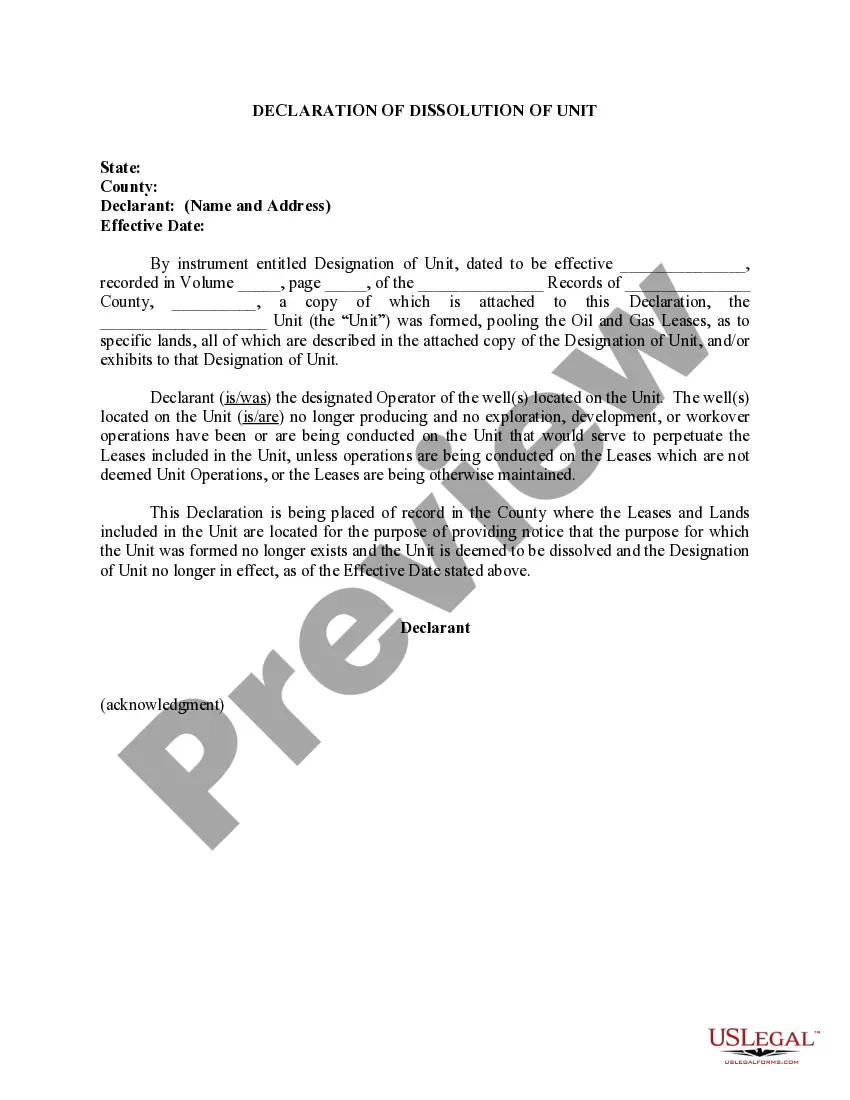

New Hampshire Declaration of Dissolution of Unit

Description

How to fill out Declaration Of Dissolution Of Unit?

US Legal Forms - one of many most significant libraries of lawful types in the United States - gives a wide array of lawful papers web templates you can obtain or print out. Making use of the web site, you can find a large number of types for company and individual reasons, categorized by classes, claims, or key phrases.You will discover the latest types of types such as the New Hampshire Declaration of Dissolution of Unit within minutes.

If you already have a subscription, log in and obtain New Hampshire Declaration of Dissolution of Unit from your US Legal Forms catalogue. The Acquire button can look on each kind you view. You have accessibility to all in the past delivered electronically types in the My Forms tab of your own accounts.

If you would like use US Legal Forms the first time, listed below are straightforward directions to help you started off:

- Make sure you have picked the correct kind for your personal town/county. Select the Preview button to check the form`s content material. Look at the kind information to ensure that you have chosen the correct kind.

- In the event the kind doesn`t match your specifications, utilize the Look for area towards the top of the screen to discover the one who does.

- If you are pleased with the form, validate your decision by visiting the Acquire now button. Then, select the costs plan you want and supply your accreditations to sign up to have an accounts.

- Method the transaction. Make use of your credit card or PayPal accounts to perform the transaction.

- Choose the file format and obtain the form in your product.

- Make modifications. Load, modify and print out and indicator the delivered electronically New Hampshire Declaration of Dissolution of Unit.

Every single template you included in your bank account does not have an expiration day and it is yours for a long time. So, if you wish to obtain or print out another duplicate, just visit the My Forms section and then click in the kind you need.

Obtain access to the New Hampshire Declaration of Dissolution of Unit with US Legal Forms, probably the most considerable catalogue of lawful papers web templates. Use a large number of specialist and express-specific web templates that satisfy your company or individual demands and specifications.

Form popularity

FAQ

To request the issuance of a tax certification for a withdrawal, cancellation, dissolution or good standing, the Form AU-22, Certification Request Form, must be completed in full and submitted with a non-refundable fee of $30.00 made payable to the State of New Hampshire.

How do you dissolve a New Hampshire Corporation? To dissolve your New Hampshire Corporation, you file Articles of Dissolution by Board of Directors and Shareholders with the New Hampshire Department of State (DOS).

New Hampshire, however, is different: it does not treat partnerships as pass-through entities, and instead requires them to pay both the business profits tax and the business enterprise tax.

The tax is imposed on both the buyer and the seller at the rate of $. 75 per $100 of the price or consideration for the sale, granting, or transfer. What types of transactions are taxable? All contractual transfers are subject to tax unless specifically exempt under RSA 78-B:2.

Administrative dissolution is an action taken by the Secretary of State that results in the loss of a business entity's rights, powers and authority.

All business organizations, including Limited Liability Companies (LLC), taxed as a partnership federally must file Form NH-1065 return provided they have conducted business activity in New Hampshire and their gross business income from everywhere is in excess of $92,000.

An essential step in dissolving the business is filing an official dissolution document with the New Hampshire Secretary of State: Corporation Division. This will let the New Hampshire Corporate Commission know that you're winding up the business and intend to dissolve.

To revive a New Hampshire LLC, you'll need to file the reinstatement application with the New Hampshire Secretary of State. You'll also have to fix the issues that led to your New Hampshire LLC's dissolution and (in some cases) obtain a Tax Compliance Certificate from the New Hampshire Department of Revenue.