New Jersey Reorganization of Partnership by Modification of Partnership Agreement

Description

How to fill out Reorganization Of Partnership By Modification Of Partnership Agreement?

Finding the appropriate legal document template can be quite a challenge.

Clearly, there is a multitude of templates accessible online, but how do you locate the official form you require.

Utilize the US Legal Forms website. This service offers thousands of templates, including the New Jersey Reorganization of Partnership by Modification of Partnership Agreement, suitable for both professional and personal purposes.

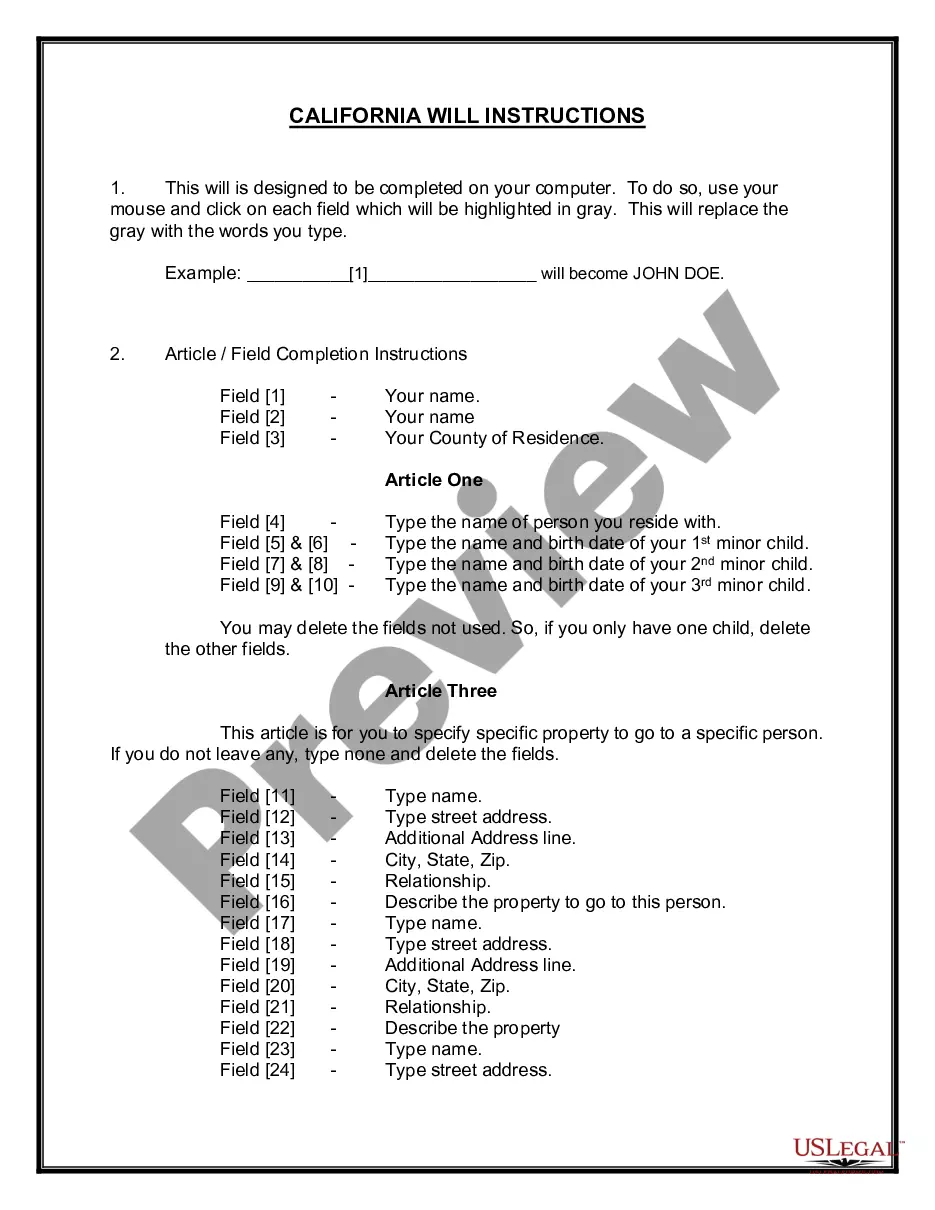

You can preview the form using the Review button and read the form description to confirm it meets your needs.

- All forms are reviewed by experts and comply with federal and state regulations.

- If you are already a member, Log In to your account and click the Download button to access the New Jersey Reorganization of Partnership by Modification of Partnership Agreement.

- Leverage your account to browse the legal forms you have previously obtained.

- Visit the My documents section of your account to retrieve another copy of the document you need.

- For new users of US Legal Forms, here are some simple steps to follow.

- First, ensure you have selected the correct form for your locality/county.

Form popularity

FAQ

Schedule J 1065 is used to report each partner's share of income, deductions, and credits from the partnership. This schedule helps in determining the tax obligations for each partner based on their share of the partnership's income. When engaging in the New Jersey Reorganization of Partnership by Modification of Partnership Agreement, accurately completing Schedule J ensures that all partners have clarity on their tax responsibilities.

Yes, an amended Form 1065 can be filed electronically, making the process more efficient. Many tax software programs offer this capability, allowing you to submit amendments quickly and conveniently. This electronic filing option supports prompt compliance, which is particularly beneficial during New Jersey Reorganization of Partnership by Modification of Partnership Agreement.

