New Hampshire Shoring Services Contract - Self-Employed

Description

How to fill out Shoring Services Contract - Self-Employed?

Are you currently in a situation where you require documents for either business or personal purposes on a regular basis.

There are numerous legal document templates available online, but finding ones you can rely on is not straightforward.

US Legal Forms provides a vast array of form templates, including the New Hampshire Shoring Services Contract - Self-Employed, specifically designed to meet state and federal requirements.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the New Hampshire Shoring Services Contract - Self-Employed anytime, if needed. Simply click on the desired template to download or print the document.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and prevent mistakes. The service offers professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a little easier.

- If you are already familiar with the US Legal Forms website and have an account, simply sign in.

- After that, you can download the New Hampshire Shoring Services Contract - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Get the template you need and ensure it matches the correct city/region.

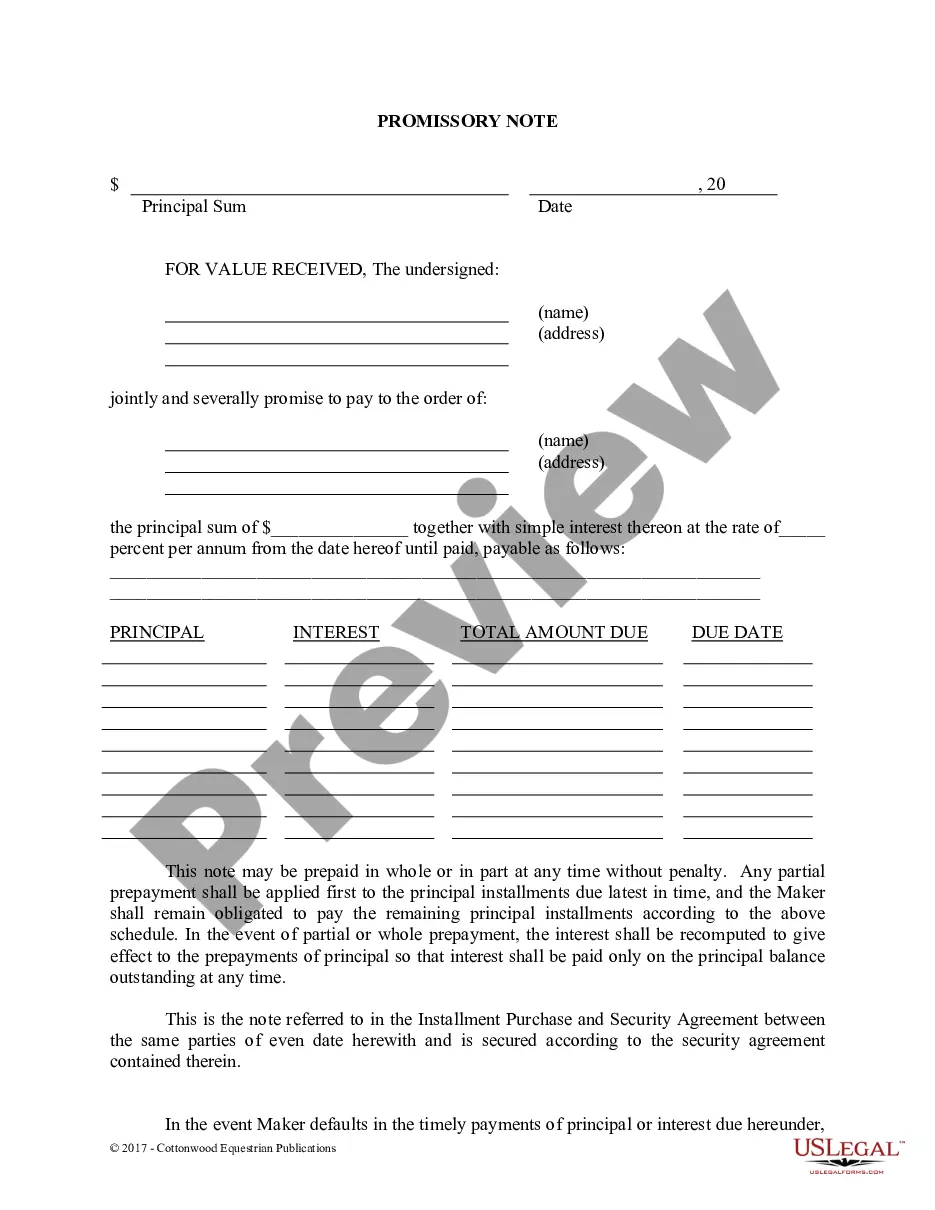

- Utilize the Review feature to examine the form.

- Read the description to confirm that you have selected the right document.

- If the form is not what you seek, use the Search box to find the template that fulfills your needs.

- Once you find the correct template, click Purchase now.

- Select the payment plan you prefer, complete the necessary information to create your account, and place your order using PayPal or a Credit Card.

- Choose a convenient document format and download your copy.

Form popularity

FAQ

When writing a self-employment contract, ensure you include your business name, services offered, and the terms of payment. Specify the duration of the contract and any relevant conditions such as confidentiality or exclusivity. Tailor the contract to be effective for a New Hampshire Shoring Services Contract - Self-Employed by aligning it with the state’s legal requirements.

To write a contract for a 1099 employee, clearly define the work to be performed, payment schedule, and terms of engagement. Be explicit about the independent status of the contractor to avoid any confusion about employment obligations. A New Hampshire Shoring Services Contract - Self-Employed should adhere to legal standards and clarify the contractor's responsibilities without implying an employer-employee relationship.

Filling out an independent contractor agreement involves providing essential information such as the contractor's details, the scope of work, and payment terms. It is crucial to specify whether the contractor is responsible for their own taxes and insurance. If you are constructing a New Hampshire Shoring Services Contract - Self-Employed, make sure to incorporate any state-specific regulations into the agreement.

