New Jersey Executive Employee Stock Incentive Plan

Description

How to fill out Executive Employee Stock Incentive Plan?

You can spend hours online searching for the legal document template that fits the state and federal specifications you need. US Legal Forms offers thousands of legal forms that have been reviewed by professionals.

You can effortlessly download or print the New Jersey Executive Employee Stock Incentive Plan from their services.

If you already have a US Legal Forms account, you can Log In and click on the Download button. After that, you can fill out, modify, print, or sign the New Jersey Executive Employee Stock Incentive Plan. Every legal document template you obtain is yours indefinitely.

- To obtain another copy of a purchased document, visit the My documents tab and click the relevant option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions outlined below.

- Firstly, ensure you have selected the correct document template for your region/city.

- Review the document description to confirm you have chosen the suitable form.

- If available, utilize the Review button to look through the document template as well.

- If you wish to acquire another version of your form, use the Search field to find the template that meets your needs and requirements.

Form popularity

FAQ

To establish a New Jersey Executive Employee Stock Incentive Plan, start by consulting with HR and financial experts who specialize in ESOPs. They can help you understand the steps involved in creating an ESOP that aligns with your company’s goals. Additionally, platforms like uslegalforms offer valuable resources to navigate the legal requirements effectively. By taking these steps, you can successfully implement an ESOP that benefits both your business and your employees.

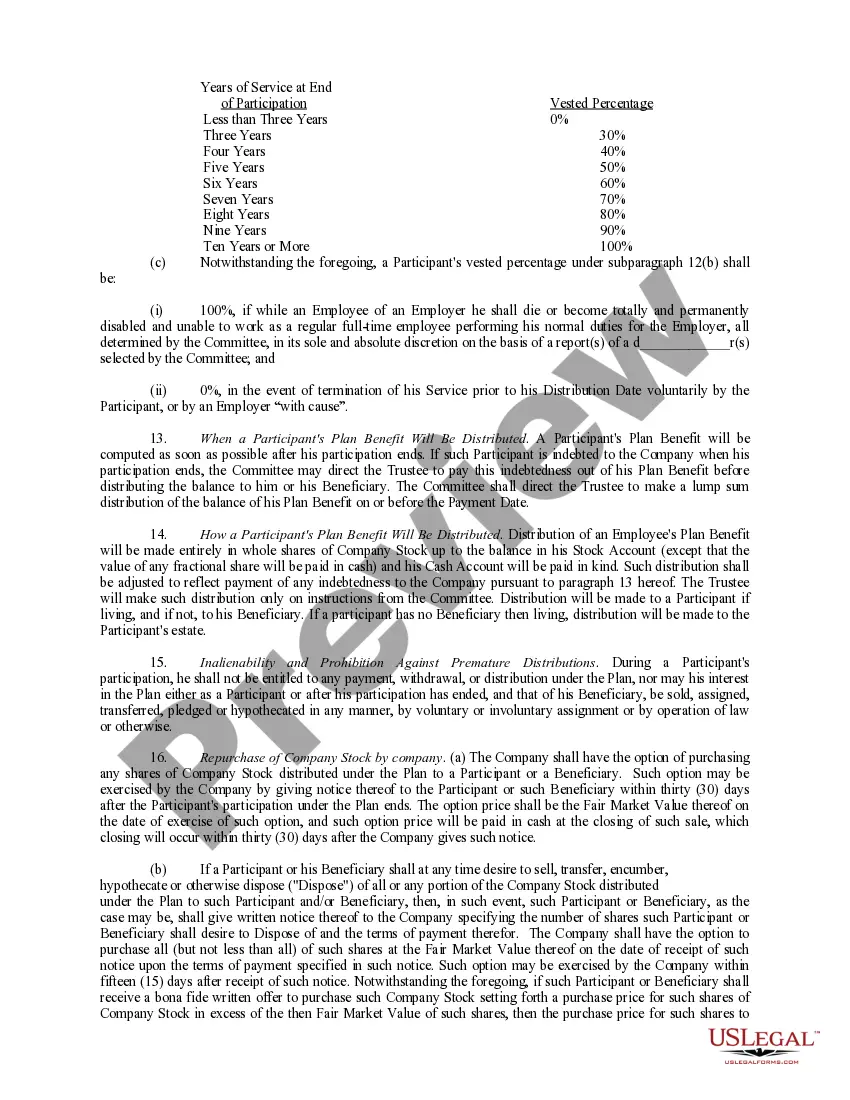

The ESOP employee program allows employees to become shareholders, empowering them to have a stake in the company’s success. Under a New Jersey Executive Employee Stock Incentive Plan, employees typically receive shares as part of their compensation package or through contributions made by the company. This program aims to motivate employees by aligning their interests with company performance, fostering a culture of ownership.

One downside of a New Jersey Executive Employee Stock Incentive Plan is the potential financial burden it can place on a company. If the company faces financial difficulties, maintaining the ESOP can strain resources. Additionally, valuing the stock can be complex, leading to potential disputes. It's essential to weigh these factors before proceeding.

Starting a New Jersey Executive Employee Stock Incentive Plan involves several key steps. First, you need to evaluate whether an ESOP is the right fit for your business. After determining this, engage with professionals to draft the plan documents and establish a trust. Finally, submit the required forms to the IRS and adequately inform your employees about the benefits.

To set up a New Jersey Executive Employee Stock Incentive Plan, begin by defining your company's goals for the plan. Next, consult with financial advisors and legal experts to ensure compliance with federal and state regulations. After creating a comprehensive plan, seek approval from your board of directors. Once approved, communicate the details to your employees clearly.

The salary for a Government Representative 2 in New Jersey typically ranges from $55,000 to $90,000 per year, depending on experience and location within the state. This position may offer access to additional benefits, including stock options under plans like the New Jersey Executive Employee Stock Incentive Plan. Exploring the full compensation package is essential for anyone considering a career in this area. These incentives can enhance overall job satisfaction and motivate long-term commitment.

The salary range for positions within the Civil Service Commission in New Jersey varies based on the specific job and responsibilities. Generally, employees can earn between $50,000 and $120,000 per year. Additionally, certain roles may be eligible for benefits associated with the New Jersey Executive Employee Stock Incentive Plan, adding to overall compensation. Therefore, it's valuable to research specific positions for a clearer salary picture.

An equity incentive plan is a program that offers employees company shares or stock options as part of their compensation. For example, the New Jersey Executive Employee Stock Incentive Plan grants employees stock options that can increase in value over time, aligning their interests with the company's success. This structure motivates employees to contribute to the company’s growth, benefiting both the individual and the organization. Engaging with such plans can enhance job satisfaction and retention.

Salaries for government employees in New Jersey vary widely based on position and level of responsibility. Generally, state government employees can expect to earn anywhere from $40,000 to over $100,000 annually. Additionally, specialized roles such as those tied to the New Jersey Executive Employee Stock Incentive Plan may offer enhanced compensation and benefits. It's essential to consider these plans as you evaluate potential earnings.

Reporting an Employee Stock Ownership Plan (ESOP) distribution on your tax return involves listing it as income in the year you receive the distribution. This income may be subject to various tax rules, particularly if it comes from a New Jersey Executive Employee Stock Incentive Plan. To ensure accurate reporting and compliance with tax regulations, consider using uslegalforms as a reliable resource for guidance.