New Jersey Assignment of Money Due

Description

How to fill out Assignment Of Money Due?

If you require to sum up, acquire, or print official document templates, utilize US Legal Forms, the leading collection of legal forms available online.

Take advantage of the site's user-friendly and efficient search feature to locate the documents you need.

Various templates for business and personal use are organized by type and state, or keywords. Use US Legal Forms to obtain the New Jersey Assignment of Money Due with just a few clicks.

Step 5. Process the payment. You can use your Visa or Mastercard or PayPal account to complete the transaction.

Step 6. Choose the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the New Jersey Assignment of Money Due. Every legal document format you download is yours indefinitely. You have access to every form you downloaded in your account. Visit the My documents section and select a form to print or download again. Be proactive and acquire, and print the New Jersey Assignment of Money Due with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms member, Log In to your account and select the Acquire option to get the New Jersey Assignment of Money Due.

- You can also access forms you've previously downloaded in the My documents section of your account.

- If you’re using US Legal Forms for the first time, follow the instructions listed below.

- Step 1. Ensure you have selected the form for the correct city/state.

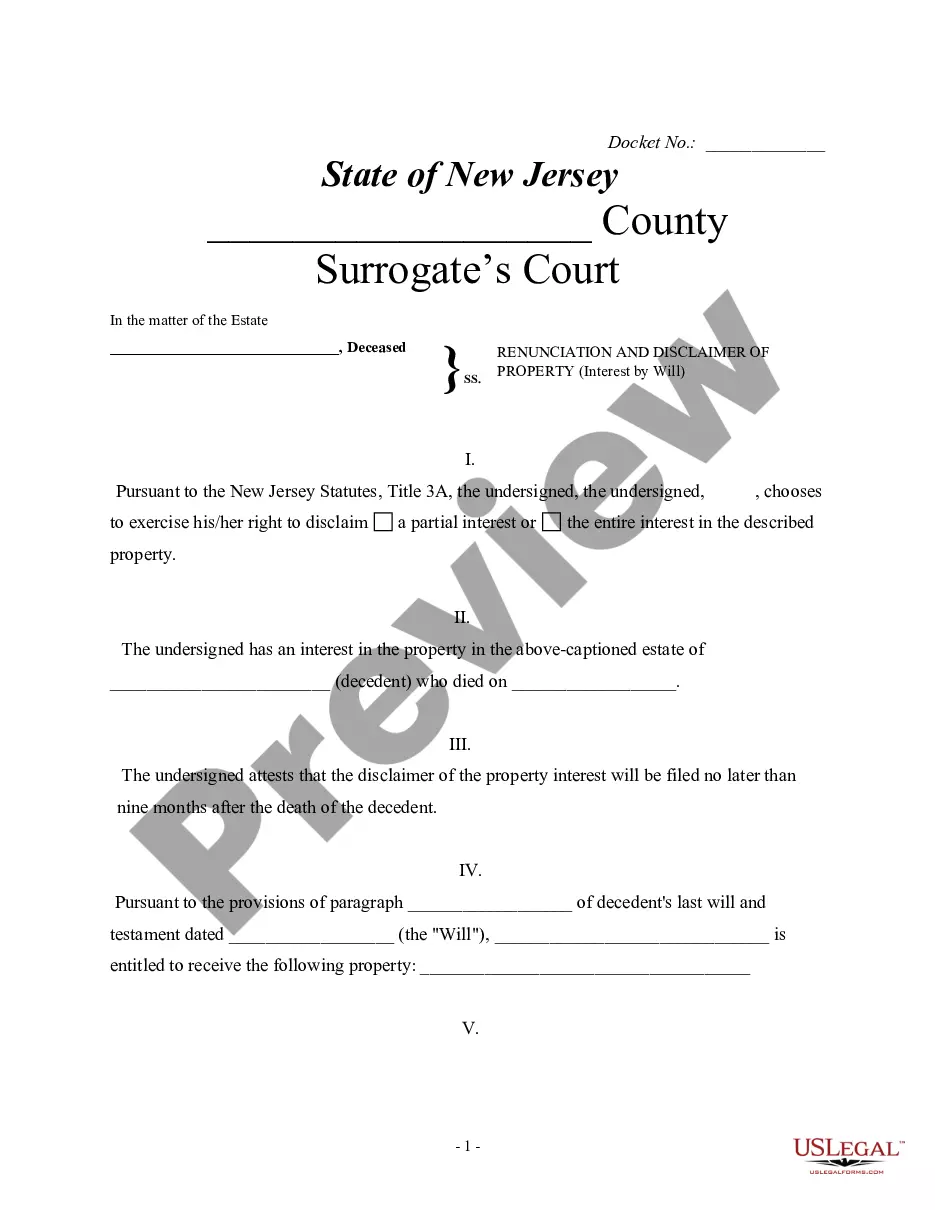

- Step 2. Use the Review option to examine the form's content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other forms in the legal form format.

- Step 4. Once you have located the form you want, click on the Acquire now button. Choose the payment plan you prefer and enter your details to register for an account.

Form popularity

FAQ

Yes, garnishment can be taken from a bank account if a legal judgment supports it. Creditors may seek a court order to withdraw funds directly from your account, affecting your financial stability. Understanding the implications of the New Jersey Assignment of Money Due can help you manage these situations. Platforms like US Legal Forms provide valuable resources to help you understand your options and rights.

Generally, the government must provide notice before taking money from your bank account. However, certain situations, such as tax debts or court judgments, may allow for immediate action without prior notification. It's important to be aware of the rules surrounding the New Jersey Assignment of Money Due to protect your assets. If you need assistance, US Legal Forms offers resources that can help clarify your rights.

In New Jersey, you can stop a wage garnishment immediately by filing a motion with the court that issued the garnishment. This motion can argue that the garnishment is causing undue hardship or is otherwise improper. Understanding the New Jersey Assignment of Money Due can empower you to present a strong case. Legal resources such as US Legal Forms can assist you in drafting the necessary documents.

