New Jersey Notice of Private Sale of Collateral (Non-consumer Goods) on Default

Description

How to fill out Notice Of Private Sale Of Collateral (Non-consumer Goods) On Default?

Are you presently in a circumstance where you require documents for both business and personal purposes almost every day.

There are numerous legal document templates available online, but locating reliable ones can be challenging.

US Legal Forms offers thousands of document templates, similar to the New Jersey Notice of Private Sale of Collateral (Non-consumer Goods) on Default, which can be tailored to meet federal and state requirements.

Choose the pricing plan you prefer, fill in the required information to create your account, and pay for the order using PayPal, Visa, or MasterCard.

Select a convenient file format and download your copy. Find all the document templates you have purchased in the My documents section. You can obtain an additional copy of the New Jersey Notice of Private Sale of Collateral (Non-consumer Goods) on Default at any time, if needed. Just select the required document to download or print the template. Use US Legal Forms, the largest collection of legal documents, to save time and prevent errors. The service provides professionally crafted legal document templates for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New Jersey Notice of Private Sale of Collateral (Non-consumer Goods) on Default template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the document you need and ensure it is for your specific city/state.

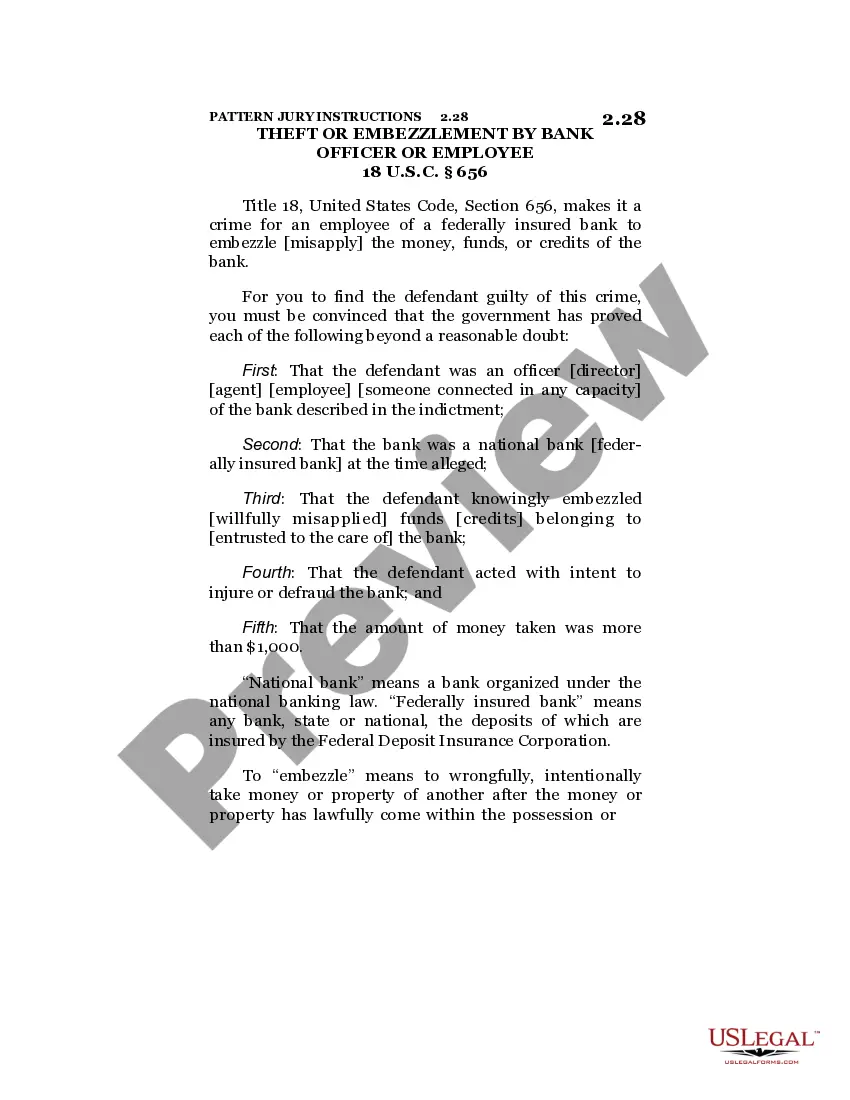

- Utilize the Review button to examine the document.

- Check the details to confirm that you have chosen the correct template.

- If the document is not what you are looking for, use the Search field to find the template that meets your needs.

- Once you find the right document, click Get now.

Form popularity

FAQ

Yes, when a debtor defaults, a secured creditor can often take possession of the collateral without going to court, provided they do so without breaching the peace. This ability allows secured parties to act quickly to stay within their legal rights, especially when they follow the steps outlined in a New Jersey Notice of Private Sale of Collateral (Non-consumer Goods) on Default. However, it is essential for the creditor to avoid any unlawful seizure or confrontation.

Article 9 of the Uniform Commercial Code (UCC), as adopted by all fifty states, generally governs secured transactions where security interests are taken in personal property. It regulates creation and enforcement of security interests in movable property, intangible property, and fixtures.

Article 9 is an article under the Uniform Commercial Code (UCC) that governs secured transactions, or those transactions that pair a debt with the creditor's interest in the secured property.

A PMSI is created in goods when a seller retains a security interest in the goods sold on credit by a security agreement. A debtor need not sign the financing statement. Attachment must occur in order to make a security interest enforceable against the debtor and against third parties.

Section 9-609 of the Uniform Commercial Code (UCC) permits the secured party to take possession of the collateral on default (unless the agreement specifies otherwise):

Collateral Disposition means any sale, transfer or other disposition (whether voluntary or involuntary) to the extent involving assets or other rights or property that constitute Collateral.

Your debtor defaults, or is in default, when they fail to fulfill the obligations identified in the Security Agreement. Default includes bankruptcy or insolvency of your debtor, debtor's failure to pay debts when due, removal of collateral and failure to insure collateral.

Section 9-609 of the Uniform Commercial Code (UCC) permits the secured party to take possession of the collateral on default (unless the agreement specifies otherwise):

Generally, a secured creditor may seek to enforce its rights on its collateral upon a borrower's default. A secured creditor's remedies include an Article 9 sale, the right to sell the collateral to a third party in a private or public sale without judicial proceedings.

Under Section 9-611 of the Uniform Commercial Code, a secured creditor is required, in most circumstances, to send a reasonable authenticated notification of disposition. The notice is intended to provide the debtor, and other interested parties, an opportunity to monitor the disposition of the collateral, purchase