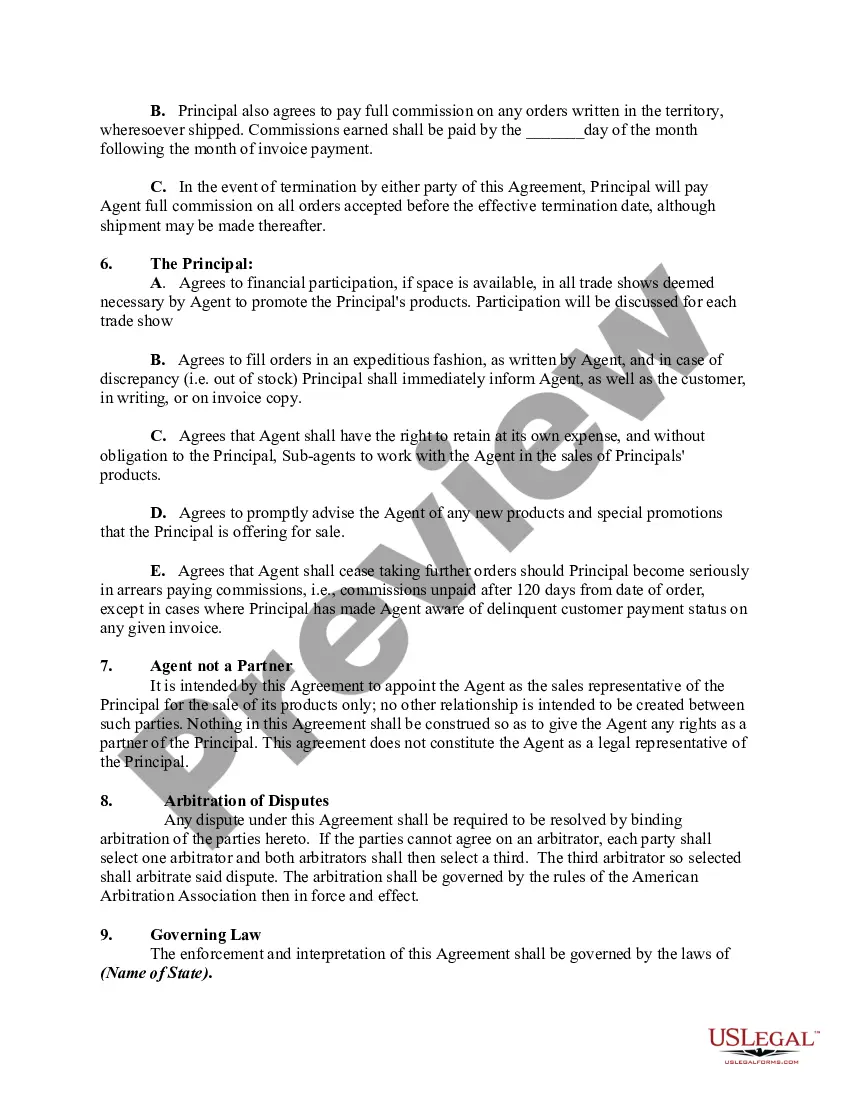

New Jersey Agreement between Sales Agent and Manufacturer - Distributor

Description

How to fill out Agreement Between Sales Agent And Manufacturer - Distributor?

You can spend hours on the web trying to locate the correct legal format that satisfies the state and federal regulations you need.

US Legal Forms provides thousands of legal templates that are reviewed by professionals.

You can conveniently obtain or create the New Jersey Agreement between Sales Agent and Manufacturer - Distributor through our service.

If you want to find another version of the template, use the Search field to locate the format that meets your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and click the Download option.

- Subsequently, you can complete, edit, print, or sign the New Jersey Agreement between Sales Agent and Manufacturer - Distributor.

- Each legal format you purchase is yours indefinitely.

- To get an additional copy of a purchased template, go to the My documents section and click the appropriate link.

- If you are using the US Legal Forms website for the first time, follow the simple steps below.

- First, ensure that you have selected the correct format for your state/city of choice. Refer to the template description to confirm you have selected the right template.

- If available, use the Preview option to review the format as well.

Form popularity

FAQ

To write a sales commission agreement, specify the commission rate, payment frequency, and duties of the sales agent. Ensure the terms are consistent with the New Jersey Agreement between Sales Agent and Manufacturer - Distributor for smooth operations. Document everything clearly to avoid misunderstandings in the future.

Creating a distribution agreement involves drafting a document that outlines the roles of the distributor and manufacturer. Include crucial elements like payment terms, delivery schedules, and termination conditions, all in accordance with the New Jersey Agreement between Sales Agent and Manufacturer - Distributor. Utilize templates from platforms like UsLegalForms for added guidance.

To write an agreement between two companies, clearly define the parties involved, specified terms, and conditions. Include key details such as obligations, payment terms, and confidentiality clauses, ensuring alignment with the New Jersey Agreement between Sales Agent and Manufacturer - Distributor. Proofread the document to ensure clarity and comprehension before finalizing.

When writing a distribution letter, begin with a clear subject line. In the body, introduce your intent, specify the products or services involved, and reference any relevant agreements, such as the New Jersey Agreement between Sales Agent and Manufacturer - Distributor. Conclude with a call to action and your contact information.

To write a distribution plan, start by defining your target market and distribution channels. Next, outline the roles and responsibilities of each party involved in the New Jersey Agreement between Sales Agent and Manufacturer - Distributor. Finally, set measurable goals, timelines, and performance metrics to evaluate success.

Filling out the NJ W4 form involves providing personal information like your name, Social Security Number, and filing status. Ensure you indicate any additional adjustments if they apply, particularly if your income relates to a New Jersey Agreement between Sales Agent and Manufacturer - Distributor. Prompt accuracy will help in proper tax withholding from your paycheck, aligning with your tax obligations.

In New Jersey, professional services are generally not subject to sales tax. This includes services such as legal, engineering, and consulting, which may be integral to the New Jersey Agreement between Sales Agent and Manufacturer - Distributor. However, it’s crucial to review specific service categories, as certain transactions might fall under taxable regulations.

The NJ ST-4 form is utilized to claim an exemption from sales tax on purchases related to specific business activities, including those in a New Jersey Agreement between Sales Agent and Manufacturer - Distributor. By filling out this form accurately, businesses can ensure they are not overpaying taxes on qualifying purchases. It is important to be familiar with the details required to complete this form correctly.

To obtain a seller's permit in New Jersey, you must register your business with the state. This includes providing information about your business structure and activities related to the New Jersey Agreement between Sales Agent and Manufacturer - Distributor. After registration, the state will issue your seller's permit, allowing you to collect sales tax legally.

Calculating sales tax penalties and interest in New Jersey requires you to first identify the amount of tax owed. Then, penalties may apply if you're late in payment. Under the New Jersey Agreement between Sales Agent and Manufacturer - Distributor context, you can visit the NJ Division of Taxation's website for accurate formulas and guidelines to ensure compliance and avoid additional charges.