New Jersey Checklist for Remedying Identity Theft of Deceased Persons

Description

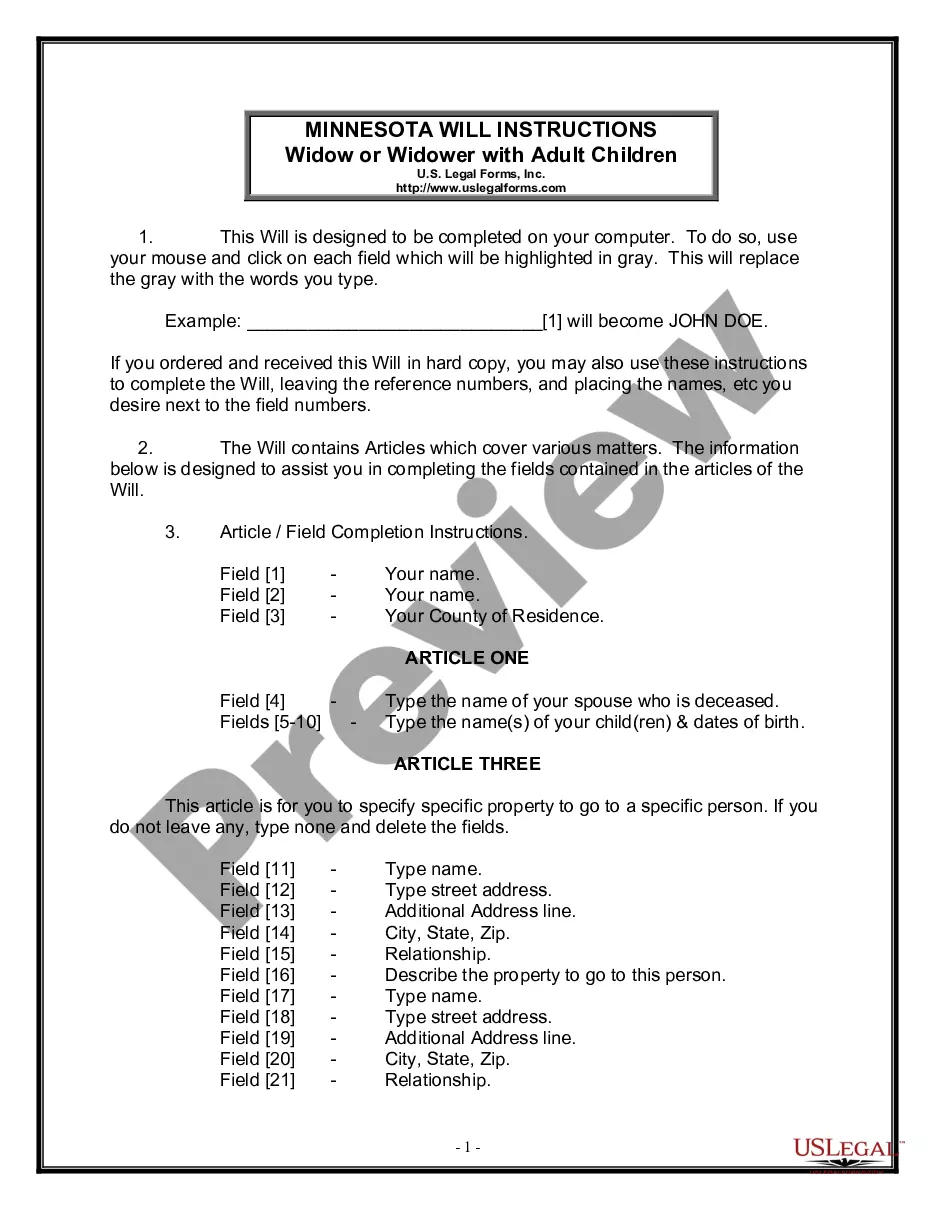

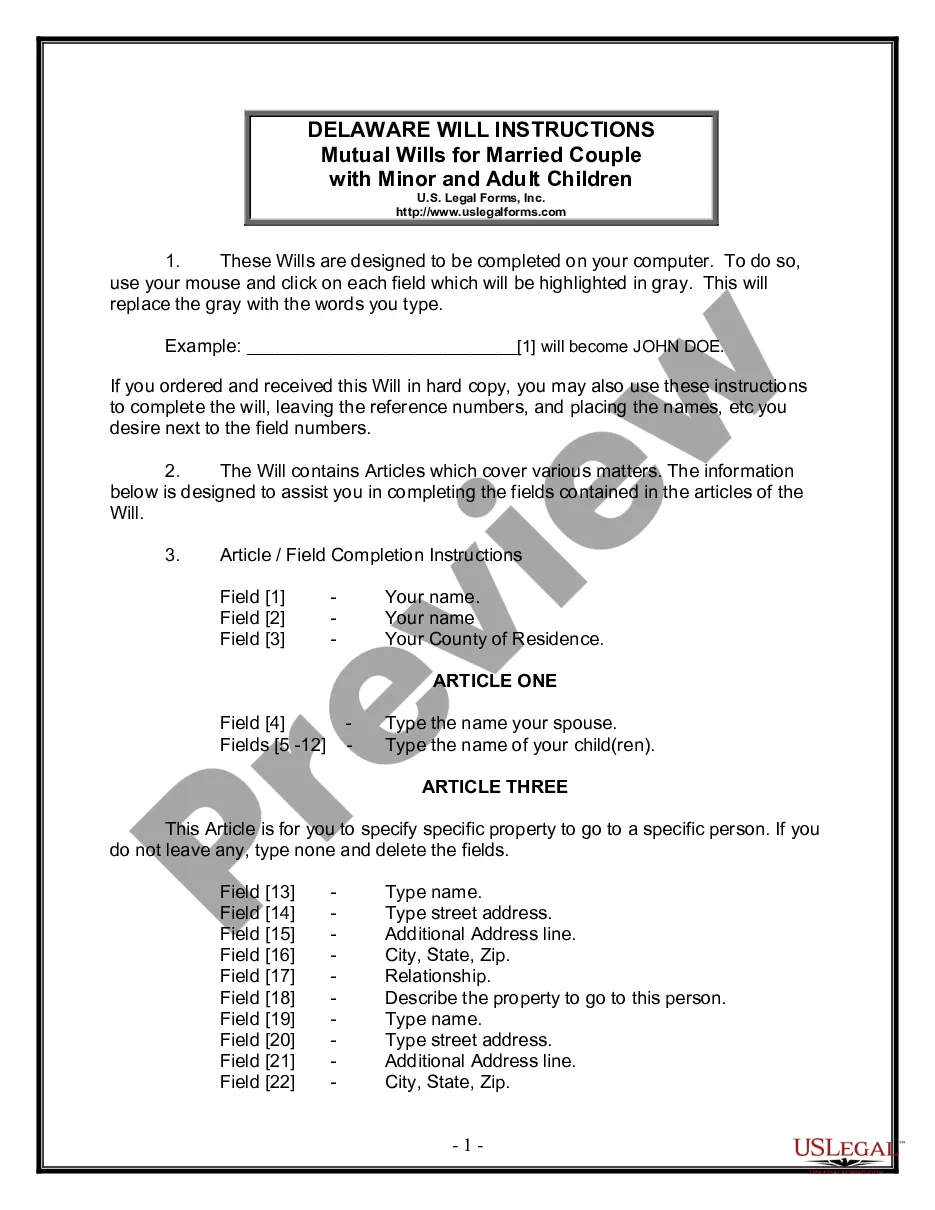

How to fill out Checklist For Remedying Identity Theft Of Deceased Persons?

Selecting the optimal legal document web template can be challenging. Indeed, there are numerous designs accessible on the web, but how can you acquire the legal type you require.

Use the US Legal Forms platform. The service offers a vast array of templates, including the New Jersey Checklist for Addressing Identity Theft of Deceased Individuals, suitable for both business and personal purposes. All forms are vetted by experts and comply with state and federal standards.

If you are already registered, Log In to your account and click the Download button to retrieve the New Jersey Checklist for Addressing Identity Theft of Deceased Individuals. Utilize your account to access the legal forms you have previously purchased. Navigate to the My documents section of your account to obtain another copy of the document you need.

Complete, modify, print, and sign the received New Jersey Checklist for Addressing Identity Theft of Deceased Individuals. US Legal Forms is the largest collection of legal forms where you can find various document templates. Utilize the service to download correctly crafted paperwork that adheres to state regulations.

- If you are a new user of US Legal Forms, here are simple guidelines to follow.

- First, ensure you have selected the correct form for your city/region. You can view the form using the Review button and read the form description to confirm it is suitable for you.

- If the form does not fulfill your requirements, use the Search field to find the appropriate form.

- Once you are confident that the form is suitable, click the Purchase now button to acquire the form.

- Select the payment plan you need and enter the required information. Create your account and complete the transaction using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

Form popularity

FAQ

