New Jersey Sample Letter for Deed of Trust and Promissory Note

Description

How to fill out Sample Letter For Deed Of Trust And Promissory Note?

It is possible to devote time on the web trying to find the legitimate document format which fits the federal and state specifications you want. US Legal Forms supplies thousands of legitimate forms that happen to be examined by experts. It is possible to download or print out the New Jersey Sample Letter for Deed of Trust and Promissory Note from the support.

If you currently have a US Legal Forms accounts, you may log in and click on the Download key. Next, you may total, change, print out, or indicator the New Jersey Sample Letter for Deed of Trust and Promissory Note. Every legitimate document format you get is yours permanently. To acquire an additional duplicate for any purchased develop, visit the My Forms tab and click on the related key.

Should you use the US Legal Forms site for the first time, adhere to the simple guidelines under:

- Initial, be sure that you have selected the best document format for your region/metropolis that you pick. Read the develop explanation to ensure you have selected the correct develop. If offered, take advantage of the Preview key to search from the document format too.

- If you would like find an additional model in the develop, take advantage of the Lookup industry to get the format that fits your needs and specifications.

- Once you have discovered the format you want, click on Acquire now to proceed.

- Choose the pricing program you want, enter your qualifications, and register for a merchant account on US Legal Forms.

- Total the purchase. You can utilize your bank card or PayPal accounts to fund the legitimate develop.

- Choose the format in the document and download it to your product.

- Make changes to your document if necessary. It is possible to total, change and indicator and print out New Jersey Sample Letter for Deed of Trust and Promissory Note.

Download and print out thousands of document themes utilizing the US Legal Forms site, that offers the most important assortment of legitimate forms. Use expert and state-distinct themes to handle your company or personal demands.

Form popularity

FAQ

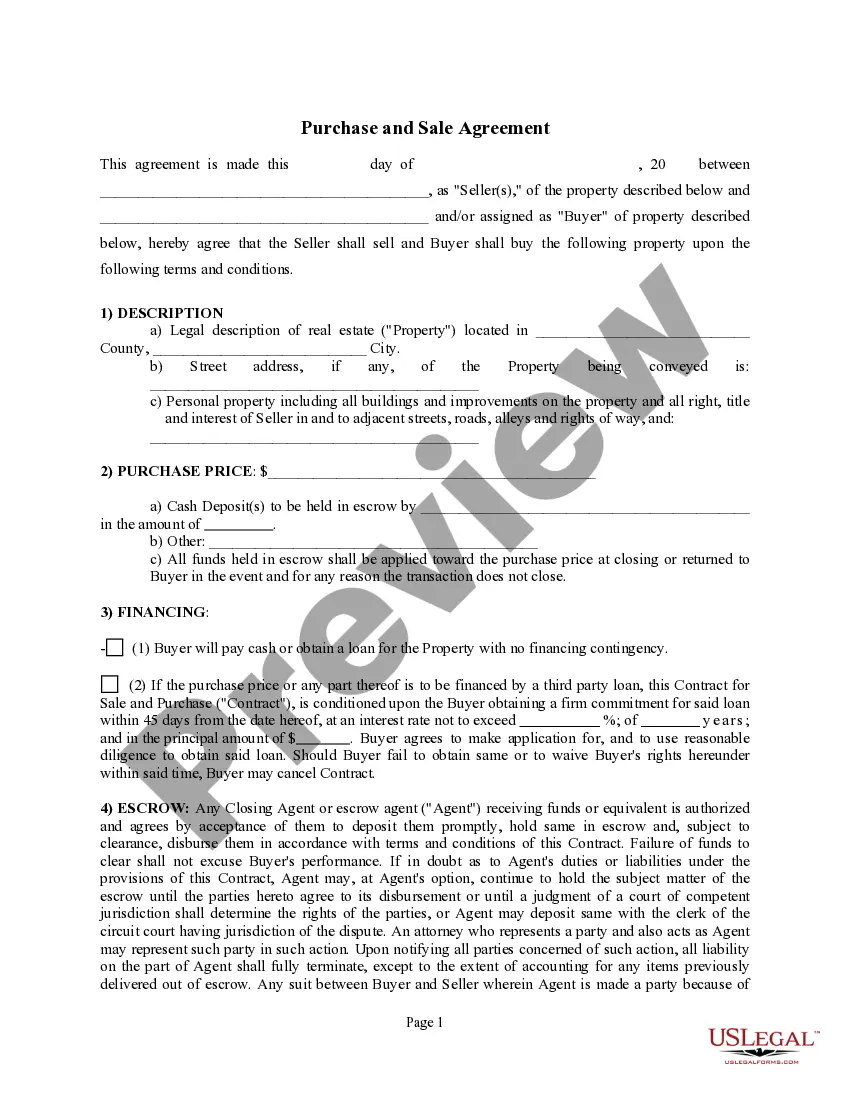

A Standard Document used for transferring an interest in an unsecured promissory note to a revocable trust that can be customized for use in any US jurisdiction. This Standard Document contains integrated notes and drafting tips.

A trust deed is always used together with a promissory note that sets out the amount and terms of the loan. The property owner signs the note, which is a written promise to repay the borrowed money.

The promissory note describes the debt's amount, interest rate, and late fees. A lender holds the promissory note until the mortgage loan is paid off. Unlike the mortgage or deed of trust, the promissory note is not entered into county land records.

A simple example would be the situation in which one member of a family advances money to another and asks the second member to hold the money or to invest it for him. A more complicated example of an implied trust would be the situation in which one party provides money to another for the purchase of property.

A deed of trust involves three parties: (1) the trustor, who is the person who received the loan, (2) the beneficiary, who is the person who loaned the money to the trustor, and (3) the trustee, who is the person that released the loan once it has been paid off.

With a deed of trust, the lender gives the borrower the funds to make the home purchase. In exchange, the borrower provides the lender with a promissory note. The promissory note outlines the terms of the loan and the borrower's promise (hence the name) to pay.

Over to the Trustees mentioned hereunder, is hereby acknowledged by the Trustees, who hereby accept the appointment as such Trustees of the said Trust, under the terms and conditions, set out hereunder for the fulfillment of the objects of the Trust, more fully and particularly described and set out hereunder.

Ing to the term of a trust instrument, it can be defined into different types. For example: Inter Vivo trust is created when the settlor is alive. Testamentary trust is usually created through the terms of a settlor's will and goes into effect after the death of the settlor.