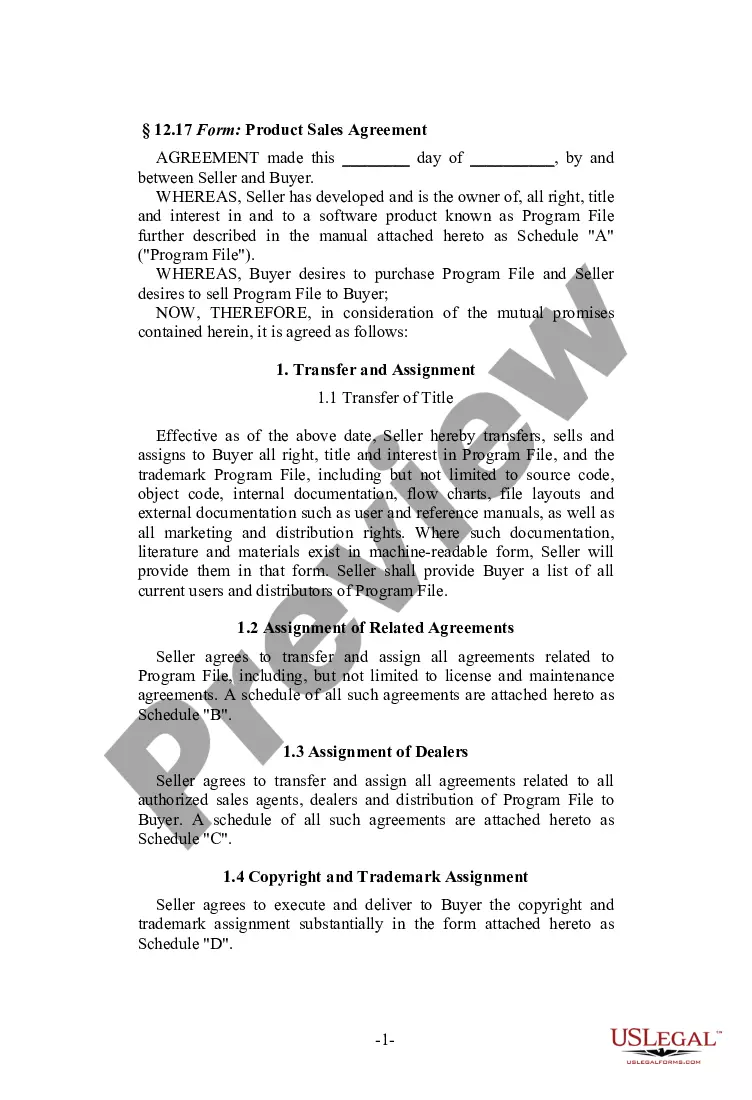

New Jersey Software Product Sales Agreement

Description

How to fill out Software Product Sales Agreement?

You can spend numerous hours online searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal documents that can be reviewed by professionals.

It is easy to retrieve or print the New Jersey Software Product Sales Agreement from their service.

If you need to find an additional copy of the form, utilize the Search field to find the template that meets your requirements.

- If you already possess a US Legal Forms account, you can Log In and then click the Download button.

- Afterwards, you can complete, modify, print, or sign the New Jersey Software Product Sales Agreement.

- Every legal document template you buy is yours indefinitely.

- To acquire another copy of any purchased form, navigate to the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the state/city of your choice.

- Review the form description to ensure you have chosen the right template.

Form popularity

FAQ

Filling out the ST-4 form in New Jersey requires you to provide details about your sales tax exempt purchases. Start by entering your business information, then list the items bought under a New Jersey Software Product Sales Agreement. The form includes instructions that guide you on the necessary information needed, ensuring you complete it accurately to benefit from tax exemptions.

