New Jersey Demand for Acknowledgment of Shipping Dates

Description

A contract for sale imposes an obligation on each party that the other's expectation of receiving due performance will not be impaired. When reasonable grounds for insecurity arise with respect to the performance of either party, the other may in writing demand adequate assurance of due performance and until he receives such assurance may if commercially reasonable suspend any performance for which he has not already received the agreed return.

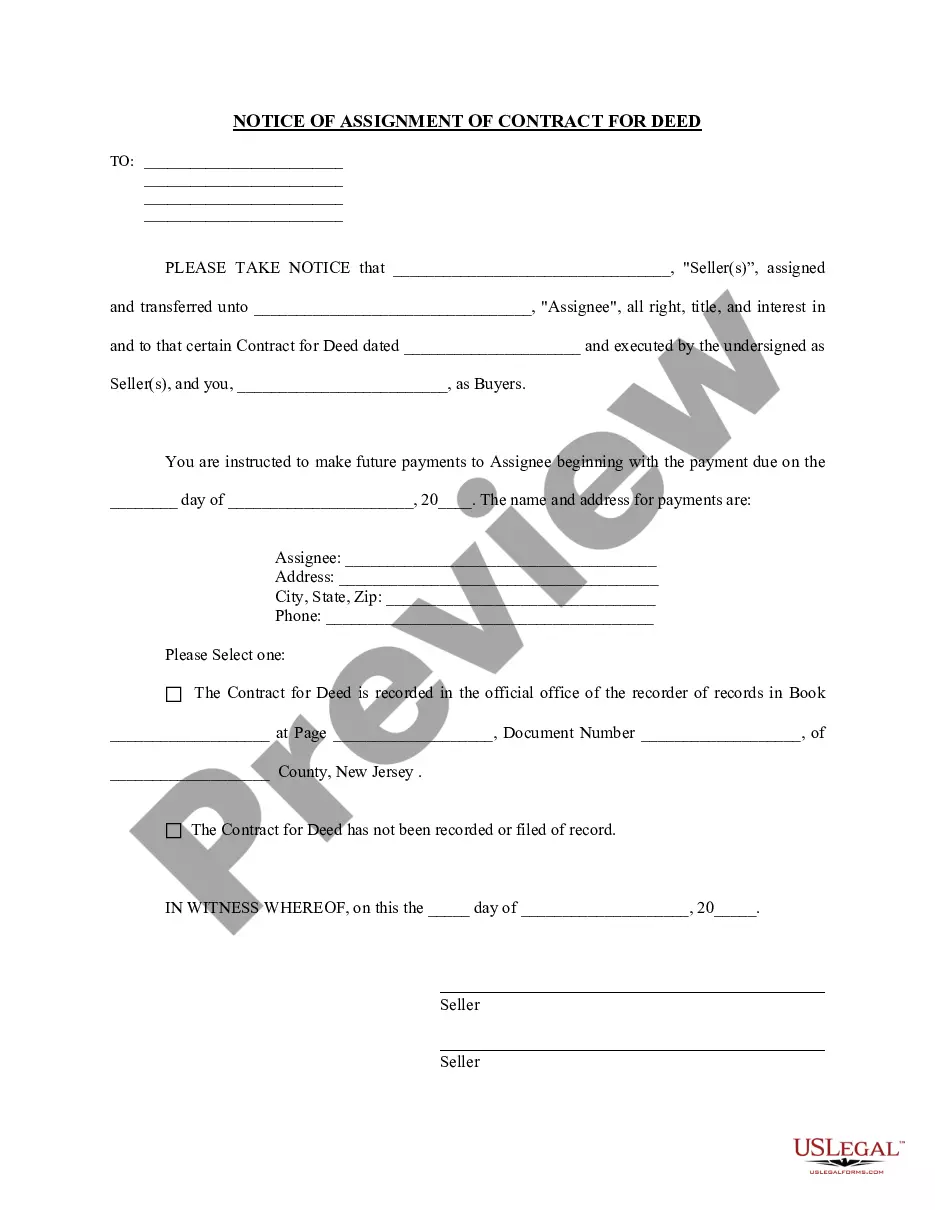

How to fill out Demand For Acknowledgment Of Shipping Dates?

