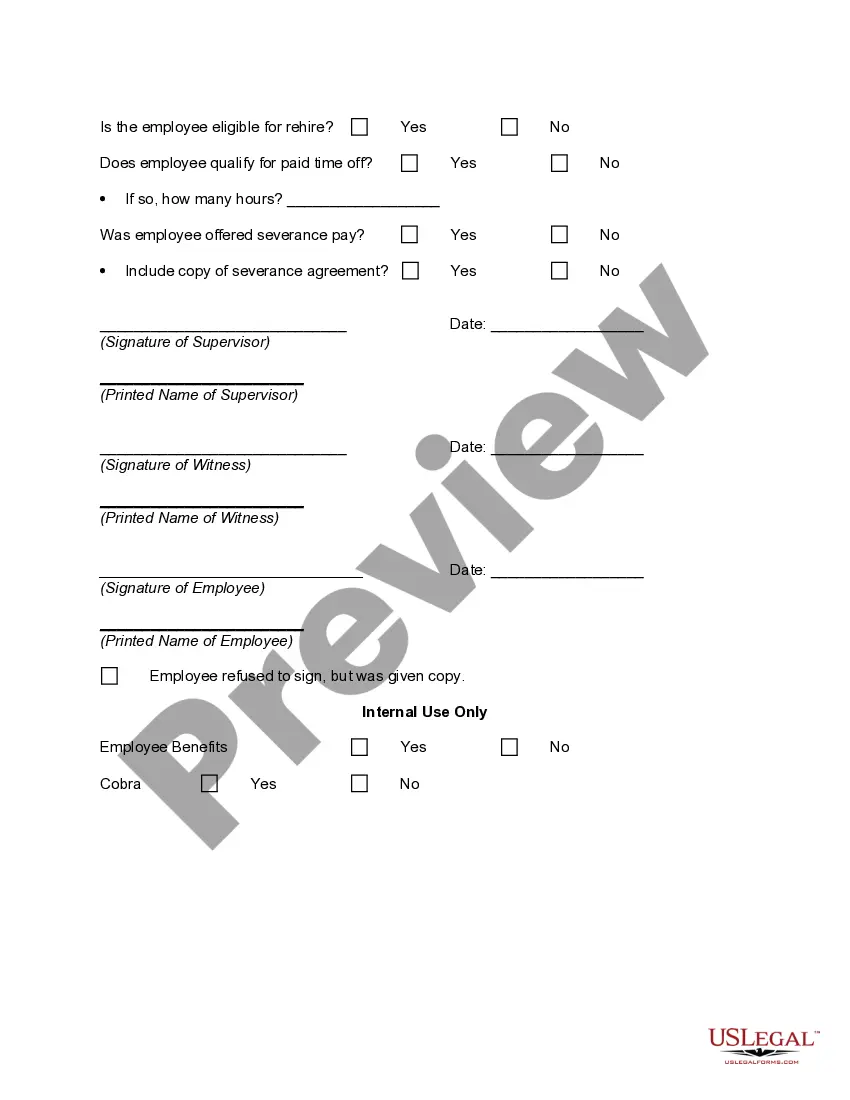

How to fill out Record Of Separation From Employment?

Are you presently in the location where you frequently require documents for various business or specific aims almost all the time.

There is a range of legal document templates available online, but finding ones you can depend on is challenging.

US Legal Forms offers a multitude of form templates, such as the New Jersey Employment Separation Record, which are designed to comply with state and federal guidelines.

Once you find the correct form, click Purchase now.

Choose the pricing plan you wish, fill out the required information to create your account, and pay for the order with your PayPal or credit card.

- If you are already acquainted with the US Legal Forms site and have your account, simply Log In.

- Then, you can download the New Jersey Employment Separation Record template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/region.

- Use the Preview button to review the form.

- Check the description to confirm you have selected the correct form.

- If the form is not what you are seeking, use the Search field to find the form that meets your needs and requirements.

Form popularity

FAQ

Federal and State law dictate how long employers must retain certain employee related records. For instance, Form I-9 should be retained for either three (3) years after the date of hire or for one (1) year after employment is terminated, whichever is later.

Are termination letters required? Most companies are not required by law to give employees letters of termination. The exceptions are those located in Arizona, California, Illinois and New Jersey. Most employers, however, do provide termination letters as a professional courtesy and a legal record.

EEOC Regulations require that employers keep all personnel or employment records for one year. If an employee is involuntarily terminated, his/her personnel records must be retained for one year from the date of termination.

Under New Jersey law, absent an employment contract, all employment is at-will. In other words, an employer generally can terminate an employee at any time for any reason.

The employer should retain the records in question for three years after termination of employment.

New Jersey law does not require a notice of separation from either the employee or employer. However, if an employer has a policy on notices of separation and that policy is recognized as an enforceable contract, a notice of separation may be required from the employer and/or employee in accordance with the policy.

The Payment of Wages Act, 1936 (Wages Act) The Wages Act, under Section 13A, mandates that every employer shall maintain registers and records as prescribed it the Payment of Wages Rules, 1937 and all such records should be preserved for a period of three years after the date of the last entry made therein.

All Personnel Files and Training Records: 6 years from the end of employment. Redundancy Records: 6 years. Sickness Absence Records: A minimum of 3 months but potentially up to 6 years after employment ends.

Federal and State law dictate how long employers must retain certain employee related records. For instance, Form I-9 should be retained for either three (3) years after the date of hire or for one (1) year after employment is terminated, whichever is later.

The employer must keep the wage and hour records described above for a period of six years. The employer must keep the wage and hour records described above at the place of employment or in a central office in New Jersey.