New Jersey Individual Credit Application

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

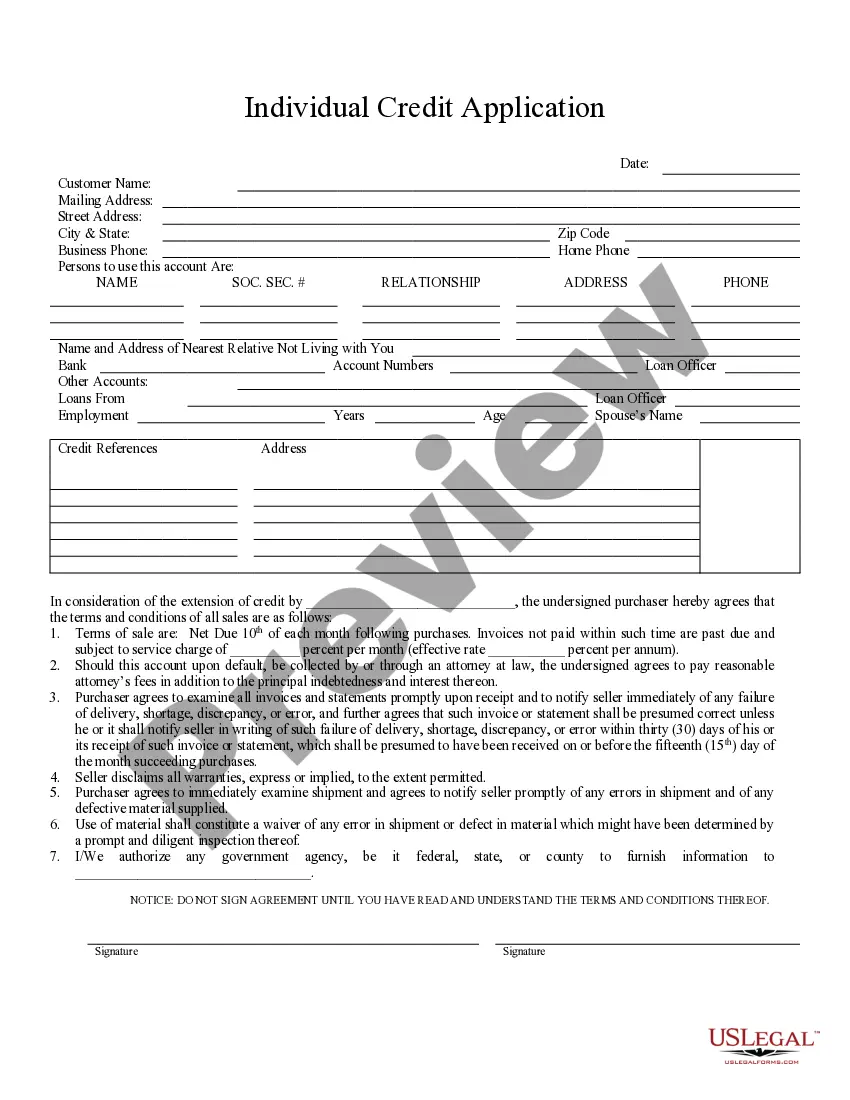

How to fill out New Jersey Individual Credit Application?

US Legal Forms is a unique platform where you can find any legal or tax document for submitting, including New Jersey Individual Credit Application. If you’re tired with wasting time looking for ideal samples and spending money on papers preparation/attorney fees, then US Legal Forms is exactly what you’re seeking.

To enjoy all the service’s benefits, you don't have to download any application but simply pick a subscription plan and register your account. If you already have one, just log in and find a suitable template, download it, and fill it out. Saved documents are all stored in the My Forms folder.

If you don't have a subscription but need to have New Jersey Individual Credit Application, have a look at the recommendations below:

- Double-check that the form you’re taking a look at applies in the state you need it in.

