New Jersey Deferred Compensation Agreement - Short Form

Description

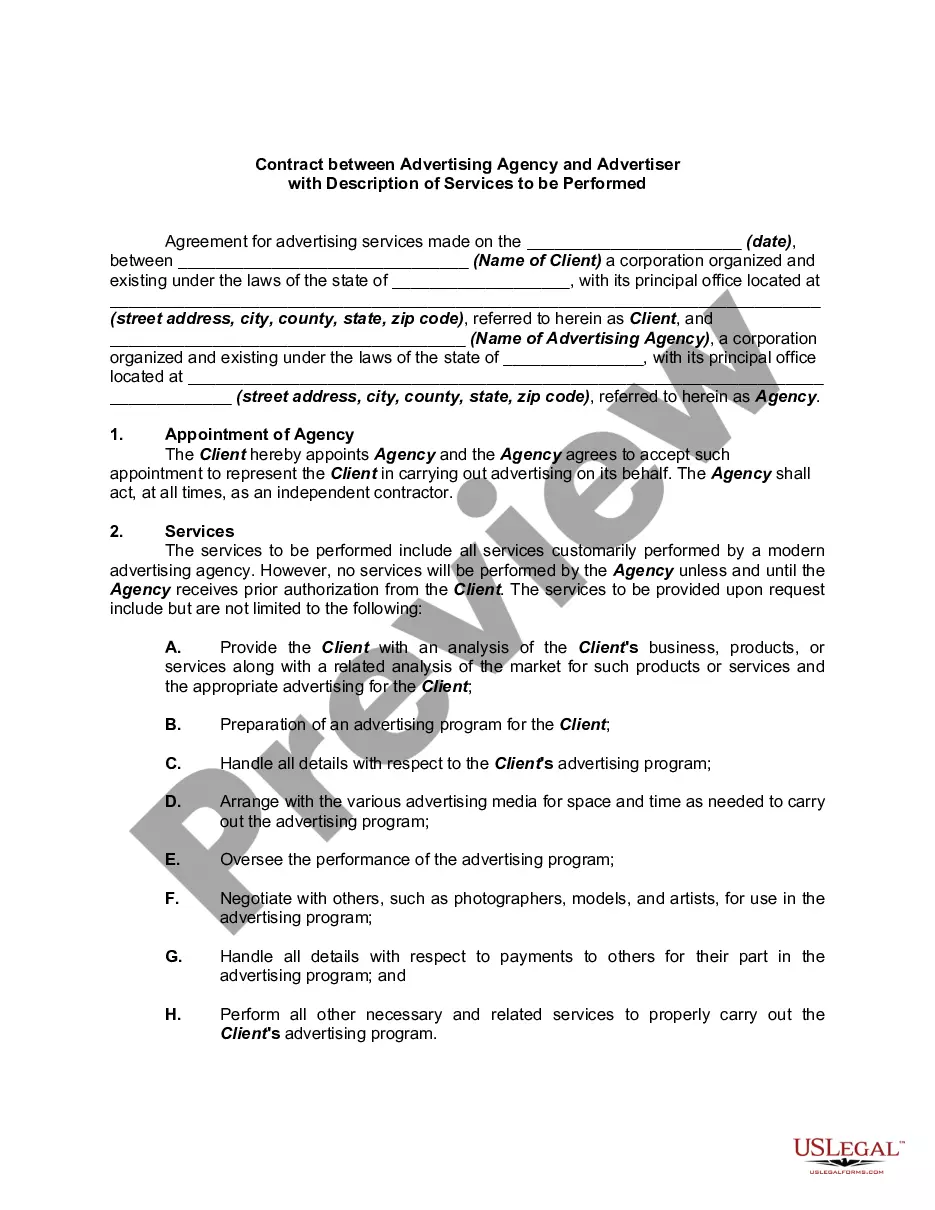

How to fill out Deferred Compensation Agreement - Short Form?

If you wish to total, download, or print authentic document templates, utilize US Legal Forms, the largest compilation of valid forms available online.

Leverage the site`s user-friendly and straightforward search to find the documents you need.

