New Jersey Contract with Independent Contractor - Contractor has Employees

Description

How to fill out Contract With Independent Contractor - Contractor Has Employees?

You can invest hours online attempting to discover the legal document template that meets the state and federal requirements you require.

US Legal Forms offers a vast array of legal documents that can be evaluated by professionals.

It is easy to download or print the New Jersey Contract with Independent Contractor - Contractor has Employees from my services.

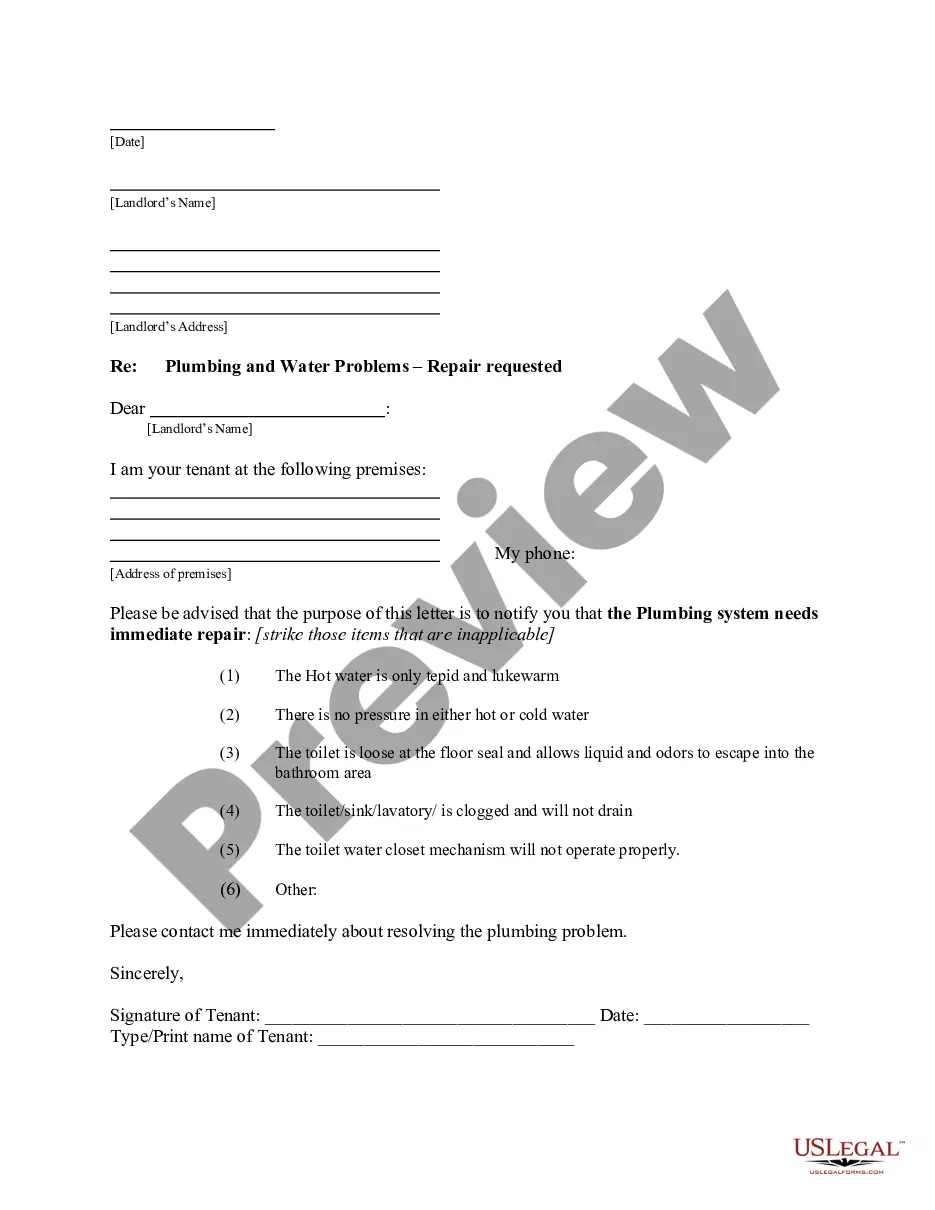

If available, utilize the Review button to look over the document template as well.

- If you already possess a US Legal Forms account, you can Log In and press the Acquire button.

- Afterward, you can fill out, modify, print, or sign the New Jersey Contract with Independent Contractor - Contractor has Employees.

- Every legal document template you obtain is your exclusive property permanently.

- To get another version of any purchased form, visit the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your desired region/city.

- Review the form description to confirm you have chosen the right form.

Form popularity

FAQ

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

The individual is customarily engaged in an independently established trade, occupation, profession or business.

A contractor also called a contract worker, independent contractor or freelancer is a self-employed worker who operates independently on a contract basis.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

A contract worker, also known as an independent contractor or 1099 employee (based on the 1099 tax form they receive), is an individual who enters into a contractual agreement with a business in order to provide a service in exchange for a fee.

During President Donald Trump's administration, the DOL issued a final rule clarifying when workers are independent contractors versus employees. The rule applied an economic-reality test that primarily considers whether the worker operates his or her own business or is economically dependent on the hiring entity.

Cons of Independent Contracting Employers like contractors because they can avoid paying for taxes and benefits, and that means those costs fall entirely on independent contractors. Contractors must withhold their own federal, state, and local taxes. They may also have to submit quarterly estimated taxes to the IRS.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

If you are classified as an "independent contractor," you may be paid with a 1099 with no deductions made for taxes, unemployment, or other contributions that an employee pays.