New Jersey Promissory Note Payable on a Specific Date

Description

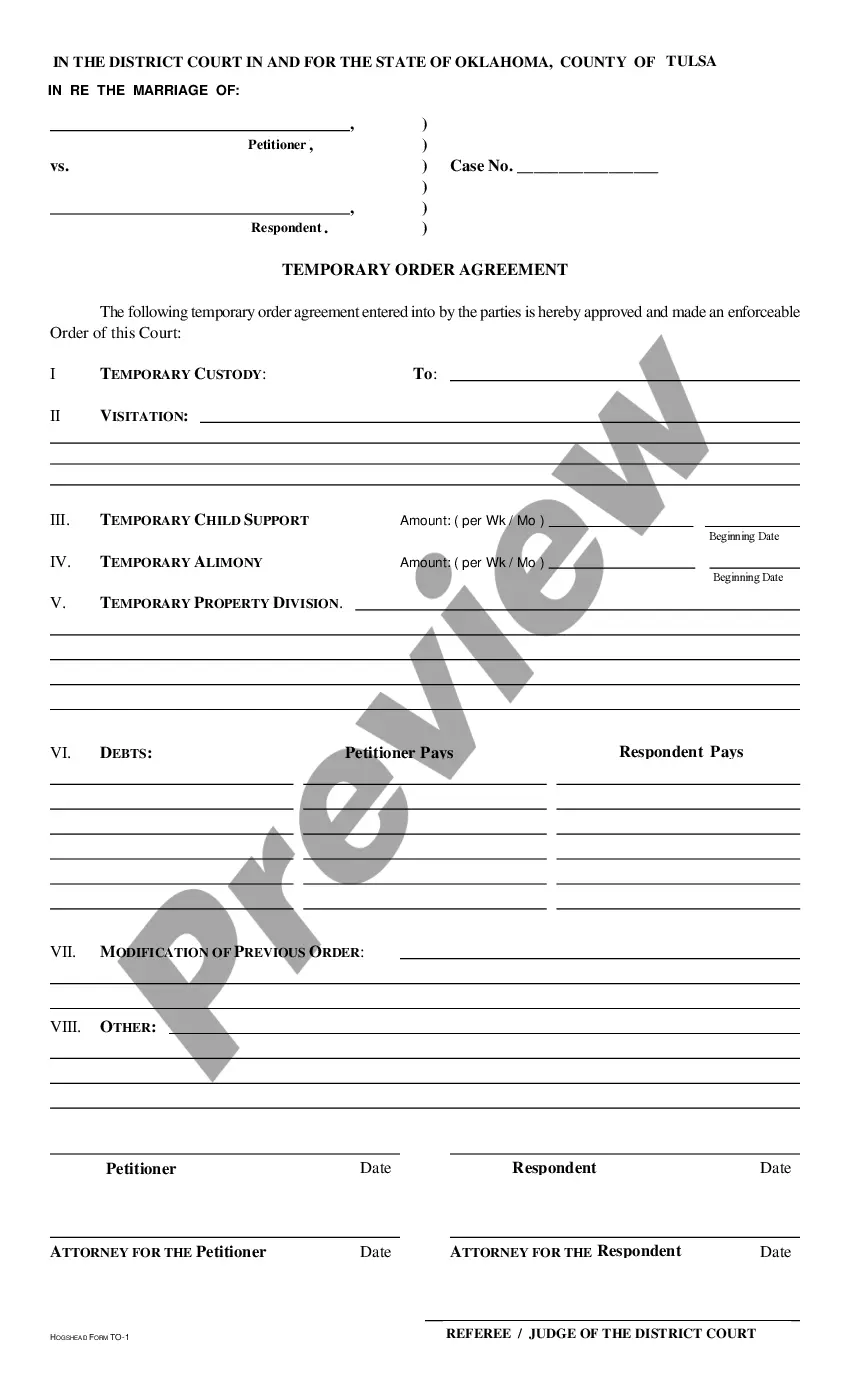

How to fill out Promissory Note Payable On A Specific Date?

Finding the appropriate legal document template can be a challenge. Clearly, there are numerous options accessible online, but how can you secure the legal form you require? Utilize the US Legal Forms platform. This service offers a vast array of templates, including the New Jersey Promissory Note Payable on a Specific Date, suitable for both business and personal purposes. All forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and press the Download button to obtain the New Jersey Promissory Note Payable on a Specific Date. Use your account to review the legal forms you have previously purchased. Go to the My documents section of your account to retrieve another copy of the document you need.

If you are a new user of US Legal Forms, here are simple steps for you to follow: First, ensure that you have selected the correct form for your location/state. You can review the form using the Preview button and read the form description to confirm it is suitable for you. If the form does not meet your requirements, utilize the Search field to find the correct form. Once you are confident that the form is appropriate, click the Purchase now button to obtain the form. Choose the pricing plan you prefer and enter the necessary information. Create your account and complete the purchase using your PayPal account or credit card. Select the file format and download the legal document template to your device.

- Fill out, edit, print, and sign the obtained New Jersey Promissory Note Payable on a Specific Date.

- US Legal Forms is the largest collection of legal documents where you can find a variety of form templates.

- Utilize the service to acquire professionally crafted documents that adhere to state requirements.

Form popularity

FAQ

A promissory note due on a specific date is a legal document that specifies the amount borrowed and the exact date by which the borrower must repay the lender. This type of note ensures clarity in the repayment schedule, minimizing potential disputes. Utilizing a New Jersey Promissory Note Payable on a Specific Date helps establish a straightforward agreement between parties.

Yes, a holder of a demand promissory note can request payment at their discretion, without needing to provide a specific reason. This flexibility is a key feature of such notes, including a New Jersey Promissory Note Payable on a Specific Date. Knowing this helps borrowers plan and be prepared for potential demands. It is vital to maintain clear communication with the lender to avoid unexpected surprises.

The grace period of a promissory note is the time allowed after the due date during which the borrower can make a payment without facing penalties. For a New Jersey Promissory Note Payable on a Specific Date, this grace period might vary based on the agreement. While some notes may offer a few days, others might not provide any grace period. Check your document for this detail to understand your responsibilities better.

Generally, a note cannot be prepaid before the date established in the note for payment. A state statute that establishes a ceiling or maximum rate of interest to be charged on the loan is called a usury statute.

Definition: The maturity date of a note is the time and date when the interest and principal is due in full and must be repaid. A note or promissory note is a written promise to a pay specific amount of money at a future date. The future date is called the maturity date.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

A prepayment may be allowed by a promissory note. A prepayment provision would allow you, as a borrower, to pay a debt early without paying an extra premium payment or penalty. It can consist of the unpaid accrued interest and the unpaid principal sum as of the date of prepayment.

While the statute of limitations on an action in an obligation, liability, or contract is four years, Commercial Code Section 3118(a) gives a statute of limitations of six years for an action to be enforced on the party to pay their promissory note. This time period starts from the due date that's listed on the note.

A Promissory Note Due on a Specific Date is a loan contract that enables a lender and borrower to agree on a set date for repayment. By giving a clear deadline to the borrower, this lending document can help to ensure that the loan will be repaid in full and on time.