New Hampshire Cease and Desist for Debt Collectors

Description

How to fill out Cease And Desist For Debt Collectors?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a range of legal form templates that you can download or print.

By using the website, you can find thousands of forms for both business and personal purposes, organized by categories, states, or keywords. You can locate the most recent versions of forms such as the New Hampshire Cease and Desist for Debt Collectors within minutes.

If you already possess a membership, Log In and download the New Hampshire Cease and Desist for Debt Collectors from the US Legal Forms library. The Download button will be available on every form you view. You can access all previously downloaded forms from the My documents tab of your account.

Complete the purchase. Use your Visa or Mastercard or PayPal account to finalize the transaction.

Retrieve the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded New Hampshire Cease and Desist for Debt Collectors. Every template you added to your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you desire. Gain access to the New Hampshire Cease and Desist for Debt Collectors with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are straightforward steps to help you begin.

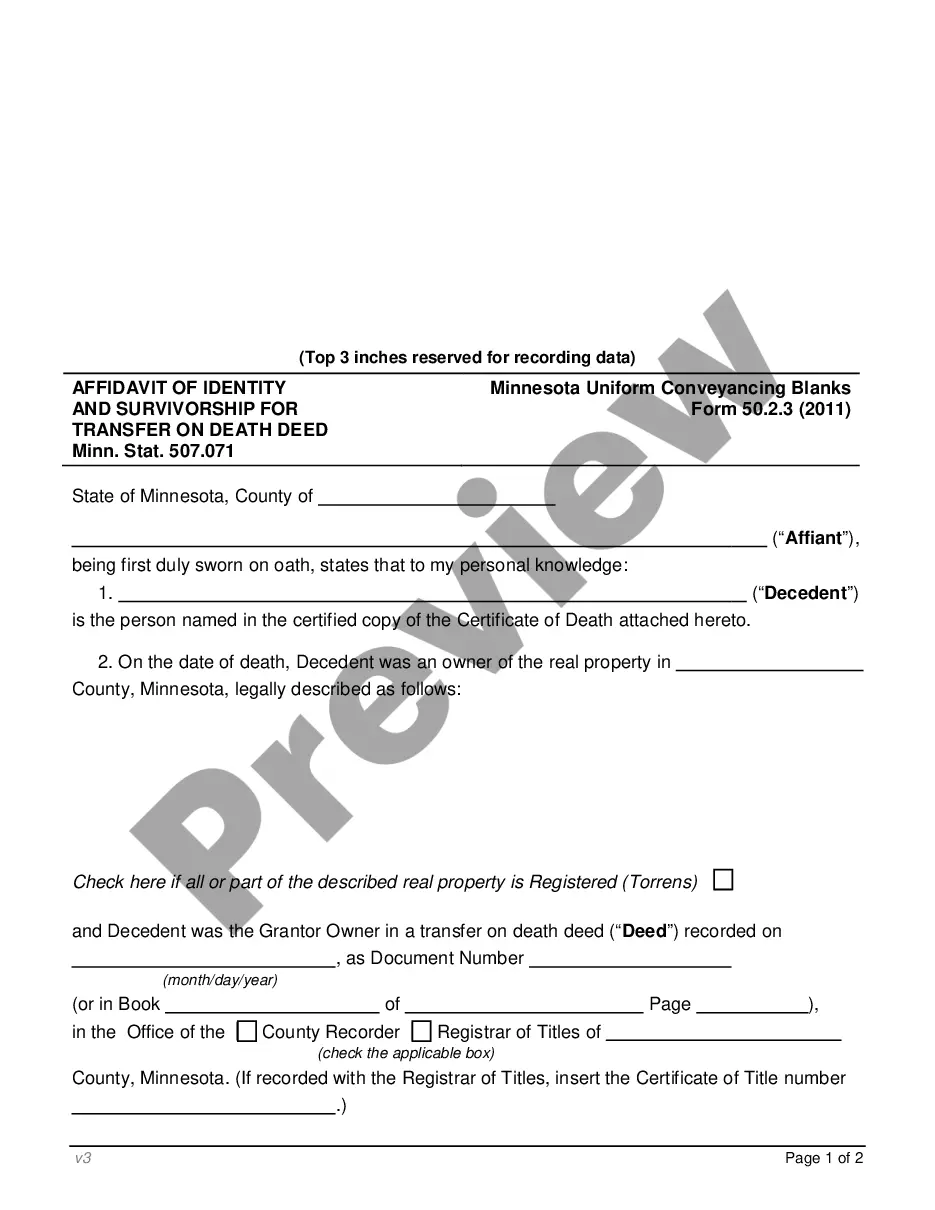

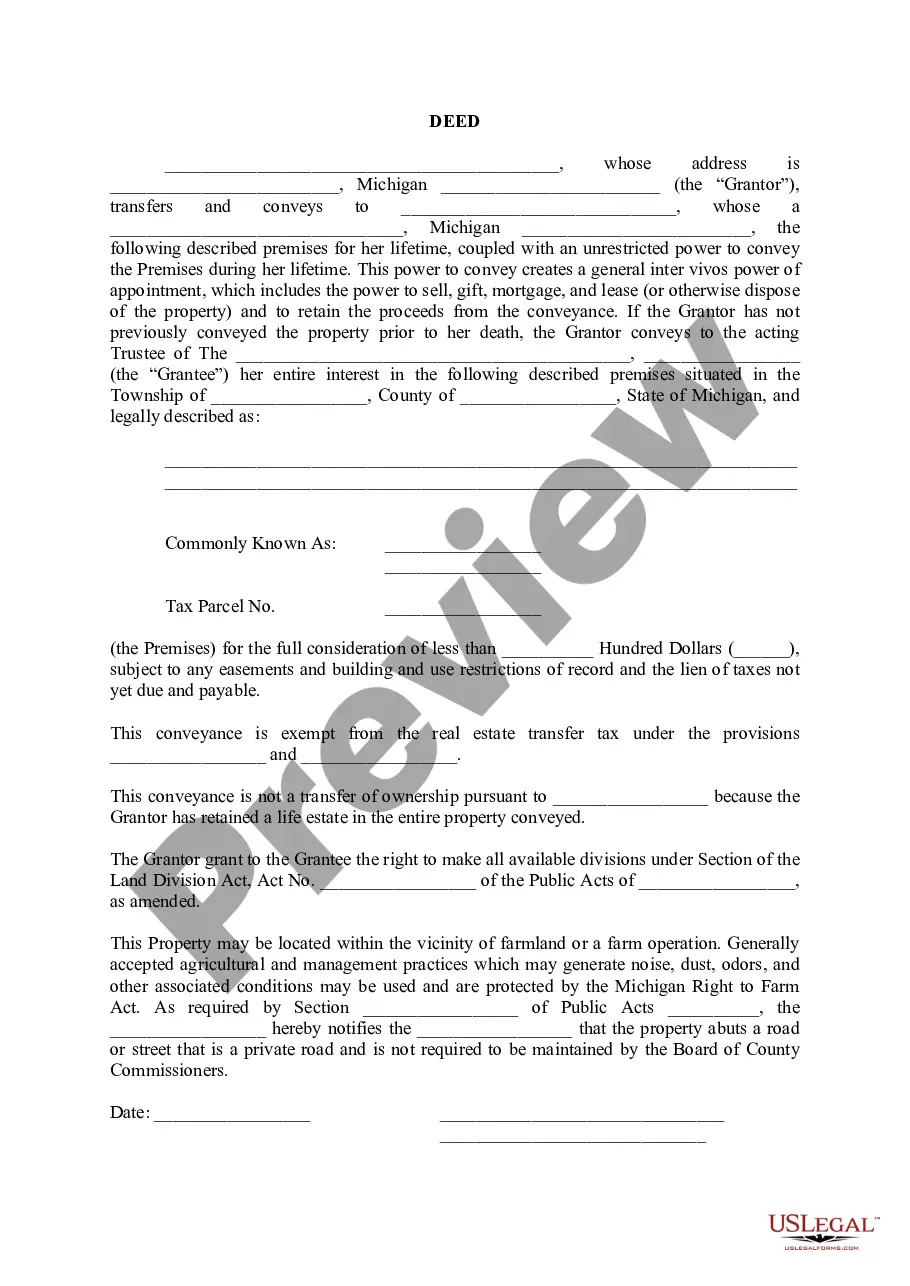

- Ensure you have selected the correct form for your city/region. Click on the Review button to examine the form's content.

- Check the form description to confirm you have chosen the right form.

- If the form does not meet your requirements, utilize the Search bar at the top of the screen to find one that does.

- If you are happy with the form, confirm your selection by clicking the Buy now button.

- Then, select the payment plan you prefer and provide your information to register for an account.

Form popularity

FAQ

Yes, cease and desist letters can be effective for stopping communication from debt collectors. Once the collector receives your letter, they are legally obligated to cease all contact unless they have a valid reason to continue. This action can give you the space you need to resolve your debt situation. For a proper approach, you might consult US Legal Forms to ensure your New Hampshire Cease and Desist for Debt Collectors is properly formatted and legally sound.

