New Jersey Revocable Trust for Married Couple

Description

How to fill out Revocable Trust For Married Couple?

Have you ever been in a situation where you need paperwork for either professional or personal reasons almost daily.

There are numerous legal document templates available online, but finding ones you can trust isn't straightforward.

US Legal Forms provides thousands of form templates, such as the New Jersey Revocable Trust for Married Couple, which are designed to comply with state and federal regulations.

Once you find the appropriate form, click on Buy now.

Choose the pricing plan that fits your needs, fill out the required information to make your payment, and complete the transaction with your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New Jersey Revocable Trust for Married Couple template.

- If you don't have an account and want to start using US Legal Forms, follow these steps.

- Locate the form you need and make sure it corresponds to your specific city/state.

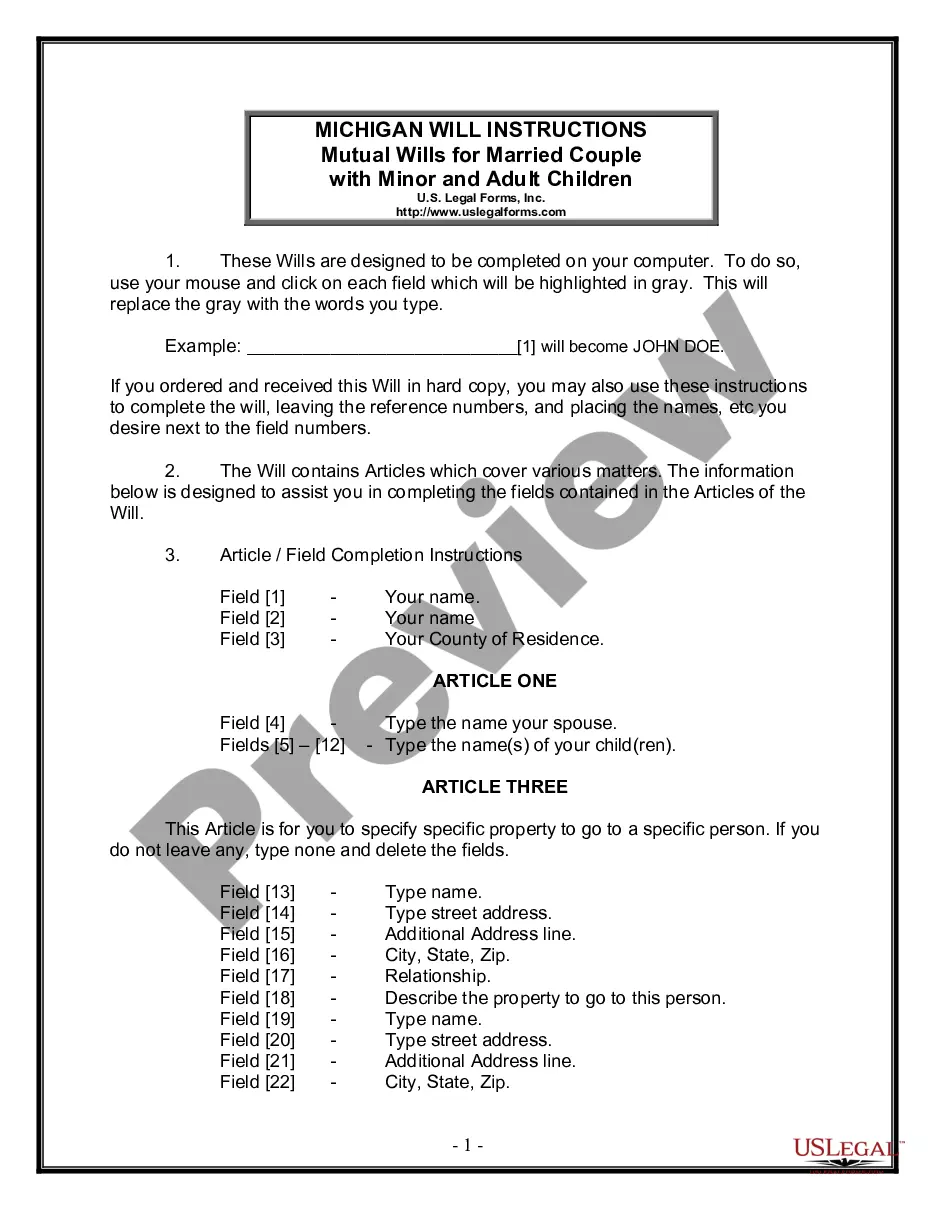

- Use the Preview option to examine the form.

- Review the details to ensure you have selected the correct form.

- If the form isn’t what you require, use the Lookup box to find a form that matches your needs and specifications.

Form popularity

FAQ

Having a New Jersey Revocable Trust for Married Couple offers significant benefits. This type of trust allows you to manage your assets during your lifetime and distribute them according to your wishes after your passing. Additionally, it helps avoid probate, saving time and costs for your family. If you want to ensure that your assets are handled smoothly, consider creating a properly structured revocable trust with assistance from platforms like uslegalforms.

New Jersey has specific rules governing the establishment and operation of trusts. For a New Jersey Revocable Trust for Married Couple, it is essential to have a clear trust document that complies with state laws. Regularly review and update the trust as needed to reflect changes in your circumstances or the law to ensure it remains valid and effective.

To set up a New Jersey Revocable Trust for Married Couple, begin with drafting a comprehensive trust agreement that outlines your intentions. Ensure that you identify the trustee who will manage the trust and specify the beneficiaries. Utilize resources like USLegalForms to access templates and guidance, making the setup process more manageable.

A New Jersey Revocable Trust for Married Couple offers numerous benefits, including avoiding probate, ensuring privacy, and simplifying estate management. It allows you to maintain control over your assets during your lifetime and aligns your estate plan with your wishes. This type of trust can streamline the transfer of assets to beneficiaries seamlessly.

