New Jersey Notice to Lessor from Lessee Exercising Option to Purchase

Description

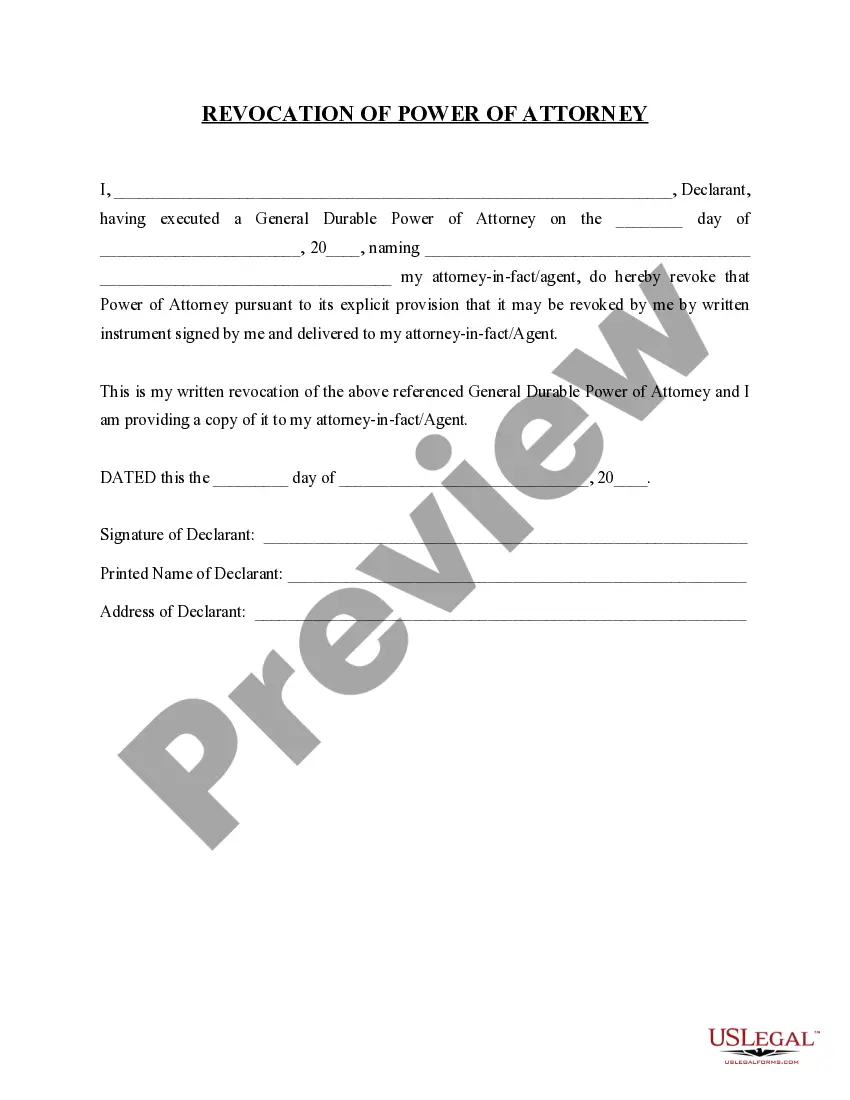

How to fill out Notice To Lessor From Lessee Exercising Option To Purchase?

You can spend numerous hours online trying to locate the appropriate legal document template that fulfills the state and federal requirements you need.

US Legal Forms offers thousands of legal documents that have been vetted by professionals.

You can easily download or print the New Jersey Notice to Lessor from Lessee Exercising Option to Purchase from our service.

If available, utilize the Preview button to browse through the document template as well. If you wish to find another version of your form, use the Search area to find the template that suits your needs and requirements. Once you have identified the template you need, click on Acquire now to proceed. Choose the pricing plan you want, enter your details, and register for a free account on US Legal Forms. Complete the transaction using your Visa or Mastercard or PayPal account to pay for the legal form. Select the format of your document and download it to your device. You can make adjustments to your document if possible. You can complete, edit, sign, and print the New Jersey Notice to Lessor from Lessee Exercising Option to Purchase. Obtain and print thousands of document templates using the US Legal Forms website, which provides the largest collection of legal forms. Use professional and state-specific templates to address your business or personal needs.

- If you already possess a US Legal Forms account, you can Log In and click the Obtain button.

- Then, you can complete, modify, print, or sign the New Jersey Notice to Lessor from Lessee Exercising Option to Purchase.

- Each legal document template you acquire is yours permanently.

- To obtain an additional copy of any purchased form, navigate to the My documents section and click the corresponding button.

- If you are visiting the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the county/city of your choice.

- Review the form summary to make sure you have chosen the correct form.

Form popularity

FAQ

4. How Do You Exercise an Option to Purchase? Once a buyer decides that he wishes to purchase the property, the buyer may exercise the Option to Purchase before the Option Period ends, according to the manner set out in the Option to Purchase.

You only exercise an option if you want to buy or sell the actual underlying asset. It's important to note that most options are not exercised, even the profitable ones. For example, say you bought a call option for a premium of $1 on a stock with a strike price of $10.

You can choose to exercise your call option if it is in the money, meaning the strike price is lower than the stock price. For example, if the strike price is $30 and the stock price is $20, exercising would not make you money because you can purchase the stock for $10 less than the strike price.

The order to exercise your options depends on the position you have. For example, if you bought to open call options, you would exercise the same call options by contacting your brokerage company and giving your instructions to exercise the call options (to buy the underlying stock at the strike price).

The option period will be the period in which you will have the ability to trigger the option and proceed to purchase the land. You will be required to serve an option notice on the landowner, at which point a deposit will usually be payable and a binding contract will be entered into.

Exercising an option is beneficial if the underlying asset price is above the strike price of a call option or the underlying asset price is below the strike price of a put option. Traders don't have to exercise an option because it is not an obligation.

When you convert a call option into stock by exercising, you now own the shares. You must use cash that will no longer be earning interest to fund the transaction, or borrow cash from your broker and pay interest on the margin loan.

To exercise an option, you simply advise your broker that you wish to exercise the option in your contract. Your broker will initiate an exercise notice, which informs the seller or writer of the contract that you are exercising the option.

A type of option which grants a right (but not an obligation) for a potential buyer to acquire an asset from a seller at a specified price (or a price to be calculated in accordance with a pre-agreed formula). The option is generally exercisable during a specified period.

As it turns out, there are good reasons not to exercise your rights as an option owner. Instead, closing the option (selling it through an offsetting transaction) is often the best choice for an option owner who no longer wants to hold the position.