Indemnification is the act of making another "whole" by paying any loss another might suffer. This usually arises from a clause in a contract where a party agrees to pay for any monetary damages which arise or have arisen.

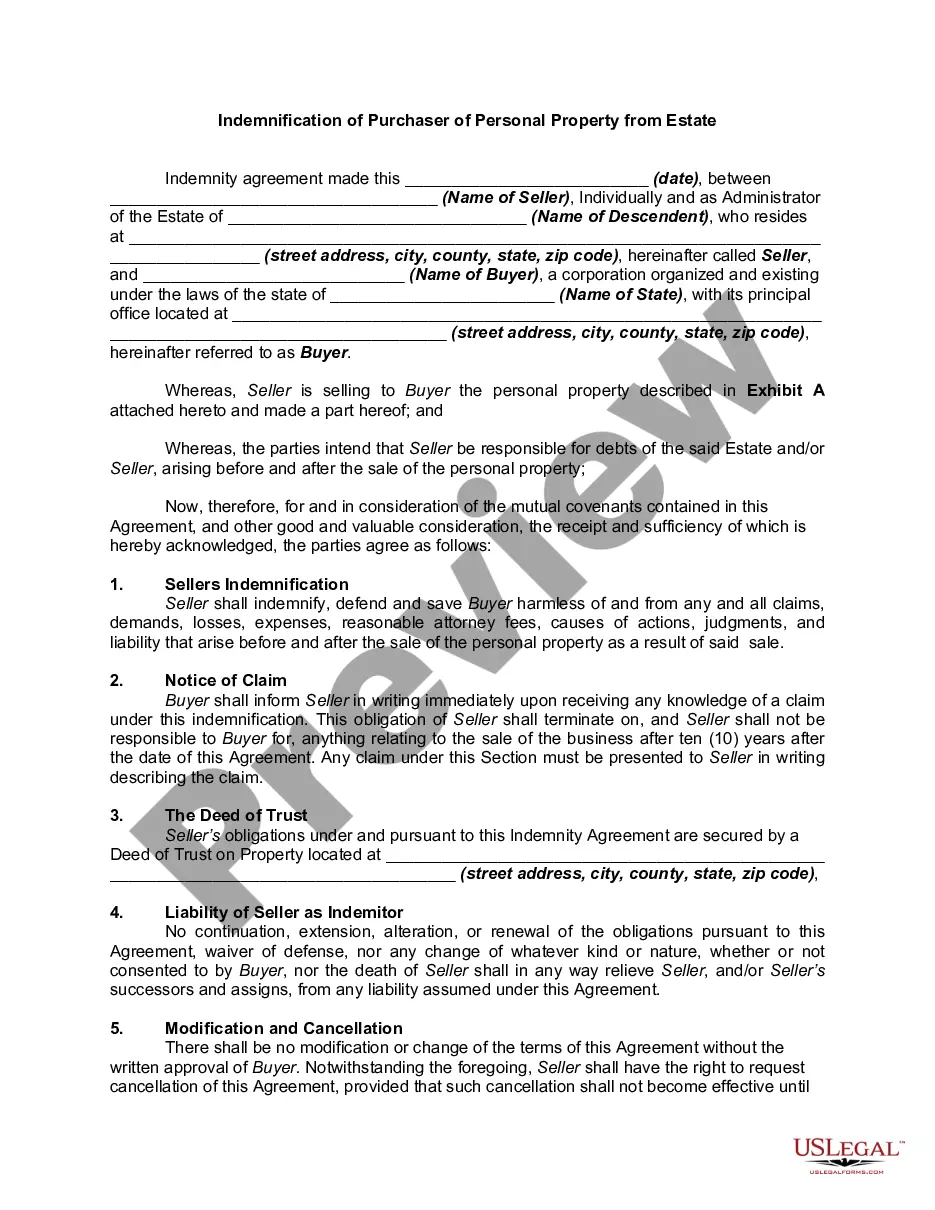

New Jersey Indemnification of Purchaser of Personal Property from Estate

Description

How to fill out Indemnification Of Purchaser Of Personal Property From Estate?

If you need to finalize, obtain, or print authorized document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search feature to locate the documents you require.

