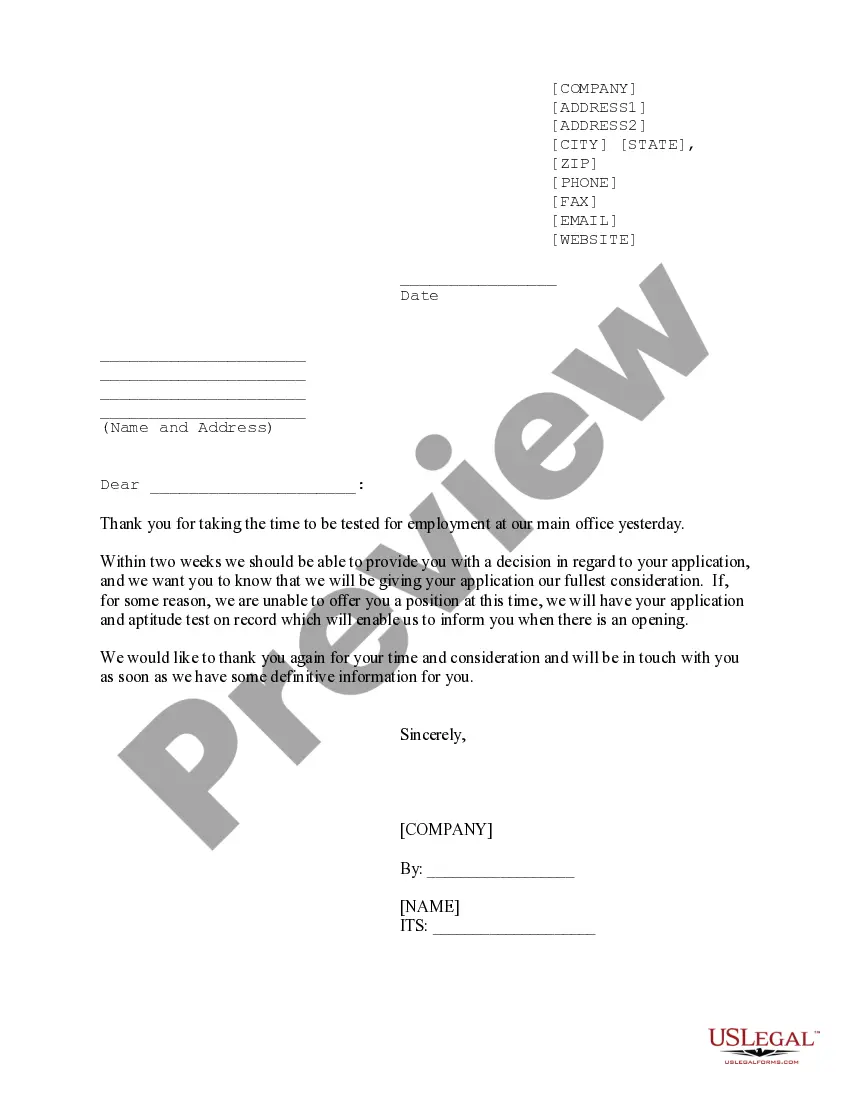

New Jersey Sample Letter for Return of Late Payment and Denial of Discount

Description

How to fill out Sample Letter For Return Of Late Payment And Denial Of Discount?

Finding the appropriate official document format can be challenging.

Clearly, there are numerous templates accessible online, but how can you obtain the official version you desire.

Utilize the US Legal Forms website. The platform offers a vast array of templates, including the New Jersey Sample Letter for Return of Late Payment and Denial of Discount, which you can utilize for business and personal purposes.

If the form does not meet your needs, utilize the Search field to find the appropriate document.

- All the forms are vetted by professionals and meet federal and state requirements.

- If you are already registered, Log In to your account and click on the Acquire button to locate the New Jersey Sample Letter for Return of Late Payment and Denial of Discount.

- Access your account to review the legal documents you have previously purchased.

- Go to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward steps for you to follow.

- First, ensure you have selected the correct form for your jurisdiction. You can review the form using the Review option and examine the form details to ensure it is suitable for your needs.

Form popularity

FAQ

A reasonable cause for penalty abatement could be a serious illness or an unexpected financial burden that prevented timely payments. Documenting your circumstances strengthens your request. The 'New Jersey Sample Letter for Return of Late Payment and Denial of Discount' offers a useful framework to articulate your situation effectively and make your case compelling.

To write a penalty abatement letter, begin with a formal greeting and state your purpose clearly. Provide details about your account or the penalties in question, and explain your reason for requesting abatement. Using the 'New Jersey Sample Letter for Return of Late Payment and Denial of Discount' template can guide you through the process, ensuring clarity and professionalism.

Typically, penalties such as late payment fees or underpayment penalties may qualify for first time abatement. The IRS often considers your filing history when determining eligibility. Utilizing the 'New Jersey Sample Letter for Return of Late Payment and Denial of Discount' can assist you in articulating your case effectively, increasing your chances of approval.

To write a letter waiving penalty charges, start with a polite introduction and clearly state your request. Include relevant details, such as your account number and specific charges you want waived. Reference the 'New Jersey Sample Letter for Return of Late Payment and Denial of Discount' to provide a structured approach, and ensure you conclude with a courteous closing.

A solid reason for requesting a penalty waiver might include first-time compliance issues, circumstances beyond your control, or the presence of reasonable cause. It’s essential to articulate your reasons clearly and support them with documentation. A New Jersey Sample Letter for Return of Late Payment and Denial of Discount can assist you in laying out your case convincingly.

Writing a reasonable cause letter to the IRS involves stating your situation clearly and honestly. Begin with your information, explain the circumstances leading to the penalty, and provide any evidence of compliance or good faith efforts. A New Jersey Sample Letter for Return of Late Payment and Denial of Discount may help you ensure your letter is well-organized and complete.

An example of a penalty abatement letter includes a structured introduction stating your request, followed by a clear explanation of the reason for the abatement. It’s essential to mention any relevant tax information or previous compliance. Utilizing a New Jersey Sample Letter for Return of Late Payment and Denial of Discount can provide insight into how to format and present your request effectively.

Writing a penalty waiver letter involves a clear and direct approach. First, address the letter to the appropriate authority and state your request clearly. Include any supporting details or reasons, and you might find a New Jersey Sample Letter for Return of Late Payment and Denial of Discount to be a valuable reference to structure your letter accurately.

To write a letter asking for a penalty waiver, start with a polite introduction, followed by the purpose of your letter. Describe the reason for your request, ensuring to include any supporting evidence. Consider using a New Jersey Sample Letter for Return of Late Payment and Denial of Discount to help you format your request appropriately.

time penalty abatement in New Jersey refers to a relief option allowing taxpayers to request forgiveness of penalties for certain tax liabilities under specific circumstances. This option is typically available for firsttime offenders or individuals with a good compliance history. You can obtain further guidance through a New Jersey Sample Letter for Return of Late Payment and Denial of Discount.