The main difference lies in control and flexibility. A New Jersey Revocable Trust for Married Couple can be altered or revoked at any time by the creators. In contrast, an irrevocable trust cannot be changed easily, which means you lose control over the assets placed in it. Understanding these distinctions is crucial in deciding which trust aligns with your goals.

One common mistake parents make when setting up a trust fund is not involving their children in the discussion. This omission can lead to confusion and disputes later on. It is vital to communicate the purpose and details of the New Jersey Revocable Trust for Married Couple to avoid misunderstandings. Educating your children fosters transparency and trust.

Setting up a New Jersey Revocable Trust for Married Couple involves several steps. Start by identifying your assets and beneficiaries. Then, draft the trust document, clearly outlining your wishes and appointing a trustee. Finally, transfer the assets into the trust to ensure they are managed according to your preferences.

The most popular form of marital trust is typically the irrevocable marital trust, but many couples thrive with a New Jersey Revocable Trust for Married Couple. This type of trust allows for flexibility and can be adjusted as family needs evolve. Couples appreciate the ability to manage their financial futures without relinquishing control of their assets during their lifetimes. An estate planning professional can help couples determine what works best for their unique situation.

The disadvantages of a joint trust can present challenges, especially in unforeseen circumstances. If one spouse becomes incapacitated, the other may face difficulties managing the trust if specific provisions are not established. Additionally, joint trusts can complicate the estate settlement process, particularly if children from previous relationships are involved. It is often beneficial to discuss these concerns with a professional when considering a New Jersey Revocable Trust for Married Couple.

Remarried couples often benefit from a New Jersey Revocable Trust for Married Couple, which can address the unique challenges they face. This type of trust allows for clear instructions about asset distribution, which can help minimize conflicts among children from previous marriages. Creating specific guidelines can protect each spouse’s interests while ensuring that the trust serves their family dynamics effectively. Consulting with experts can provide tailored advice for your situation.