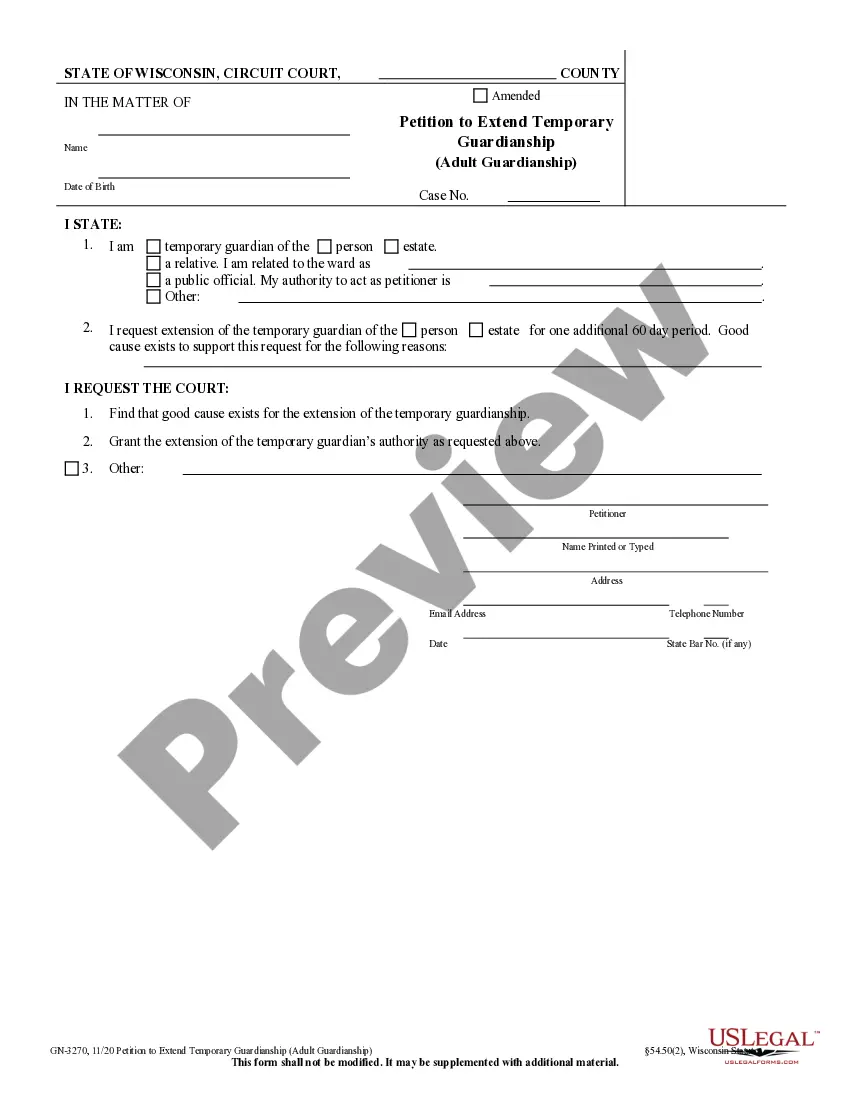

- Preview the sample and look at its description.

- Click Buy Now to access the sign up webpage.

- Choose a pricing plan and proceed signing up by entering some info.

- Choose a payment method to finish the sign up.

- Save the file by selecting the preferred format (.docx or .pdf)

Now, submit the document online or print it. If you feel uncertain about your New Jersey Individual Credit Application sample, contact a attorney to examine it before you send out or file it. Begin without hassles!

Form popularity

FAQ

Eligibility Requirements $150,000 or less for homeowners age 65 or over or blind or disabled; or. $75,000 or less for homeowners under age 65 and not blind or disabled.

Note: Residents with gross income of $20,000 or less ($10,000 if filing status is single or married/CU partner, filing separate return) are eligible for a property tax credit only if they were 65 years or older or blind or disabled on the last day of the tax year.

$250 Senior Citizens and Disabled Persons Property Tax Deduction. If you are age 65 or older, or disabled, and have been a New Jersey resident for at least one year, you may be eligible for an annual $250 property tax deduction.

An annual $250 deduction from real property taxes is provided for the dwelling of a qualified senior citizen, disabled person or their surviving spouse. To qualify, you must be age 65 or older, or a permanently and totally disabled individual or the unmarried surviving spouse, age 55 or more, of such person.

The Earned Income Tax Credit (EITC) is a federal and state tax benefit for individuals and families who earn low-to moderate incomes in NJ. It is a tax credit that may reduce the amount of taxes you owe, or provide you with a refund, even if you don't owe any taxes.

Step 1: You must apply for and claim a federal EITC. Step 2: Once you have your federal EITC amount, you must file a New Jersey Resident Income Tax Return (Form NJ-1040) to claim the NJEITC. Step 3: Wait for your refund!

NJ TaxationYou can deduct your property taxes paid or $15,000, whichever is less. For Tax Years 2017 and earlier, the maximum deduction was $10,000. For tenants, 18% of rent paid during the year is considered property taxes paid.

The property tax credit reduces your tax due because it is subtracted directly from your tax liability. The benefit is a refundable credit of $50. You can claim only one of these benefits on your tax return.

New Jersey Earned Income Tax Credit NJEITC is a cash-back tax credit that puts money back into the pockets of working families and individuals, including the self-employed, who earn low- to moderate-income.For Tax Year 2020 eligible NJ residents will receive 40% of the federal EITC.