Have you been within a place that you require paperwork for either business or specific purposes just about every day? There are a lot of authorized record layouts accessible on the Internet, but locating versions you can depend on is not simple. US Legal Forms gives thousands of form layouts, like the New Jersey Answer of Defendants to Complaint by Debtor For Harassment in Attempting to Collect a Debt, Using Harassing and Malicious Information, and Violating the Federal Fair Debt Collection Practices Act, which are written to fulfill state and federal specifications.

In case you are already informed about US Legal Forms web site and have a merchant account, just log in. After that, you are able to obtain the New Jersey Answer of Defendants to Complaint by Debtor For Harassment in Attempting to Collect a Debt, Using Harassing and Malicious Information, and Violating the Federal Fair Debt Collection Practices Act design.

If you do not offer an accounts and need to begin using US Legal Forms, abide by these steps:

- Find the form you will need and make sure it is for your correct area/area.

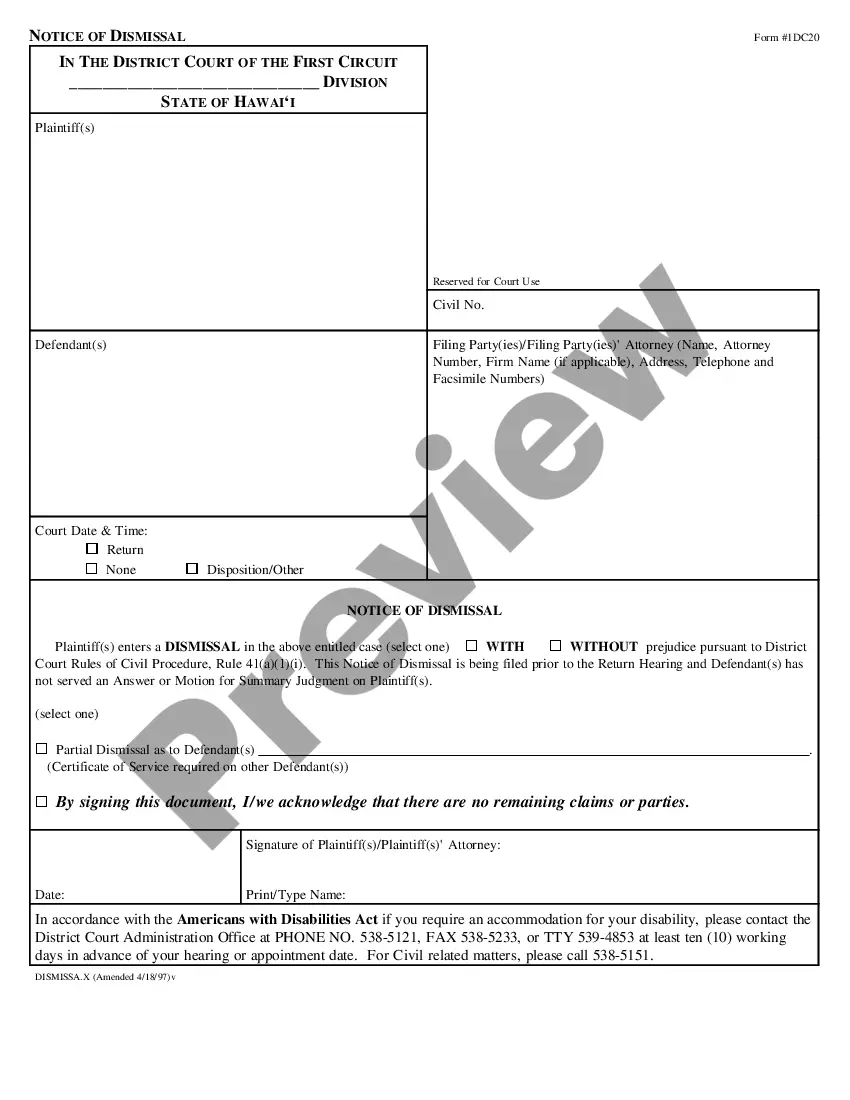

- Use the Review button to review the form.

- See the description to ensure that you have selected the proper form.

- In case the form is not what you are searching for, make use of the Research field to discover the form that meets your needs and specifications.

- When you discover the correct form, just click Buy now.

- Choose the rates strategy you want, fill in the necessary information and facts to make your account, and pay for the order with your PayPal or Visa or Mastercard.

- Pick a convenient paper format and obtain your copy.

Discover every one of the record layouts you may have bought in the My Forms menu. You can obtain a further copy of New Jersey Answer of Defendants to Complaint by Debtor For Harassment in Attempting to Collect a Debt, Using Harassing and Malicious Information, and Violating the Federal Fair Debt Collection Practices Act any time, if required. Just go through the required form to obtain or printing the record design.

Use US Legal Forms, by far the most substantial variety of authorized kinds, to conserve time as well as steer clear of errors. The services gives professionally created authorized record layouts that can be used for a variety of purposes. Create a merchant account on US Legal Forms and begin producing your daily life easier.