New Jersey Sample Letter for Asset Sale

Description

How to fill out Sample Letter For Asset Sale?

US Legal Forms - among the most significant libraries of lawful kinds in the USA - offers a wide range of lawful record web templates you may acquire or printing. Using the internet site, you can find 1000s of kinds for organization and person reasons, categorized by classes, says, or search phrases.You can find the most recent types of kinds like the New Jersey Sample Letter for Asset Sale within minutes.

If you have a registration, log in and acquire New Jersey Sample Letter for Asset Sale from the US Legal Forms library. The Obtain key will appear on each develop you see. You have access to all in the past saved kinds in the My Forms tab of the account.

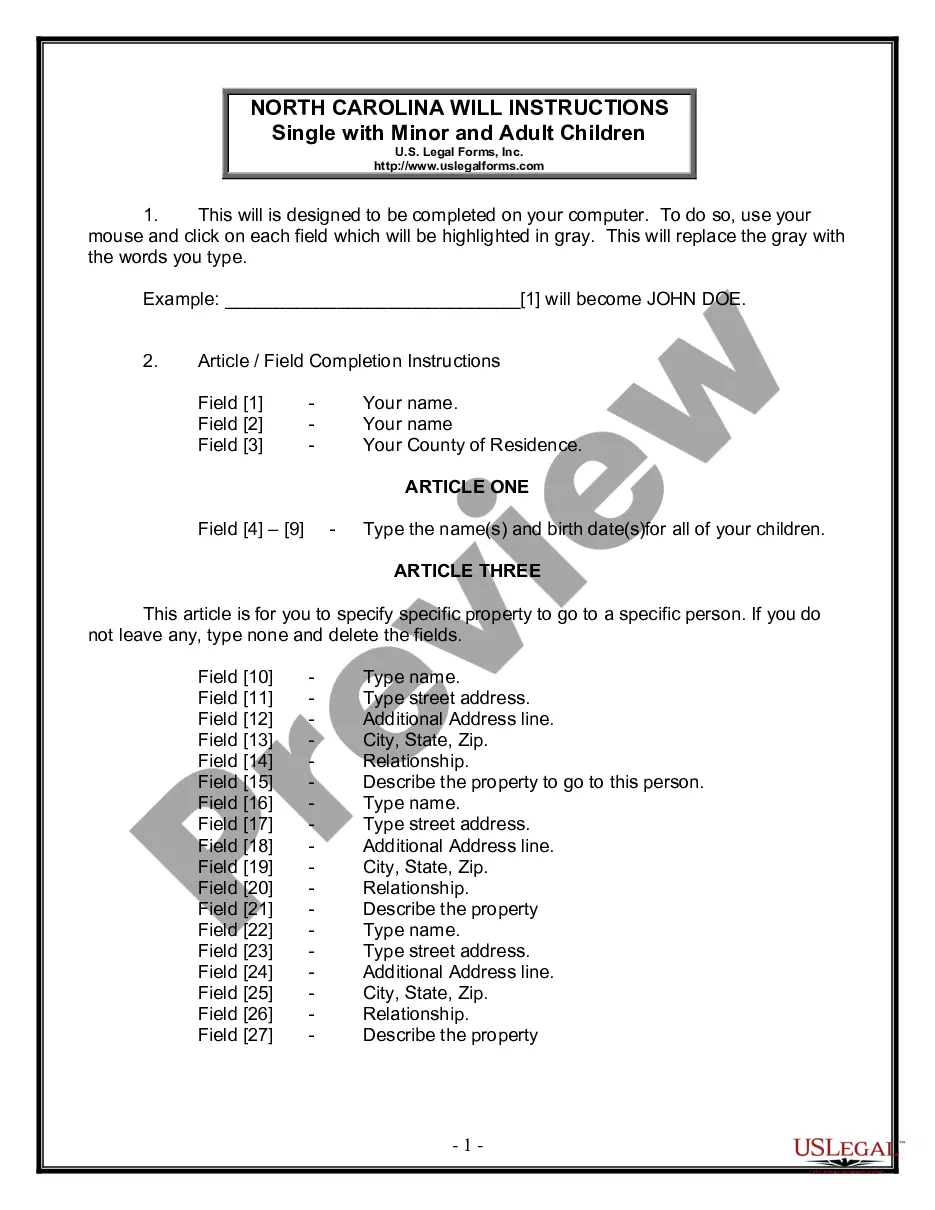

If you wish to use US Legal Forms the first time, here are easy recommendations to help you started out:

- Make sure you have picked out the best develop for the city/state. Go through the Preview key to examine the form`s content. Look at the develop information to actually have chosen the right develop.

- In case the develop doesn`t suit your specifications, use the Search area at the top of the monitor to discover the one which does.

- When you are satisfied with the form, affirm your decision by simply clicking the Acquire now key. Then, opt for the costs program you want and provide your references to register for the account.

- Method the transaction. Use your Visa or Mastercard or PayPal account to finish the transaction.

- Select the file format and acquire the form on your gadget.

- Make adjustments. Load, modify and printing and indication the saved New Jersey Sample Letter for Asset Sale.

Each and every web template you included in your money lacks an expiration time and it is your own forever. So, if you want to acquire or printing an additional version, just check out the My Forms section and click on the develop you need.

Gain access to the New Jersey Sample Letter for Asset Sale with US Legal Forms, by far the most substantial library of lawful record web templates. Use 1000s of skilled and status-particular web templates that satisfy your organization or person requires and specifications.

Form popularity

FAQ

Notice must contain: All business names and addresses used by Seller and Buyer within the past three years; Location and general description of assets to be sold; Location and (expected) date of the Bulk Sale; Whether the Bulk Sale is a Small Cash Sale.

A bulk sale, sometimes called a bulk transfer, is when a business sells all or nearly all of its inventory to a single buyer and such a sale is not part of the ordinary course of business.

The New Jersey Bulk Sale Act (N.J.S. -38) (the ?Bulk Sale Act?) applies to many types of transactions and can expose purchasers, transferees and assignees (each a ?Purchaser?) to all of a seller's State tax liabilities.

The current bulk sales law, N.J.S.A. -38, applies to any sale, transfer or assignment in bulk of any part or all of a person's ?business assets,? other than in the ordinary course of business (e.g. the bulk sales law would not apply to a homebuilder selling homes as they would be considered inventory).

NJ Taxation A bulk sale is the sale, transfer, or assignment of an individual or company's business asset(s). This can be in whole or in part. To collect the proper taxes, the purchaser must notify the Division anytime there is a bulk sale.

There are a number of exemptions from the bulk sale requirements. For example, a person selling a one family or two family home need not file the notification. However, the sale of a vacant lot is not exempt. The sale of a one family house by a limited liability company or corporation is not exempt.

9600. 1099, R6. This form is to be used to notify the Director of the Division of Taxation, of any bulk transfer in ance with Section 22(c) of the New Jersey State Sales and Use Tax Act and Section 15 of the New Jersey Business Personal Property Tax Act.

Bulk Sale means the sale or other disposition, in a single transaction or a series of related transactions (and directly or indirectly), to a single buyer of two more assets (consisting of Loans, including any separate REO Property or other Acquired Property into which any Loan is converted) that (i) are not from a ...