US Legal Forms - one of the largest collections of official documents in the United States - offers a variety of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms like the New Jersey Request for Acknowledgment of Shipping Dates in moments.

Review the form description to confirm that you have selected the right one.

If the form does not meet your requirements, use the Search bar at the top of the screen to find the one that does.

- If you already possess a monthly subscription, sign in and download New Jersey Request for Acknowledgment of Shipping Dates from the US Legal Forms library.

- The Download button will appear on each form you view.

- You can access all previously acquired forms in the My documents section of your account.

- If this is your first time using US Legal Forms, here are simple instructions to help you get started.

- Ensure you have selected the correct form for your city/county.

- Click the Preview button to review the contents of the form.

Form popularity

FAQ

The New Jersey wage payment law, specifically -4.1 et seq., addresses employer obligations regarding the timely payment of wages to employees. This law ensures that workers receive their wages without unnecessary delay. Understanding this law is crucial for compliance and for safeguarding employee rights. By staying informed, you can align your business practices with the requirements of the New Jersey Demand for Acknowledgment of Shipping Dates to maintain good standing.

Yes, New Jersey provides an e-file authorization form which is crucial for taxpayers who wish to e-file their returns. This authorization ensures that the e-filing process is official and compliant with state regulations. The form is simple to complete and serves as a vital part of your electronic filing. Rely on the New Jersey Demand for Acknowledgment of Shipping Dates for reassurance on submission correctness.

To file a Pass-Through Entities (PTE) extension in New Jersey, you should submit Form NJ-1065EXT. This form allows you to request an extension for filing your NJ-1065 return. Be mindful of the deadlines to avoid late penalties. Using the New Jersey Demand for Acknowledgment of Shipping Dates can assist you in managing your extension filings effectively.

Yes, New Jersey does utilize Form 8879 for e-filing authorization. This form is essential for confirming that the taxpayer and the person filing on their behalf are in agreement. Completing this form correctly ensures that your electronic submissions are accepted. By leveraging tools that integrate with the New Jersey Demand for Acknowledgment of Shipping Dates, you can enhance your filing efficiency.

To authorize e-filing in New Jersey, you will need to use Form 8879. This form effectively allows you to electronically sign your return and grants you the authorization to e-file on behalf of your business. After completing this form, you can submit your tax documents swiftly and securely. Consider relying on the New Jersey Demand for Acknowledgment of Shipping Dates for timely confirmations of your filings.

The NJ-1065 form is required for partnerships operating in New Jersey. This includes any business entity that meets the definition of a partnership under state law. If your partnership has income, deductions, or credits to report, you must file this form. Ensuring compliance with the New Jersey Demand for Acknowledgment of Shipping Dates can streamline your filing process.

When you e-file in New Jersey, the acceptance time can vary but is typically processed within 24 to 48 hours. This means you can receive confirmation of your filing quickly, allowing you to focus on other important matters. However, during peak tax seasons, there may be slight delays. Using the New Jersey Demand for Acknowledgment of Shipping Dates can help you keep track of your e-filing status.

Statute 34-11 4.2 in New Jersey pertains to the timely payment for services rendered in the construction industry, reinforcing the importance of adhering to payment schedules. This law aims to protect workers from delayed payments and ensure transparency in transactions. Familiarity with the New Jersey Demand for Acknowledgment of Shipping Dates can greatly assist in maintaining compliance with such regulations.

Yes, New Jersey plans to raise the minimum wage to $15 per hour by 2024, with further increases indexed to inflation beginning in 2025. This adjustment aims to support workers and ensure fair compensation. Businesses can enhance their operations and compliance with changes like these by utilizing the New Jersey Demand for Acknowledgment of Shipping Dates to keep track of financial commitments.

The statute of limitations for claims under the New Jersey Prompt Payment Act is typically one year from the date the payment is due. This law ensures that contractors and subcontractors receive timely payments for their work. The New Jersey Demand for Acknowledgment of Shipping Dates is essential in documenting shipping timelines and payment schedules in compliance with this Act.