Various templates for business and personal purposes are organized by categories and keywords, or by state.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

Step 6. Select the format of the legal form and download it to your device. Step 7. Fill out, modify, and print or sign the New Jersey Indemnification of Purchaser of Personal Property from Estate. Every legal form template you acquire is yours permanently. You can access every form you downloaded in your account. Visit the My documents section and choose a form to print or download again. Stay competitive and download, and print the New Jersey Indemnification of Purchaser of Personal Property from Estate with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- Utilize US Legal Forms to find the New Jersey Indemnification of Purchaser of Personal Property from Estate with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to obtain the New Jersey Indemnification of Purchaser of Personal Property from Estate.

- You can also access forms you have previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

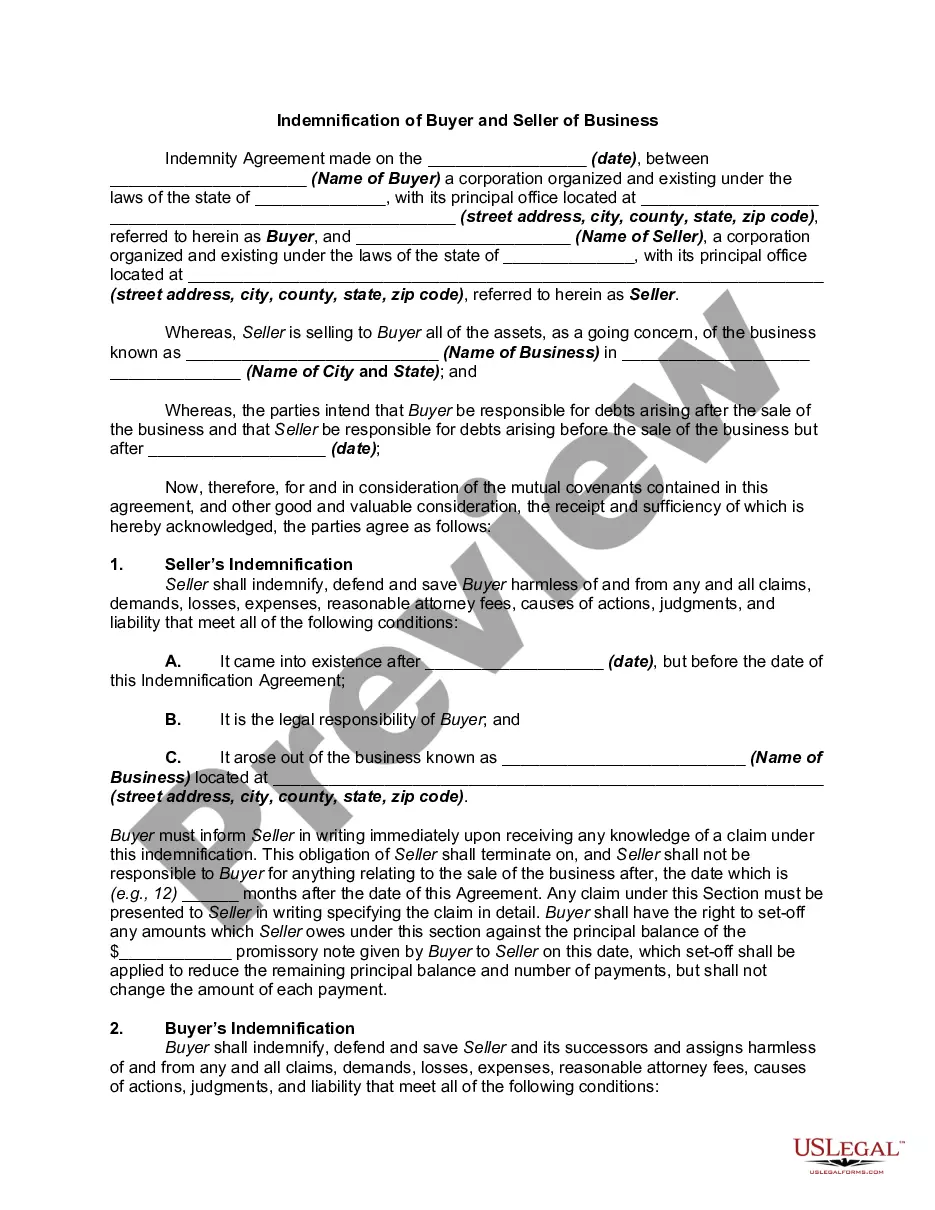

- Step 2. Use the Preview option to review the form’s content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the page to find alternative versions of the legal form template.

