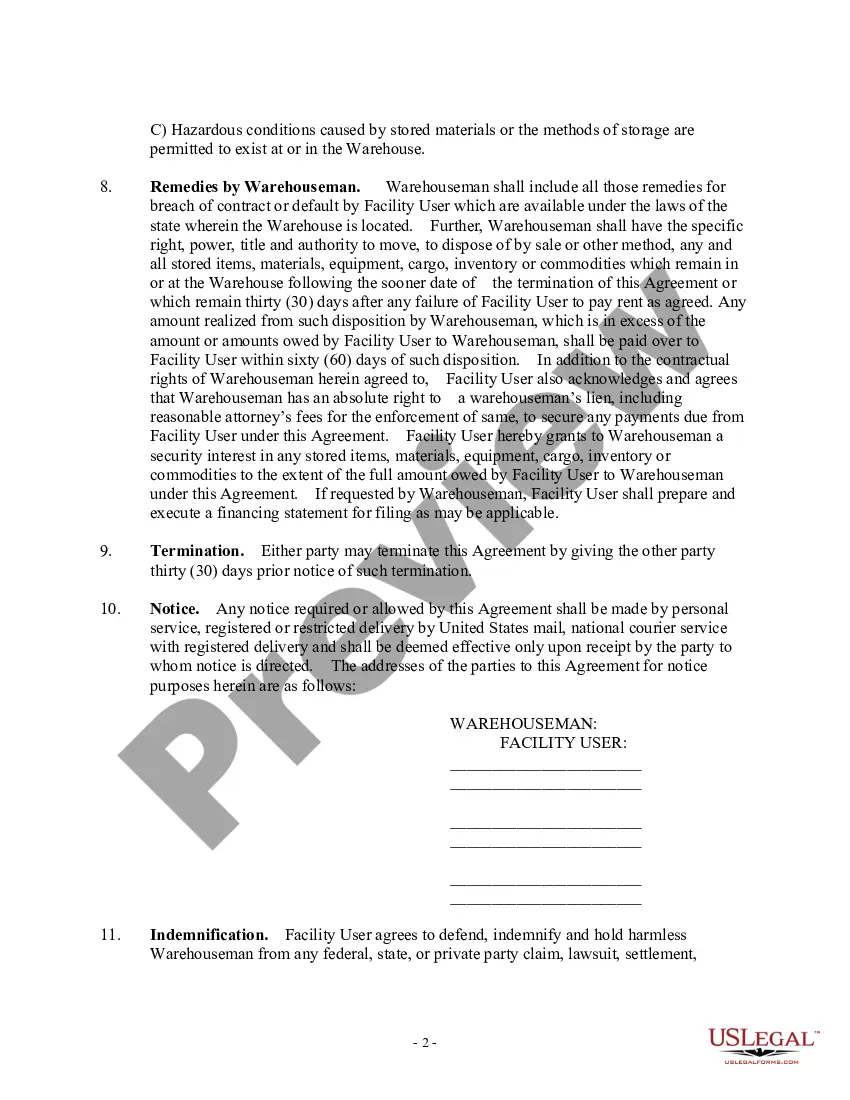

New Jersey Warehouse and Storage Agreement

Description

How to fill out Warehouse And Storage Agreement?

You can allocate time online exploring for the valid document template that complies with the state and federal regulations you need.

US Legal Forms provides thousands of valid forms that are assessed by experts.

You can directly acquire or print the New Jersey Warehouse and Storage Agreement from your service.

If available, use the Review button to navigate through the document template as well.

- If you already hold a US Legal Forms account, you can sign in and click on the Obtain button.

- Then, you can complete, modify, print, or sign the New Jersey Warehouse and Storage Agreement.

- Every valid document template you purchase is your property indefinitely.

- To obtain another copy of any acquired form, visit the My documents tab and click on the appropriate button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the county/city of your choice.

- Check the form details to confirm you have chosen the right one.

Form popularity

FAQ

Abandoning a storage unit can have negative repercussions for your credit score. Storage facilities may report unpaid debts to credit bureaus if you fail to settle your New Jersey Warehouse and Storage Agreement. To protect your credit, it's advisable to communicate with the facility and address any payment issues before considering abandonment.

Exiting a storage unit contract typically requires adherence to the terms outlined in your New Jersey Warehouse and Storage Agreement. You may need to give advance notice and settle any outstanding payments. If you face difficulties, consider reaching out to your storage provider for guidance on managing your lease termination smoothly.

Starting a storage facility business involves thorough planning and understanding market demand. You need to obtain the appropriate licenses, find a suitable location, and draft a solid business plan. Additionally, familiarize yourself with New Jersey Warehouse and Storage Agreements to ensure compliance and attract customers effectively.

Yes, storage facilities usually require a contract when you rent a unit. This New Jersey Warehouse and Storage Agreement outlines terms, payment details, and rules for using the unit. Ensure you read through the agreement carefully to avoid surprises and fully understand your rights and responsibilities as a tenant.

Stopping payment on your storage unit without prior communication may lead to severe consequences. Most storage facilities require a written notice to terminate your New Jersey Warehouse and Storage Agreement. It's best to consult the terms of your contract and discuss your situation with the storage provider to avoid legal action or loss of personal property.

Yes, in New Jersey, storage services typically incur sales tax. According to the New Jersey Division of Taxation, charges for storage of personal property, including warehouse storage, are taxable. It's essential to review your New Jersey Warehouse and Storage Agreement to understand how taxes may apply to your specific situation.

Sales tax in New Jersey should be collected at the time of sale, which includes payments for taxable goods and services. If the New Jersey Warehouse and Storage Agreement covers any taxable items, the facility is required to collect the appropriate sales tax at the point of transaction. Keeping track of when and how to collect tax ensures compliance with state regulations.

Non-temporary storage may be subject to different tax regulations in New Jersey. If the storage is considered a long-term solution for business inventory or other taxable goods, tax obligations may arise. Ensuring compliance with the New Jersey Warehouse and Storage Agreement can help clarify these potential liabilities.

In many cases, storage fees can be viewed as rent for the space you occupy at a facility. The classification may depend on the specifics of the New Jersey Warehouse and Storage Agreement. Reviewing the agreement will clarify how the fees are categorized and any tax implications associated with them.

Certain items are exempt from sales tax in New Jersey, including most food items, clothing, and some medical equipment. However, when it comes to storage, understanding the different exemptions outlined in the New Jersey Warehouse and Storage Agreement is essential for compliance. For a detailed list of exemptions, you might want to check the New Jersey Division of Taxation website.