New Jersey Release and Indemnification of Personal Representative by Heirs and Devisees

Description

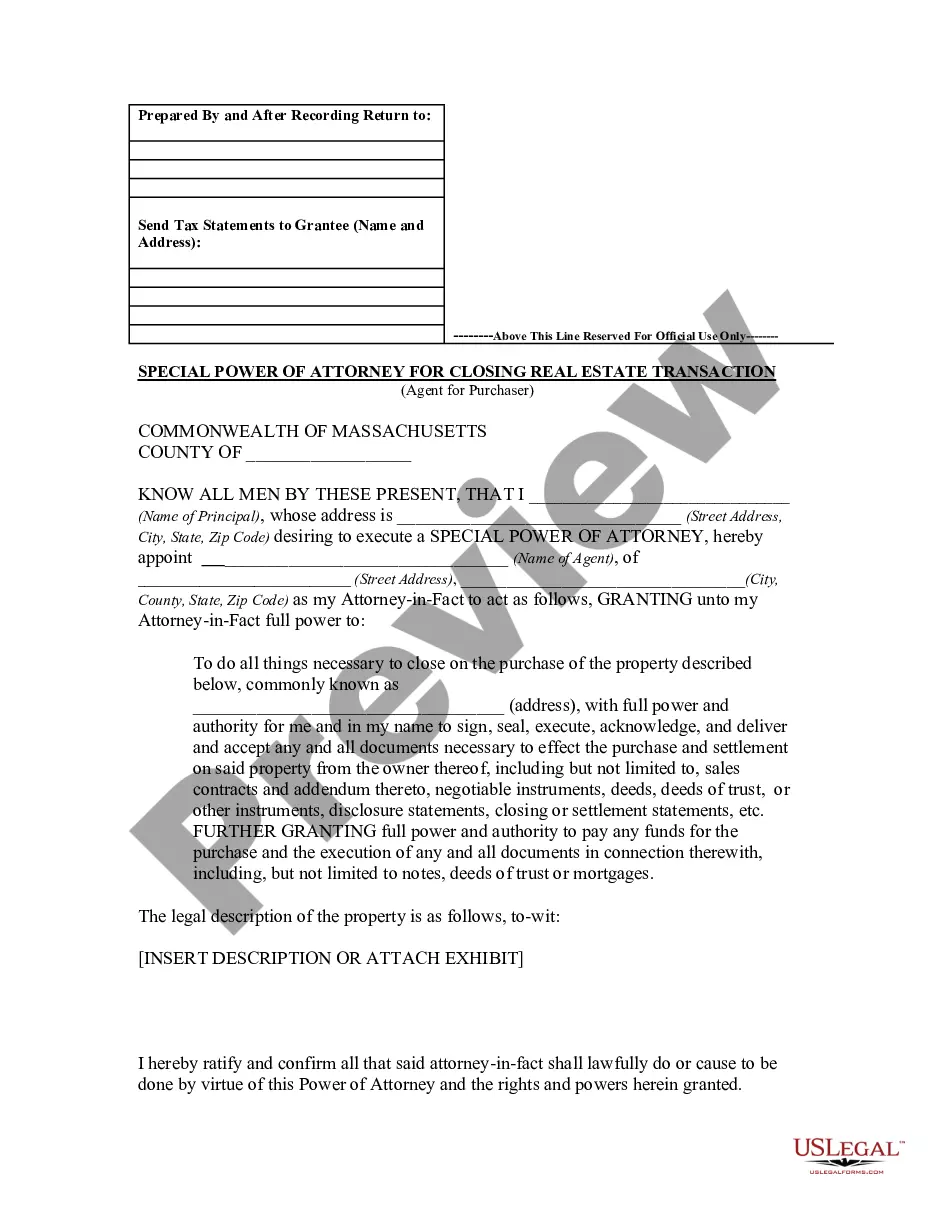

How to fill out Release And Indemnification Of Personal Representative By Heirs And Devisees?

You can allocate time on the web seeking the valid document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of valid templates that are assessed by experts.

It is easy to obtain or print the New Jersey Release and Indemnification of Personal Representative by Heirs and Devisees from the service.

If available, use the Review option to view the document template simultaneously.

- If you already possess a US Legal Forms account, you may Log In and select the Download option.

- After that, you can complete, modify, print, or sign the New Jersey Release and Indemnification of Personal Representative by Heirs and Devisees.

- Every valid document template you receive is yours indefinitely.

- To get an additional copy of any acquired form, visit the My documents section and click the corresponding option.

- If you are utilizing the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, make sure you have chosen the correct document template for the county/city of your choice.

- Review the form description to ensure you have selected the right form.

Form popularity

FAQ

Statute 2A:34-3 deals with the modification and enforcement of alimony orders in New Jersey. It outlines procedures and circumstances under which modifications may be granted or contested. This statute is essential for heirs and devisees to comprehend as it may impact estate distributions within the framework of the New Jersey Release and Indemnification of Personal Representative by Heirs and Devisees.

Statute 2A:14-2 addresses the statute of limitations on personal injury and wrongful death claims in New Jersey. Claimants must file their claims within a two-year period from the date of the incident. Understanding how this statute interacts with the New Jersey Release and Indemnification of Personal Representative by Heirs and Devisees is vital, especially for heirs managing estate claims.

Statute 3B:22-4 pertains to the distribution of assets in the estate when there is no will. It outlines how personal representatives must distribute property among heirs and beneficiaries. This law connects directly to the New Jersey Release and Indemnification of Personal Representative by Heirs and Devisees, ensuring that the process reflects the wishes of the deceased when applicable.

The short answer is that the deceased's home can't be sold before a grant has been obtained. Although executors derive their authority from the will, they can only prove their rights by taking a grant of probate.

The executor can sell property without getting all of the beneficiaries to approve. However, notice will be sent to all the beneficiaries so that they know of the sale but they don't have to approve of the sale.

An executor can sell the property alone if it is in the deceased's sole name. Selling a deceased's property owned in their sole name will require probate. Only an executor can sell a property in probate.

A removed or discharged fiduciary must deliver to his or her successor all assets as of the date of discharge generally and then he or she must prepare, file and settle his/her accounts within 60 days after entry of judgement or within such time as the court may direct.

INFORMATION TO HEIRS AND DEVISEESThis notice is being sent to persons who have or may have some interest in the estate.

In order to remove an executor or administrator who has been appointed by the court, a beneficiary must file a formal complaint for an accounting and seeking removal .

Heir generally refers to a person who is entitled to receive the decedent's property under the statutes of intestate succession, the distribution process that occurs when someone passes away without a will. A devisee is any person designated to receive real or personal property in a decedent's will.