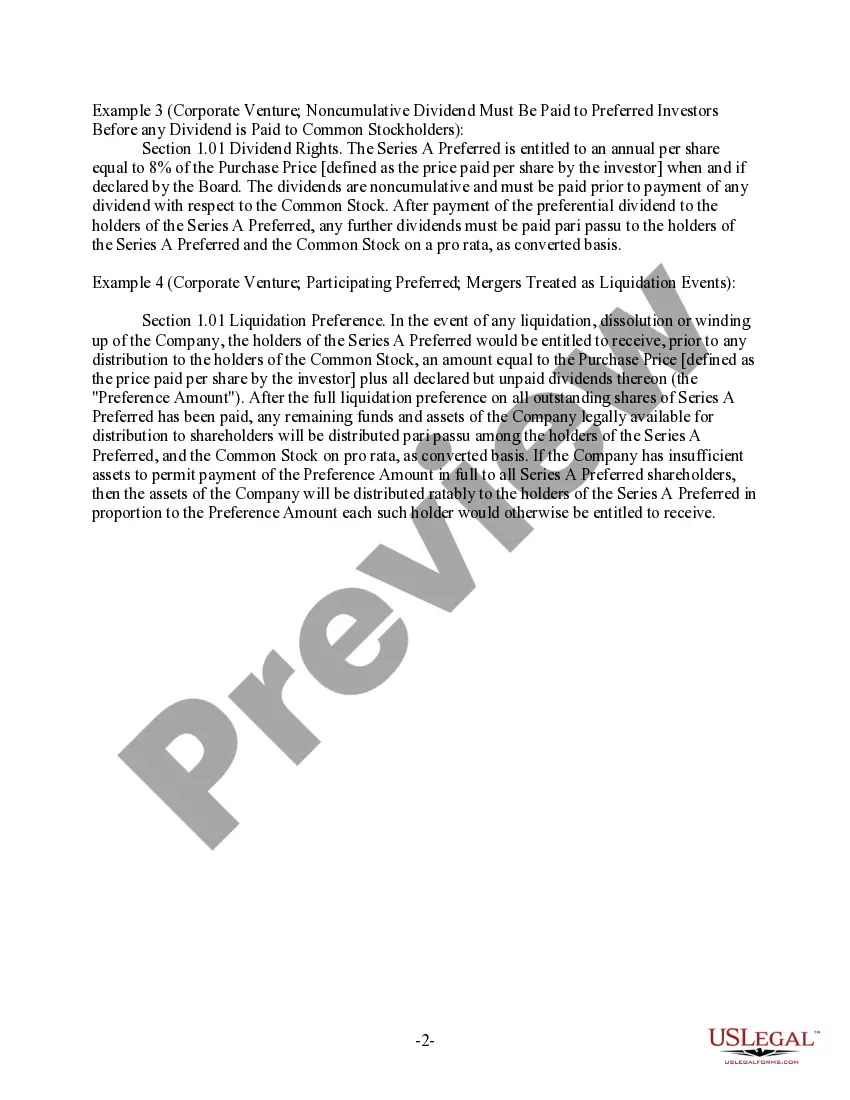

New Hampshire Clauses Relating to Preferred Returns

Description

How to fill out Clauses Relating To Preferred Returns?

You may invest several hours on the Internet looking for the authorized papers template that meets the state and federal demands you require. US Legal Forms supplies thousands of authorized kinds that happen to be reviewed by pros. It is possible to download or printing the New Hampshire Clauses Relating to Preferred Returns from your services.

If you have a US Legal Forms account, it is possible to log in and click the Acquire key. After that, it is possible to comprehensive, revise, printing, or indicator the New Hampshire Clauses Relating to Preferred Returns. Each and every authorized papers template you purchase is yours permanently. To have an additional duplicate of any acquired form, check out the My Forms tab and click the related key.

If you are using the US Legal Forms website the first time, follow the simple instructions listed below:

- Initially, make sure that you have selected the proper papers template for your county/town of your choosing. Read the form description to make sure you have selected the right form. If available, take advantage of the Preview key to search throughout the papers template at the same time.

- If you wish to find an additional variation of your form, take advantage of the Search field to get the template that fits your needs and demands.

- Upon having identified the template you want, click on Purchase now to continue.

- Choose the prices plan you want, type your credentials, and sign up for your account on US Legal Forms.

- Full the purchase. You may use your bank card or PayPal account to cover the authorized form.

- Choose the structure of your papers and download it to your system.

- Make modifications to your papers if needed. You may comprehensive, revise and indicator and printing New Hampshire Clauses Relating to Preferred Returns.

Acquire and printing thousands of papers templates using the US Legal Forms Internet site, that offers the largest variety of authorized kinds. Use expert and express-particular templates to tackle your business or personal needs.

Form popularity

FAQ

New Hampshire does not tax individuals' earned income, so you are not required to file an individual New Hampshire tax return. The state only taxes interest and dividends at 5% on residents and fiduciaries whose gross interest and dividends income, from all sources, exceeds $2,400 annually ($4,800 for joint filers).

State conformity with federal bonus depreciation rules lookup tool Alabama. Alaska. Arizona. Arkansas. California. Colorado. Connecticut. Delaware. ... Kentucky. Louisiana. Maine. Maryland. Massachusetts. Michigan. Minnesota. Mississippi. ... North Dakota. Ohio. Oklahoma. Oregon. Pennsylvania. Rhode Island. South Carolina. South Dakota.

All business organizations, including Limited Liability Companies (LLC), taxed as a partnership federally must file Form NH-1065 return provided they have conducted business activity in New Hampshire and their gross business income from everywhere is in excess of $92,000.

What Is Section 179? Eligible businesses can utilize the Section 179 tax deduction to subtract the cost of machinery and certain equipment during tax filing -- including vehicles. The program -- implemented by the U.S. government -- was designed to help small- to medium-sized businesses ease their tax burden.

No. New Hampshire does not conform to the Tax Cuts and Jobs Act provision that allows a 100% first-year deduction for the adjusted basis for qualified property acquired and placed in service after September 27, 2017, and before January 1, 2023.

State conformity approaches To the extent the IRC changes, state conformity varies based on the manner in which each state's laws interact with the IRC. Rolling conformity states such as Illinois, New Jersey, New York, and Pennsylvania automatically adopt the IRC as currently in place.

Individuals: Individuals who are residents or inhabitants of New Hampshire for any part of the tax year must file a return if they received more than $2,400 of gross interest and/or dividend income for a single individual or $4,800 of such income for a married couple filing a joint New Hampshire return.

No. New Hampshire does not conform to the Tax Cuts and Jobs Act provision that allows a 100% first-year deduction for the adjusted basis for qualified property acquired and placed in service after September 27, 2017, and before January 1, 2023. No.

The DP-10 only has to be filed if the taxpayer received more than $2400 (single) or $4800 (joint) of interest and/or dividends. TaxAct® supports this form in the New Hampshire program. The taxpayer can enter the date of residency during the New Hampshire Q&A.

New Hampshire does not tax individuals' earned income, so you are not required to file an individual New Hampshire tax return. The state only taxes interest and dividends at 5% on residents and fiduciaries whose gross interest and dividends income, from all sources, exceeds $2,400 annually ($4,800 for joint filers).