Yes, the state of New Jersey can take money from your bank account under certain conditions, such as unpaid taxes or court judgments. In such cases, they typically issue a levy to access your funds. Knowing your rights regarding the New Jersey Assignment of Money Due can help you navigate these situations effectively. For more detailed information, consider consulting legal resources or platforms like US Legal Forms.

To submit a New Jersey Power of Attorney (POA), you must first complete the appropriate form, ensuring all necessary information is accurately filled out. After completing the form, you will need to sign it in the presence of a notary public to ensure its validity. This process is essential when dealing with matters related to the New Jersey Assignment of Money Due, as a valid POA allows you to manage financial transactions on behalf of another individual. USLegalForms provides templates and guidance for a smooth submission process.

Rule in New Jersey pertains to the assignment of money due in legal proceedings. This rule outlines the procedural requirements for parties seeking to assign their rights to receive payments under certain circumstances. Understanding this rule is crucial for anyone involved in the New Jersey Assignment of Money Due, as it helps clarify how assignments can be executed legally. For more information and resources, consider exploring the services offered by USLegalForms.

Statute 34-11 4.4 in New Jersey pertains to the assignment of wages and the collection of debts. It outlines the legal framework for assigning money or wages that are due to a debtor, ensuring that both parties understand their rights and responsibilities in the process. If you are dealing with a New Jersey Assignment of Money Due, familiarizing yourself with this statute can provide clarity and help you navigate the legal landscape more effectively.

A debt typically becomes uncollectible in New Jersey after six years of inactivity. This means if a creditor has not taken any action to collect the debt during this period, they may lose the legal right to pursue it. For those handling a New Jersey Assignment of Money Due, understanding this timeline is crucial for effective debt management and ensuring you address any outstanding debts promptly.

In New Jersey, a creditor can attempt to collect a debt for a period of six years, starting from the date the debt first became due. After this time frame, the debt may become difficult to collect legally. If you're navigating a New Jersey Assignment of Money Due, it's important to act within this period to maximize your chances of successful recovery.

The 7 7 7 rule for collections refers to a guideline used by creditors to manage the collection process efficiently. It suggests that creditors should attempt to collect a debt within seven days of it becoming due, follow up again after seven days, and finally, escalate the matter after another seven days if no payment has been made. Understanding this rule can be beneficial when dealing with a New Jersey Assignment of Money Due, as it helps you stay organized and proactive in your collection efforts.