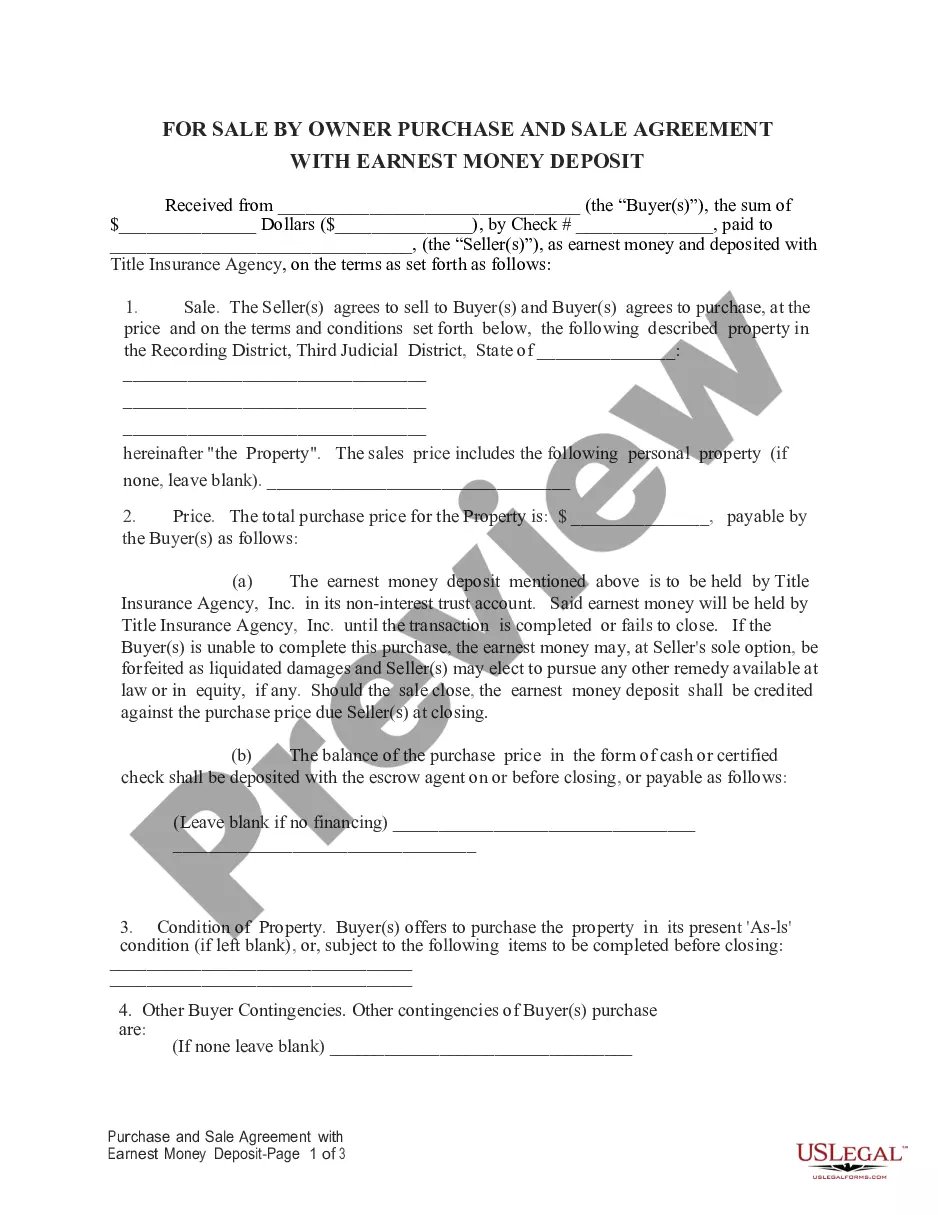

What Should I Include in a Sales Contract?Identification of the Parties.Description of the Services and/or Goods.Payment Plan.Delivery.Inspection Period.Warranties.Miscellaneous Provisions.

The agreement should identify the following essential elements:200cSeller: the party who owns the property and wants to sell it.200cBuyer: the party who will buy the property and become the new owner.200cProperty: a detailed description of the property that is being sold.200cPurchase price: how much the buyer will be paying.More items...

Affordable business financing. Crazy fast.Identity of the Parties/Date of Agreement. The first topic a sales contract should address is the identity of the parties.Description of Goods and/or Services. A sales contract should also address what is being bought or sold.Payment.Delivery.Miscellaneous Provisions.Samples.27-Mar-2020

How to fill out the New Jersey Resale CertificateStep 1 Begin by downloading the New Jersey Resale Certificate Form ST-3.Step 2 Identify the name and business address of the seller.Step 3 Describe the nature of merchandise or service of the buyer.Step 4 List the merchandise or services being purchased.More items...?

Ideally, all software purchases should be taxable to final users and exempt for business users. Instead, states tax some kinds of software and exempt others, based on whether it is customized or off-the-shelf and whether it is on CD or downloaded, all silly distinctions for tax purposes.

New Jersey's current sales tax statute exempts electronically delivered software used exclusively in the conduct of the purchaser's business. The exemption applies even if purchaser receives written manuals or training manuals.

A sale deed includes the following details:Name and address of the buyer and seller.Detailed description of the property.Total payment to be made, mode of payment, date when the payment is to be made.Date of handing over of property documents.Other terms and conditions of the sale.

Services delivered into New Jersey are taxable when they are specifically listed under N.J.S.A. B-3. Use of a software application is not listed as a taxable service. Therefore, most charges for SaaS are not subject to Sales Tax.

Clauses That go Into an Agreement to SellNames of the buyer and seller their age, and residential addresses.Date and place of execution of the agreement.Competence of parties to enter into the agreement.Rights and liabilities.Details and documents of how the seller came to own the property.More items...?