New Hampshire Partnership Formation Questionnaire

Description

This questionnaire may also be used by an attorney as an important information gathering and issue identification tool when forming an attorney-client relationship with a new client. This form helps ensure thorough case preparation and effective evaluation of a new client’s needs. It may be used by an attorney or new client to save on attorney fees related to initial interviews.

How to fill out Partnership Formation Questionnaire?

Are you presently in a position where you need documents for either business or personal purposes almost daily.

There are numerous legal document templates accessible online, but finding ones you can rely on is not simple.

US Legal Forms offers thousands of template forms, including the New Hampshire Partnership Formation Questionnaire, which can be tailored to comply with state and federal regulations.

Once you find the correct form, click Buy now.

Choose the payment plan you prefer, enter the necessary information to create your account, and complete your purchase using PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- After that, you can download the New Hampshire Partnership Formation Questionnaire template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

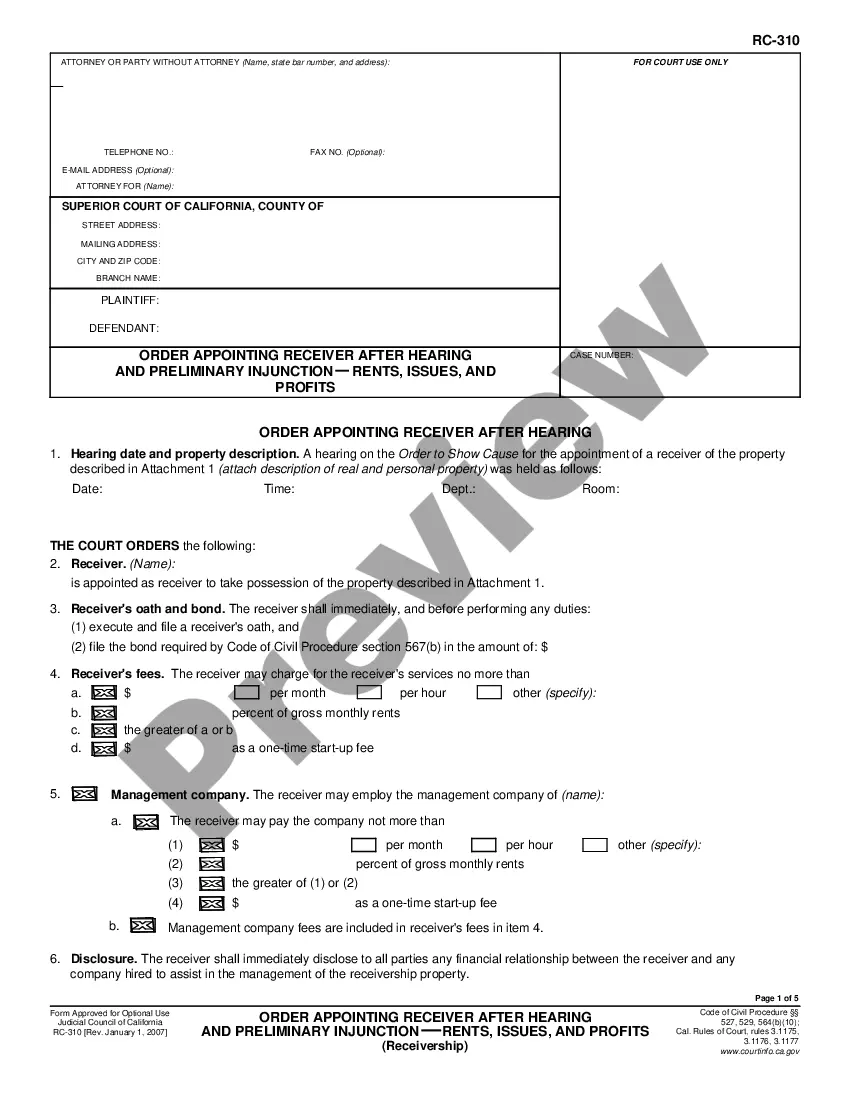

- Utilize the Review button to examine the form.

- Check the description to make sure you have selected the right form.

- If the form is not what you are looking for, use the Search box to find the form that fits your needs.

Form popularity

FAQ

The New Hampshire Business Profits Tax (BPT) is primarily the responsibility of corporations and certain business entities operating in the state. If your partnership generates profits, it may also be subject to BPT. By using the New Hampshire Partnership Formation Questionnaire, you can identify your partnership's tax obligations and ensure that you're compliant with state tax laws. This proactive approach can help you manage your partnership’s financial responsibilities effectively.

The NH 1065 form outlines the threshold for partnerships in New Hampshire regarding income reporting. Generally, partnerships must file the NH 1065 if they have gross income of $1,000 or more. Utilizing the New Hampshire Partnership Formation Questionnaire can help you understand your partnership's specific obligations and ensure you meet all filing requirements. It’s important to stay informed about these thresholds to maintain compliance.

Partnerships in New Hampshire typically use the NH 1065 form to file their annual informational return. This form provides essential information about the partnership's income, deductions, and credits. By completing the New Hampshire Partnership Formation Questionnaire, you can ensure that you have all the necessary information to accurately fill out the NH 1065 form. This process helps maintain compliance and avoid any potential penalties.

The approval time for an LLC in New Hampshire typically ranges from a few days to a couple of weeks, depending on the volume of applications. Once you submit the required forms and fees, the state reviews them for compliance. To expedite the process, consider preparing your application with the help of the New Hampshire Partnership Formation Questionnaire, which organizes all necessary details efficiently.

If an entity is not in good standing, it indicates that it has not met certain legal requirements set by the state. This can include overdue filings or unpaid taxes, which can lead to penalties or even dissolution. To avoid these issues, consider using the New Hampshire Partnership Formation Questionnaire to stay informed about your compliance needs.

An LLC may not be in good standing in New Hampshire for various reasons, such as failing to file required annual reports or not paying necessary fees. This status can affect your business's credibility and ability to operate. If you're unsure about your LLC's status, the New Hampshire Partnership Formation Questionnaire can help clarify your compliance obligations.

Filing a Business Organization Information (BOI) in New Hampshire requires submitting specific forms to the Secretary of State's office. You will need to provide details about your business, including its structure and ownership. Utilizing the New Hampshire Partnership Formation Questionnaire can streamline this process by ensuring you have all necessary information ready to go.

The New Hampshire Partnership Act establishes the legal framework for forming and managing partnerships in the state. This law outlines the rights and responsibilities of partners, as well as the procedures for creating a partnership. To navigate these regulations effectively, many individuals turn to the New Hampshire Partnership Formation Questionnaire, which simplifies the process.