A Schedule 1065 is an accompanying form used to report the income, expenses, and distributions of a partnership. This schedule provides detailed insights into the partnership’s financial activities for the tax year. By utilizing Schedule 1065 effectively, partners can ensure compliance with the regulations related to the New Jersey Reorganization of Partnership by Modification of Partnership Agreement.

Form 1065 must be filed by any partnership that has income, deductions, and credits, regardless of the income level. This includes both general and limited partnerships, as all partnerships are pass-through entities for tax purposes. Understanding who must file is crucial for partnerships engaged in New Jersey Reorganization of Partnership by Modification of Partnership Agreement to stay compliant.

To amend the NJ 1065, complete and submit the Form NJ-1065X, indicating the changes made to the original filing. Be sure to provide clear documentation that supports your amendments, which helps to clarify any discrepancies. Proper amendments are an important step in the New Jersey Reorganization of Partnership by Modification of Partnership Agreement process, ensuring that the partnership's tax filings are accurate.

Part-year residents in New Jersey should use Form NJ-1040 to file their state tax returns, including any applicable schedules. This form allows residents to report their income earned while residing in the state. For partnerships undergoing New Jersey Reorganization of Partnership by Modification of Partnership Agreement, it is essential to clarify tax obligations for part-year residents appropriately.

To amend your New Jersey state tax return, you'll need to complete Form NJ-1040X, which is the state's amended return. Be prepared to provide reasons for the changes, and submit the form along with any additional documentation. This amendment process is important in the context of New Jersey Reorganization of Partnership by Modification of Partnership Agreement, as it ensures that partnerships report their tax obligations accurately.

To change business ownership in New Jersey, you typically need to create and sign a new partnership agreement that outlines the changes. Additionally, you may need to notify the New Jersey Division of Revenue and the IRS regarding the new ownership structure. This process is vital for any New Jersey Reorganization of Partnership by Modification of Partnership Agreement, as it ensures that all legal entities are properly updated.

In New Jersey, any partnership with income, deductions, or credits must file a Form 1065. This includes partnerships that operate in the state and are subject to federal taxes. Understanding the necessity of filing a 1065 is crucial for managing compliance during New Jersey Reorganization of Partnership by Modification of Partnership Agreement.

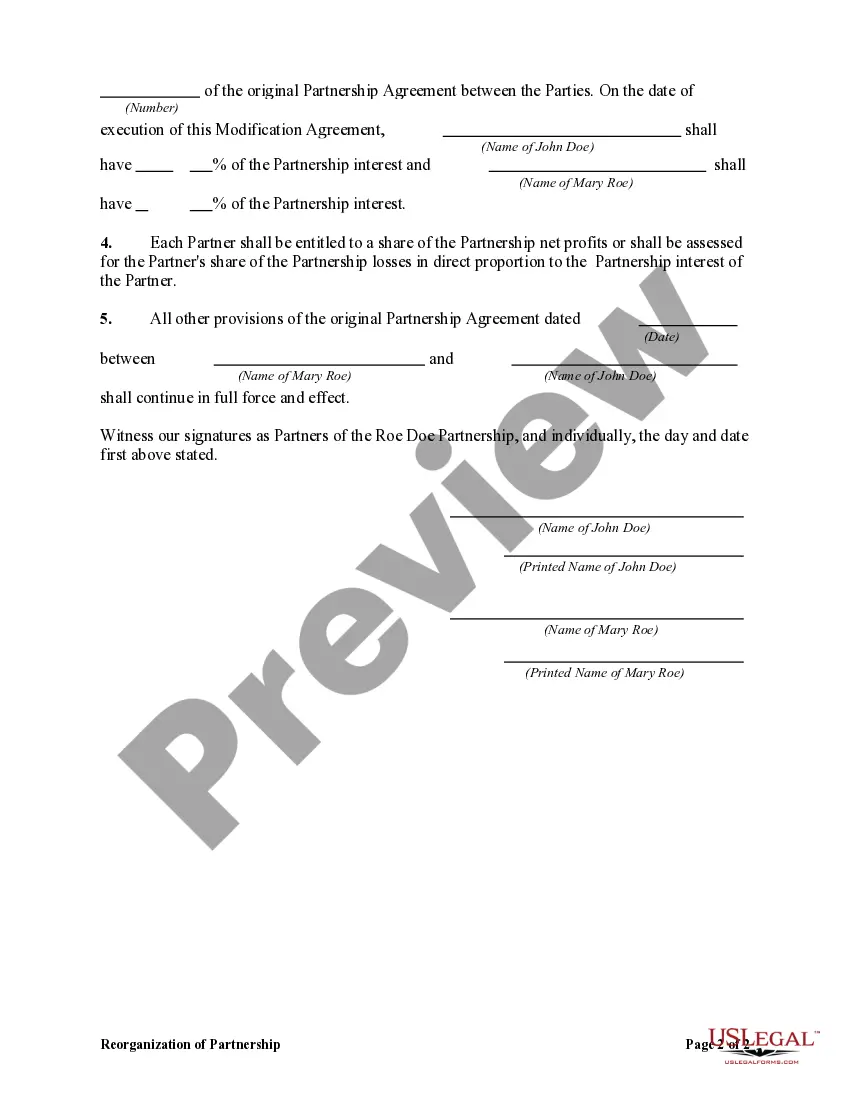

Yes, a partnership agreement can be modified or changed if all partners agree to the amendments. This process typically involves drafting a new agreement or creating an amendment document, which outlines the changes. The New Jersey Reorganization of Partnership by Modification of Partnership Agreement can greatly benefit from such modifications, ensuring that all partnership terms are current and reflective of the partners' intentions.