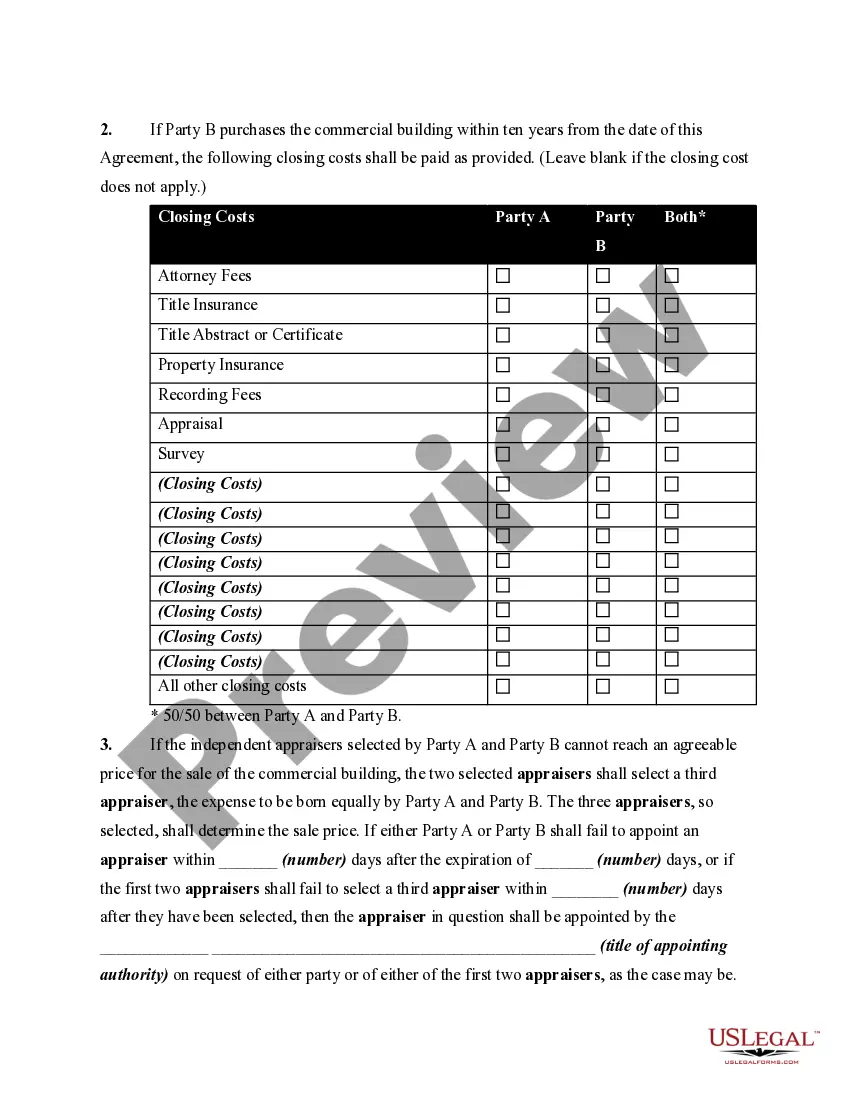

This Agreement between Partners for Future Sale of Commercial Building is used to provide for the future sale of a commercial building by giving one party the opportunity to purchase the commercial building any time in the next ten years from the date of this agreement, or by both parties agreeing to sell the commercial building outright to a third party and equally splitting the proceeds at the end of the ten-year period.

New Jersey Agreement between Partners for Future Sale of Commercial Building

Description

How to fill out Agreement Between Partners For Future Sale Of Commercial Building?

It is feasible to spend time online searching for the legal document template that satisfies the state and federal criteria you will require.

US Legal Forms offers thousands of legal forms that can be reviewed by experts.

You can download or print the New Jersey Agreement between Partners for Future Sale of Commercial Building from the service.

Read the form details to confirm you have chosen the right type. If available, utilize the Preview button to view the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Acquire button.

- After that, you can complete, edit, print, or sign the New Jersey Agreement between Partners for Future Sale of Commercial Building.

- Every legal document template you buy is yours for life.

- To obtain an additional copy of the purchased form, visit the My documents section and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your state/city of choice.

Form popularity

FAQ

Any partnership that conducts business in New Jersey must file a NJ partnership tax return if it earns income. This includes entities formed under a New Jersey Agreement between Partners for Future Sale of Commercial Building. By filing the tax return, partnerships ensure compliance and facilitate the correct allocation of income to each partner.

In New Jersey, partnerships are required to e-file their tax returns if they meet certain criteria, such as having extensive income or multiple partners. This mandate simplifies the filing process and ensures faster processing of returns. Utilizing a New Jersey Agreement between Partners for Future Sale of Commercial Building can streamline your partnership’s filing obligations and compliance with the e-file mandate.

Schedule J on the NJ-1065 form helps allocate income and loss among partners. This schedule outlines each partner's share of income, deductions, and credits based on the partnership's agreement. If you have a New Jersey Agreement between Partners for Future Sale of Commercial Building, this schedule will reflect the terms agreed upon by all parties.

Any individuals or entities wishing to collaborate for a profit can form a partnership in New Jersey. There is no specific legal requirement to create a formal agreement, but a New Jersey Agreement between Partners for Future Sale of Commercial Building can help define each partner's roles and responsibilities, reducing potential conflicts.

All partnerships operating in New Jersey must file a NJ partnership return if they have any income. This requirement applies even if the partnership does not owe federal income tax. A New Jersey Agreement between Partners for Future Sale of Commercial Building can clarify the partnership’s obligations and outline responsibilities for filing this return.

In New Jersey, any partnership that earns income or has revenues is generally required to file a partnership return. This includes partnerships formed under a New Jersey Agreement between Partners for Future Sale of Commercial Building. All partners must report their share of the partnership's income on their personal tax returns, ensuring compliance with state tax laws.

An agreement to sell in the future is a commitment between parties to complete a sale at a later date. In a New Jersey Agreement between Partners for Future Sale of Commercial Building, this can outline conditions under which the sale will occur, such as market conditions or financial milestones. Such agreements should be detailed to prevent misunderstandings later.

Yes, a land contract can be executed for commercial property in New Jersey. This agreement allows for flexible purchasing arrangements, beneficial for both sellers and buyers. However, as with any real estate transaction, ensure that the terms are clearly defined, especially in the context of a New Jersey Agreement between Partners for Future Sale of Commercial Building.

You can write your own land contract, but it is crucial to ensure that it complies with New Jersey laws. A DIY contract could save costs, but using a professional service, like USLegalForms, may provide you with templates and guidance that ensure your agreement aligns with a New Jersey Agreement between Partners for Future Sale of Commercial Building.

Yes, land can be considered commercial property if it is used for business purposes. In the context of a New Jersey Agreement between Partners for Future Sale of Commercial Building, the classification of the land affects zoning regulations, tax obligations, and property management strategies. Understanding this categorization is vital for making informed decisions about the property.