New Jersey Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check)

Description

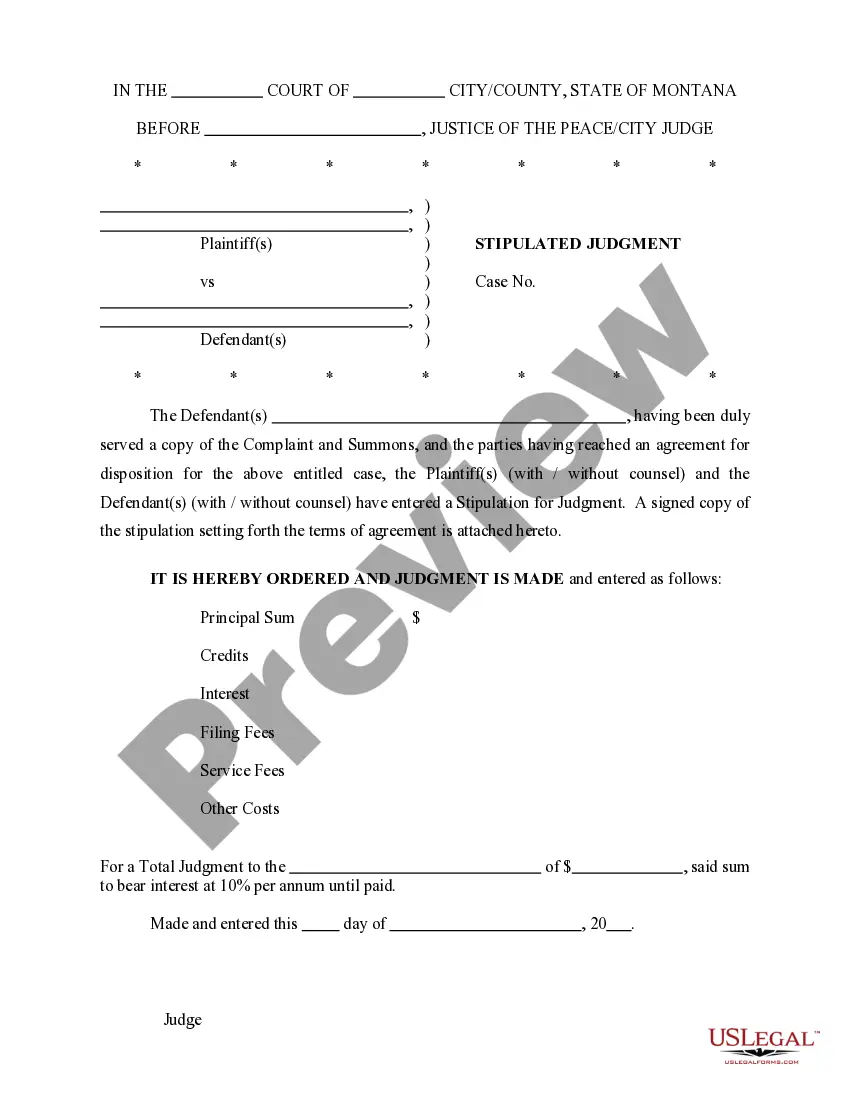

How to fill out Complaint Against Drawer Of Check That Was Dishonored Due To Insufficient Funds (Bad Check)?

Are you currently within a situation the place you need to have documents for possibly enterprise or personal functions just about every day time? There are tons of legal document templates available online, but finding types you can trust isn`t effortless. US Legal Forms gives thousands of form templates, like the New Jersey Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check), that are written to satisfy state and federal demands.

Should you be previously informed about US Legal Forms internet site and also have a free account, simply log in. Following that, it is possible to obtain the New Jersey Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check) format.

If you do not offer an bank account and want to begin to use US Legal Forms, adopt these measures:

- Obtain the form you want and make sure it is for your appropriate town/state.

- Utilize the Review option to examine the shape.

- See the information to ensure that you have selected the proper form.

- In the event the form isn`t what you`re seeking, make use of the Lookup discipline to discover the form that fits your needs and demands.

- Whenever you discover the appropriate form, simply click Buy now.

- Select the costs strategy you would like, fill in the specified information and facts to produce your bank account, and pay money for your order making use of your PayPal or bank card.

- Select a practical paper structure and obtain your version.

Discover all the document templates you have bought in the My Forms menu. You can obtain a further version of New Jersey Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check) at any time, if required. Just go through the necessary form to obtain or print out the document format.

Use US Legal Forms, probably the most extensive selection of legal forms, to save lots of efforts and steer clear of mistakes. The assistance gives skillfully made legal document templates that you can use for a selection of functions. Generate a free account on US Legal Forms and start producing your way of life easier.

Form popularity

FAQ

Under N.J.S.A. 2C:21-5, a person who is caught issuing or passing a check or similar sight order for the payment of money while knowing that it will not be honored by the drawee/bank, then he/she can be convicted of issuing or passing a bad check in NJ.

Cheque bounce is a criminal offence in India, covered under Section 138 of the Negotiable Instruments Act of 1881. So, if a complaint is filed in a court and, if found guilty, the defaulter can be punished with a prison term of two years and/or a fine, which can be as high as twice the cheque amount.

The bounced check will be returned to you, and you'll likely be subject to an overdraft fee or a nonsufficient funds fee. Is it illegal to bounce a check? It is a crime to knowingly write a check that will bounce. You could be charged with a misdemeanor or a felony for writing bad checks.

Knowingly writing a bad check is an act of fraud and it's punishable by law. Criminal penalties for people who tender checks knowing that there are insufficient funds in their accounts can vary by state. Some states require an intent to commit fraud.

Under California Penal Code Section 476a, the crime of writing a bad check while aware of insufficient funds with intent to defraud is punishable as a misdemeanor if the total amount of the checks written does not exceed $950.

The payer may be prosecuted for issuing a cheque against an account with insufficient funds. The payee may choose to prosecute the payer or allow the payer to re-issue a cheque within three months. The payer may end up in jail for up to two years for issuing a dishonoured cheque.

When you cash or deposit a check and there's not enough funds to cover it in the account it's drawn on, this is also considered non-sufficient funds (NSF). When a check is returned for NSF in this manner, the check is generally returned back to you. This allows you to redeposit the check at a later time, if available.

When there are insufficient funds in an account, and a bank decides to bounce a check, it charges the account holder an NSF fee. If the bank accepts the check, but it makes the account negative, the bank charges an overdraft fee. If the account stays negative, the bank may charge an extended overdraft fee.