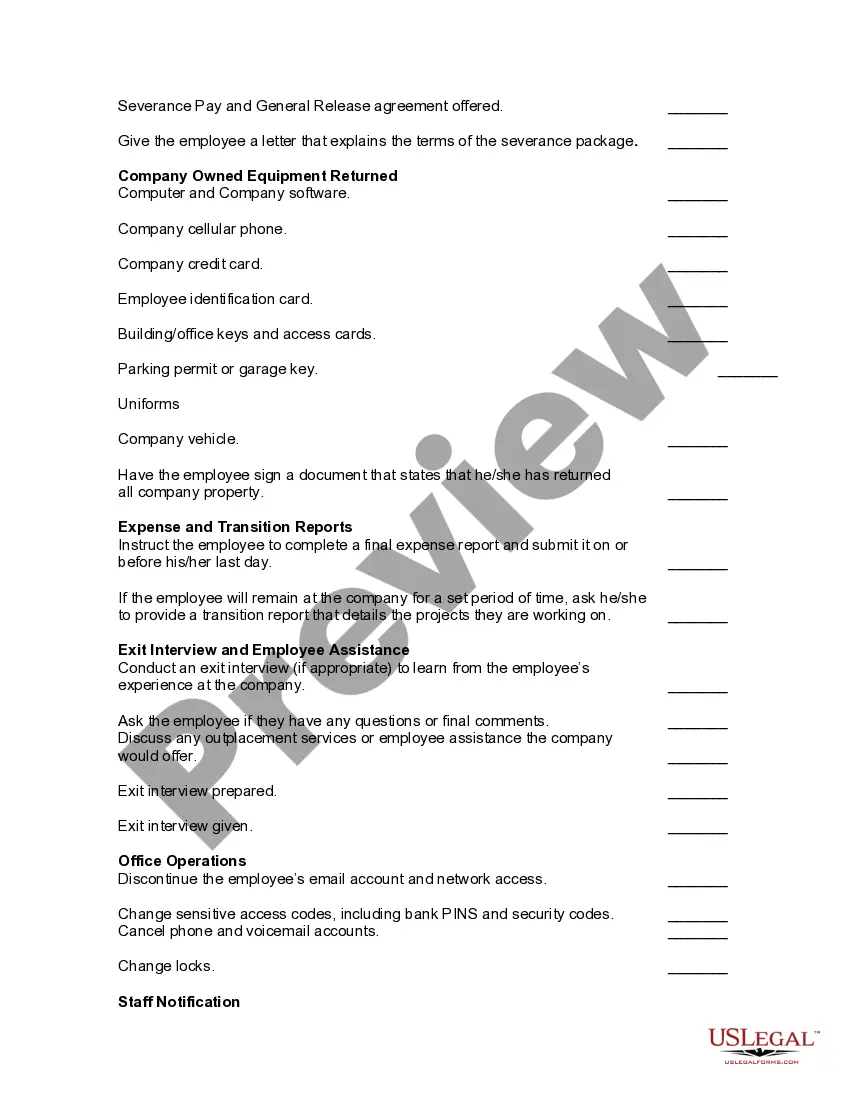

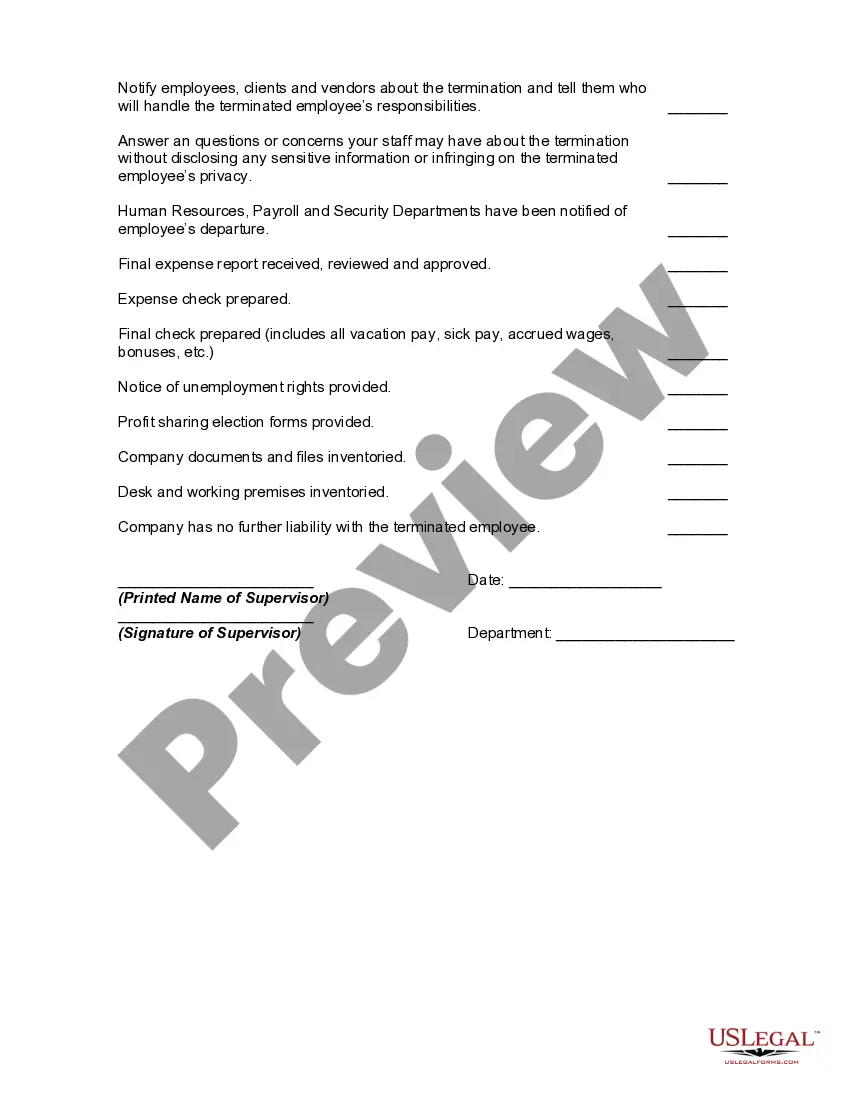

The following items should be checked off prior to an employee's final date of employment. Not all items will apply to all employees or to all circumstances.

New Jersey Worksheet - Termination of Employment

Description

How to fill out Worksheet - Termination Of Employment?

You can allocate time online searching for the legal document template that meets the state and federal regulations required. US Legal Forms offers thousands of legal documents that are evaluated by experts.

It is easy to obtain or print the New Jersey Worksheet - Termination of Employment from your services.

If you already possess a US Legal Forms account, you may Log In and then click the Download button. After that, you can complete, modify, print, or sign the New Jersey Worksheet - Termination of Employment. Every legal document template you acquire is yours permanently.

Complete the payment. You can use your credit card or PayPal account to purchase the legal document. Select the format of the document and download it to your device. Make changes to your document if necessary. You can complete, modify, and sign the New Jersey Worksheet - Termination of Employment. Download and print thousands of document templates from the US Legal Forms website, which provides the largest variety of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- To acquire another copy of the purchased form, go to the My documents tab and click the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, verify that you have selected the correct document template for the county/city of your preference. Review the document description to ensure you have chosen the appropriate form.

- If available, utilize the Review button to browse through the document template as well.