To craft a self-employed contract, start with basic details such as your name, business address, and a description of your services. Include payment terms, deadlines for deliverables, and any confidentiality agreements. Ensure that it is tailored specifically to your business needs and includes the elements required for a New Hampshire Shoring Services Contract - Self-Employed.

Yes, you can write your own legally binding contract, provided it includes essential elements like mutual consent, consideration, and lawful objectives. It is vital to use clear language and ensure both parties understand the terms. A New Hampshire Shoring Services Contract - Self-Employed should meet specific requirements, so familiarize yourself with state regulations or consider using resources like US Legal Forms.

In New Hampshire, taxable income includes wages, salaries, and income from self-employment. Therefore, if you receive payments from a New Hampshire Shoring Services Contract - Self-Employed, that income will generally be subject to taxation. Understanding what constitutes taxable income can help you effectively manage your financial responsibilities.

Contract law in New Hampshire governs the legal agreements made between parties. When entering into a New Hampshire Shoring Services Contract - Self-Employed, it is crucial to ensure that your agreement meets state standards. Knowing the basics of contract law will help you protect your interests and ensure enforceability in case of disputes.

The independent contractor rule defines the relationship between a contractor and the hiring entity. It is essential that self-employed individuals understand their status when working on a New Hampshire Shoring Services Contract - Self-Employed. If you meet the criteria for being an independent contractor, you can enjoy certain freedoms, such as setting your hours and managing your workload.

Yes, New Hampshire does tax 1099 income, but the rules can be nuanced. Usually, income reported on a 1099 form falls under the category of taxable income for self-employed individuals. Therefore, if you are earning through a New Hampshire Shoring Services Contract - Self-Employed, ensure you understand how these earnings will impact your tax filing.

Several states do not impose a self-employment tax, including Florida and Texas. This means that if you operate your business under a New Hampshire Shoring Services Contract - Self-Employed, you might find additional tax-friendly states appealing. It's wise to consider the tax implications thoroughly to make informed decisions about where to operate your business.