A 609 letter refers to a request for validation of a debt under the Fair Debt Collection Practices Act. This letter demands that the debt collector provide proof that you owe the debt before they can proceed with collection efforts. It's a useful tool to protect your rights and can be part of your strategy for managing debt. If you're unsure about how to draft a 609 letter, using resources from US Legal Forms can help you create a compliant document while navigating New Hampshire Cease and Desist for Debt Collectors.

To write a cease and desist letter to a debt collector, begin with your name and address at the top. Clearly state that you are requesting the debt collector to stop all communication regarding the debt. Include your account number and any pertinent details to clarify your request. For guidance, you may consider using the US Legal Forms platform, which provides templates specifically designed for New Hampshire Cease and Desist for Debt Collectors.

Yes, you can instruct a debt collector to cease communication. A cease and desist letter informs them that you do not wish to be contacted further. By using a New Hampshire Cease and Desist for Debt Collectors, you can effectively communicate your wishes and take control of the situation.

In New Hampshire, the statute of limitations for most debts is three years. After this period, creditors can no longer sue you to collect the debt. However, a New Hampshire Cease and Desist for Debt Collectors can be an important step in stopping any collection efforts before the debt becomes uncollectible.

Yes, you can send a cease and desist letter to a debt collector. This letter formally requests that they stop contacting you regarding the debt. Utilizing a New Hampshire Cease and Desist for Debt Collectors can help you draft an effective letter that complies with legal requirements, ensuring your rights are protected.

The 777 rule refers to a guideline that suggests debt collectors should not contact consumers more than seven times in a week. This rule aims to prevent harassment and provides consumers with a sense of control. If you feel that a collector is violating this rule, you can use a New Hampshire Cease and Desist for Debt Collectors to formally request that they stop contacting you.

To effectively issue a cease and desist for debt collectors in New Hampshire, you will need to gather documented evidence of the harassment or unwanted communication you have received. This may include copies of letters, phone call logs, or any other relevant communication. Additionally, it is essential to have your identification and any previous correspondence with the debt collector. Utilizing the US Legal Forms platform can streamline this process, providing you with the necessary templates to create a legally sound cease and desist letter.