- Step 4. After finding the form you need, click the Download Now button. Choose your preferred payment plan and enter your details to register for an account.

Form popularity

FAQ

To transfer a deed of a house after death in New Jersey, you'll need to start by gathering necessary documents, including the death certificate and a completed L9 form. The New Jersey indemnification of purchaser of personal property from estate may play a role, especially if the property is part of the estate's assets. Once you have all the required documents, you can file the deed transfer with the county clerk's office. It's often wise to consult with a real estate attorney to ensure compliance with all legal requirements.

To avoid inheritance tax in New Jersey, you should first explore exemptions that apply to certain assets and beneficiaries. Specifically, spouses, children, and other close relatives often qualify for significant exemptions. Additionally, understanding the New Jersey indemnification of purchaser of personal property from estate can aid in structuring your transactions effectively. Consulting a legal expert can provide tailored strategies to minimize your tax liability.

A L9 form in New Jersey is an essential document used in the process of indemnification for individuals purchasing personal property from an estate. It pertains specifically to the requirement of a tax clearance certificate when transferring estate assets. By completing the L9 form, you help ensure that any inheritance taxes have been settled, which simplifies the New Jersey indemnification of purchaser of personal property from estate. Make sure to obtain the L9 form from the New Jersey Division of Taxation.

In New Jersey, several assets are exempt from probate, such as life insurance policies with named beneficiaries and retirement accounts. Additionally, joint tenancy properties and assets held within specific trusts also bypass this process. By leveraging the New Jersey Indemnification of Purchaser of Personal Property from Estate, individuals can better understand how these exemptions play a role in asset distribution, allowing for seamless transitions.

The NJ 01 form is a New Jersey distribution form specifically used for reporting the inheritance of assets. This form is essential for individuals receiving property from an estate, as it helps define the beneficiaries involved in the inheritance process. With an understanding of the New Jersey Indemnification of Purchaser of Personal Property from Estate, users can navigate the implications of this form with greater confidence to ensure their rights are protected.

In New Jersey, an estate generally must be valued at over $50,000 for it to enter the probate process. This threshold applies to assets not held in specific non-probate designations. Understanding the implications of the New Jersey Indemnification of Purchaser of Personal Property from Estate can provide further insight into asset values and the estate's management to ensure compliance.

In New Jersey, an estate can remain open as long as necessary to settle obligations or distribute assets, but it is typically advisable to close it within a year. However, complex situations may require more time, particularly if challenges arise. The New Jersey Indemnification of Purchaser of Personal Property from Estate may be relevant when administering the estate, helping clarify the rights of purchasers involved in the estate process.

Non-probate assets in New Jersey include any property that is not subject to the probate process upon death. Common examples are bank accounts with payable-on-death designations, life insurance policies with named beneficiaries, and assets within a trust. Understanding non-probate assets is essential for estate planning, especially concerning the New Jersey Indemnification of Purchaser of Personal Property from Estate, which can clarify how these assets can be protected and transferred.

In New Jersey, certain assets do not go through probate, including accounts that have designated beneficiaries, joint ownership properties, and assets held in trusts. Life insurance policies and retirement accounts often fall under this category as well. By being aware of the New Jersey Indemnification of Purchaser of Personal Property from Estate, individuals can effectively manage these non-probate assets, ensuring a smoother transfer of property.

To avoid probate in New Jersey, you can utilize several strategies. One effective option is to create a living trust, which allows you to transfer your assets into the trust while you are alive. Additionally, joint ownership of property or naming beneficiaries on financial accounts can help bypass probate. Understanding the New Jersey Indemnification of Purchaser of Personal Property from Estate can also offer pathways to simplify the transfer process and protect your assets.