New Jersey Corporate Guaranty - General

Description

How to fill out Corporate Guaranty - General?

Are you currently in the situation where you require documents for either professional or personal purposes frequently.

There is a multitude of valid document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers a wide range of document templates, including the New Jersey Corporate Guaranty - General, designed to meet federal and state regulations.

Once you find the correct document, click on Purchase now.

Choose the pricing plan you prefer, fill out the required information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New Jersey Corporate Guaranty - General template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the document you need and ensure it is for the correct city/county.

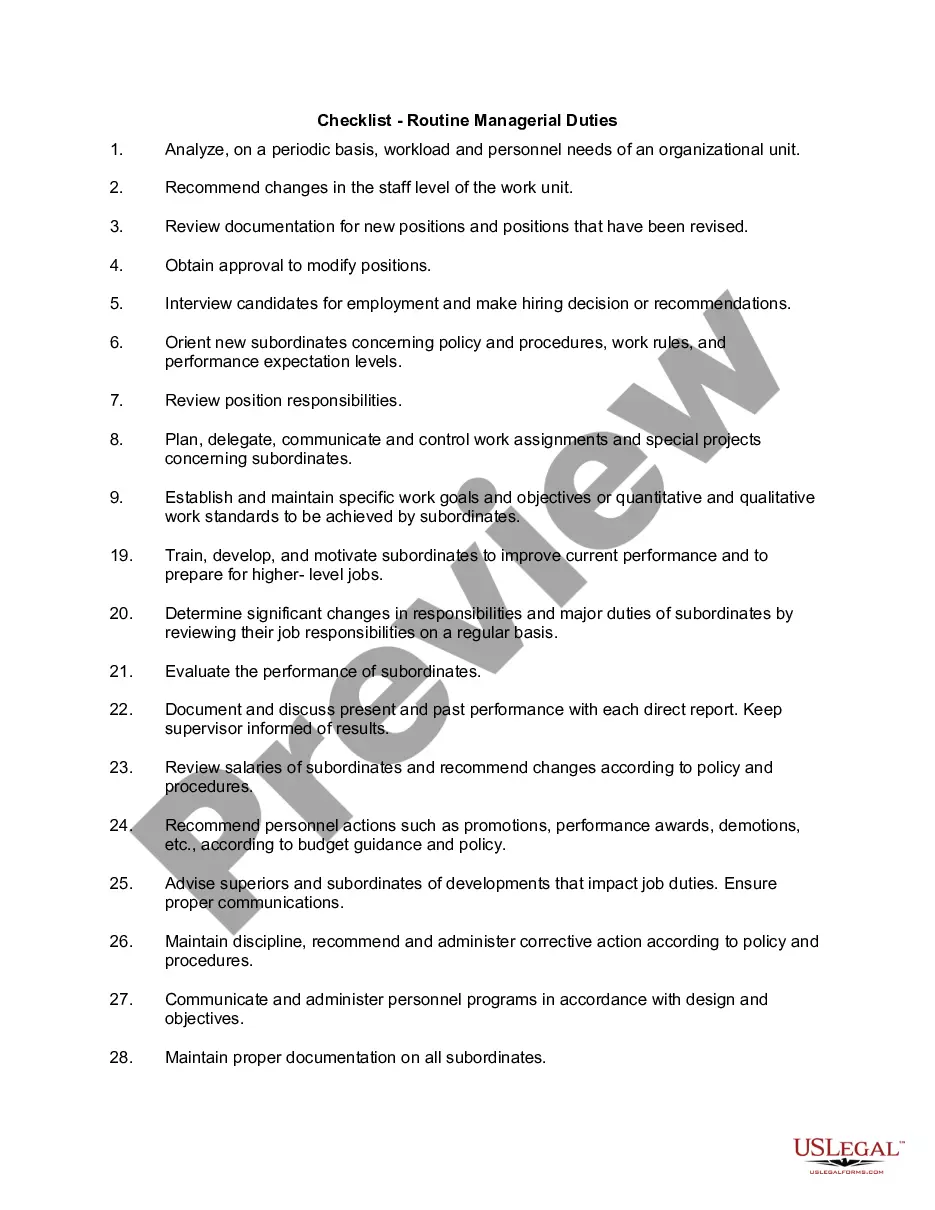

- Use the Review button to examine the form.

- Check the description to confirm you have chosen the right document.

- If the document is not what you are looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

To obtain a certificate of authority in New Jersey, you must fill out an application form and provide necessary business details. This process can typically be completed online through the New Jersey Division of Revenue's website. Ensure that you meet all requirements to speed up approval. Using platforms like US Legal Forms can help streamline this process by providing easy access to required documents and expert advice.

NJ Pliga, or the New Jersey Property Liability Insurance Guaranty Association, provides financial assistance for claims when an insured party is unable to fulfill their obligations due to insolvency. This protects consumers and boosts confidence in the state's insurance landscape. By supporting businesses with solid legal frameworks, this aligns well with the principles of the New Jersey Corporate Guaranty - General. If you're navigating the insurance landscape, US Legal Forms can help you understand your options.

A contractor's NJ certificate of authority number identifies businesses authorized to collect sales tax in New Jersey. This number is essential for contractors, as it verifies they are compliant with state tax regulations. It also helps clients confirm the legitimacy of their contractors. You can easily obtain this number when applying for your New Jersey Corporate Guaranty - General.

To obtain a New Jersey certificate of authority, you need to register your business with the New Jersey Division of Revenue and Enterprise Services. This certificate allows your business to collect sales tax in New Jersey. You can apply online via the state's official website, making it a straightforward process. Utilizing US Legal Forms can simplify your application by providing clear forms and guidance.

The New Jersey filing threshold varies based on your income and residency status. Typically, it specifies the minimum income level that obligates an individual or business to file a tax return. Being aware of this threshold is crucial when dealing with the New Jersey Corporate Guaranty - General. USLegalForms provides resources to help you determine your specific filing threshold.

A filing requirement indicates the conditions under which a taxpayer must submit forms to the state. In New Jersey, this applies to individuals and businesses that earn income or engage in certain activities. Understanding your filing requirements is key under the New Jersey Corporate Guaranty - General. Utilize platforms such as USLegalForms to navigate these obligations effectively.

The $500 dollar check program in New Jersey is subject to specific criteria set by the state. This program typically targets certain taxpayers based on their income and filing status. Stay updated on these initiatives as they may relate to the New Jersey Corporate Guaranty - General. For detailed information, consider checking reliable sources like USLegalForms.

Yes, you can paper file a New Jersey corporate tax return. However, electronic filing is preferred for faster processing and confirmation. When dealing with the New Jersey Corporate Guaranty - General, ensuring that all forms are filled correctly and submitted on time is essential. USLegalForms offers resources that make paper filing straightforward and efficient.

The New Jersey Corporate Business Tax (CBT) applies to corporations engaging in business in New Jersey. Generally, any corporation with a taxable presence must file, including foreign corporations operating within the state. Understanding the New Jersey Corporate Guaranty - General can help clarify your filing obligations. For ease and accuracy, consider platforms like USLegalForms for filing assistance.

The non-resident filing threshold for New Jersey is established based on income earned within the state. Typically, non-residents must file if they receive NJ-source income that exceeds a specific amount. If you’re navigating the New Jersey Corporate Guaranty - General, knowing this threshold is vital. Use tools like USLegalForms for assistance and clarity on your requirements.