Various templates for business and personal purposes are categorized by types, states, or keywords.

Every legitimate document template you purchase belongs to you forever. You will have access to each type you saved in your account.

Be proactive and download, and print the New Jersey Deferred Compensation Agreement - Short Form with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Employ US Legal Forms to locate the New Jersey Deferred Compensation Agreement - Short Form with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and select the Acquire option to obtain the New Jersey Deferred Compensation Agreement - Short Form.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, adhere to the instructions provided below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Review option to examine the form’s details. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Research field at the top of the screen to find other versions of the legitimate type template.

- Step 4. Once you have found the form you want, click the Purchase now option. Choose the pricing plan you prefer and provide your details to register for an account.

- Step 5. Complete the transaction. You can utilize your credit card or PayPal account to process the payment.

- Step 6. Choose the format of your legitimate type and download it to your device.

- Step 7. Complete, edit, and print or sign the New Jersey Deferred Compensation Agreement - Short Form.

Form popularity

FAQ

Setting up a deferred compensation plan involves a few straightforward steps. Start by assessing your company’s financial structure and the needs of your employees. Once you’ve outlined your objectives, consulting platforms like uslegalforms for guidance on drafting a New Jersey Deferred Compensation Agreement - Short Form will help ensure compliance with legal standards, ultimately facilitating a smooth implementation.

A deferred compensation plan can be a beneficial option for many people looking to enhance their retirement savings. It allows you to postpone a portion of your income, which can reduce your current taxable income and potentially lower your overall tax burden. By setting up a New Jersey Deferred Compensation Agreement - Short Form, you set yourself up for greater financial security in your later years.

The ideal percentage of your paycheck to contribute to a deferred compensation plan varies based on individual financial situations. Generally, experts recommend setting aside 10% to 15% of your income in a New Jersey Deferred Compensation Agreement - Short Form, but reviewing your personal financial goals is essential. By doing so, you ensure you're saving enough for retirement while still comfortably meeting your current expenses.

Starting a deferred compensation plan involves several key steps. First, understand your organization’s goals and the specific needs of your employees. Next, you can consult with financial advisors or legal experts who specialize in creating a New Jersey Deferred Compensation Agreement - Short Form to ensure all legal considerations are met, and then implement the plan accordingly.

The 10 year rule for deferred compensation refers to the period over which deferred payments are typically required to be distributed. Under this rule, payments from a New Jersey Deferred Compensation Agreement - Short Form must commence no later than 10 years after the individual separates from service. This rule ensures that employees have a dependable flow of income during their retirement years.

In New Jersey, the maximum amount you can contribute to a deferred compensation plan, such as the New Jersey Deferred Compensation Agreement - Short Form, can vary by year and plan type. Generally, the limits align with federal guidelines, which can change annually. It’s essential to stay updated on these contributions limits to maximize your retirement savings effectively.

A deferred compensation plan, including the New Jersey Deferred Compensation Agreement - Short Form, allows employees to defer a portion of their income until a later date. This arrangement can help reduce current taxable income and provide financial security in retirement. Usually, you choose how much to defer, and your employer facilitates these investments until you choose to withdraw at retirement or another qualifying event.

Reporting deferred compensation, particularly under a New Jersey Deferred Compensation Agreement - Short Form, requires attention to detail. You must include the amounts on your tax return, typically reported on Form W-2 if your employer handles it correctly. However, it’s advisable to consult with a tax professional to ensure compliance and optimize your tax position.

The primary difference between a 401k and a New Jersey Deferred Compensation Agreement - Short Form lies in their structure and tax treatment. A 401k allows employees to contribute pretax income, while deferred compensation plans typically allow for more flexible arrangements tailored to high earners. Furthermore, contributions and withdrawals differ in terms of regulations and limitations, which can impact your retirement strategy.

When considering a New Jersey Deferred Compensation Agreement - Short Form, it’s important to note that there can be downsides. If you defer compensation, you could face a higher tax burden later, as distributions are taxed as ordinary income. Additionally, if your employer faces financial difficulties, you may be at risk of losing those deferred funds. Therefore, weigh these factors carefully before proceeding.