- If you want to search for an alternative version of the document, use the Search field to find the template that satisfies your needs and requirements.

- Once you have located the template you desire, click Buy now to proceed.

- Select the pricing plan you wish, enter your details, and create an account on US Legal Forms.

Form popularity

FAQ

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

NJ-927W. Employer's Quarterly Reports - Online. NJ-W-3M. Gross Income Tax Reconciliation of Tax Withheld.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

NJ Taxation Employers must file a Gross Income Tax Reconciliation of Tax Withheld (Form NJ-W-3) each year to report the total monthly tax remitted, wages paid and withholdings. Registered employers must file Form NJ-W-3 even if no wages were paid and no tax was withheld during the year.

Most taxpayers will put a number on line 5 (indicated here by the red arrow) that will help your employer calculate how much federal income tax is to be withheld from your paycheck. That number is the number of allowances you are claiming and it's the one that gives taxpayers fits trying to get right.

How to file a W-4 form in 5 StepsStep 1: Enter your personal information. The first step is filling out your name, address and Social Security number.Step 2: Multiple jobs or spouse works.Step 3: Claim dependents.Step 4: Factor in additional income and deductions.Step 5: Sign and file with your employer.

EMPLOYER'S QUARTERLY REPORT Effective October 1, 1998, employers required to withhold and remit New Jersey gross income tax from their employee's pay will be filing one of two quarterly reports, Form NJ-927 or Form NJ-927-W, Employer's Quarterly Report.

You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.

The WR-30 form is a report of all of the people who were employed or paid wages by an employer in the state of New Jersey. Employers are required to file a WR-30 form on a quarterly basis.