Steps for Victims of Identity Theft or Fraud Place a fraud alert on your credit report. Close out accounts that have been tampered with or opened fraudulently. Report the identity theft to the Federal Trade Commission. File a report with your local police department.

Here are the most common dangers of identity theft: Fraudsters can open new accounts, credit cards, and loans in your name. You can lose your health care benefits (i.e., medical identity theft). Hackers can ?own? your email and other accounts (account takeovers). You'll have to repair your credit score.

Identity theft can have serious consequences for you and your family. It can negatively affect your credit, get you sued for debts that are not yours, result in incorrect and potentially health-threatening information being added to your medical records, and may even get you arrested.

Here are some steps you can take to prevent identity theft after someone you care about has passed away. Be mindful about expressions of grief online. Ensure social media accounts are properly shut down. Contact financial institutions and credit bureaus. Notify the federal government of the death.

Fines are a common punishment for identity theft and are commensurate with the charges levied (whether a misdemeanor or felony). Restitution: Identity thieves can be ordered to compensate a victim for financial losses, including lost wages, legal fees and even damages from emotional distress.

They may face denials of loans and mortgages, and be refused employment. They may also be unable to open a bank account, and may need to spend months or years attempting to resolve economic mistakes and issues. Identity theft can also have potentially life-threatening consequences.

Some victims can lose the ability to function and cope with everyday activities. They may be severely depressed ? some symptoms are exhaustion, overeating, anxiety, drinking, forgetfulness, or an unwillingness to leave home or their bed.

Identity theft can victimize the dead. An identity thief's use of a deceased person's Social Security number may create problems for family members. This type of identity theft also victimizes merchants, banks, and other businesses that provide goods and services to the thief.